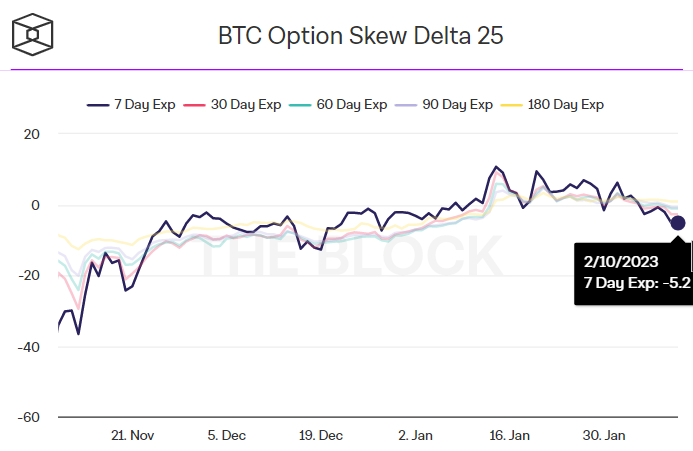

Bitcoin options markets are signaling that investor sentiment has hit a new low for the year, as investors face a mounting wall of worries including the prospect of a regulatory crackdown in the US and a possibly more hawkish US Federal Reserve monetary policy outlook. That’s according to data provided by crypto analytics firm The Block, which showed the widely followed 25% delta skew of Bitcoin options expiring in seven days hit its lowest level of the year on Friday the 10th of February.

The seven-day 25% delta skew hit -5.2 on Friday, its lowest since the 28th of December 2022. The 30, 60, 90 and 180-day 25% delta skews were all at or close to at least one-month lows, with all aside from the 180-day having fallen back under zero in recent days. That suggests investors are positioned for further downside in the Bitcoin price in the short term.

The 25% delta options skew is a popularly monitored proxy for the degree to which trading desks are over or undercharging for upside or downside protection via the put and call options they are selling to investors. Put options give an investor the right but not the obligation to sell an asset at a predetermined price, while a call option gives an investor the right but not the obligation to buy an asset at a predetermined price.

A 25% delta options skew above 0 suggests that desks are charging more for equivalent call options versus puts. This implies there is higher demand for calls versus puts, which can be interpreted as a bullish sign as investors are more eager to secure protection against (or bet on) a rise in prices.

Growing Wall of Worries

The deterioration in bond market sentiment comes with Bitcoin’s price having fallen over 7% in the last seven days, as investors take profits after 2023’s rally given rising concerns about a US regulatory crackdown and a more hawkish than previously thought Fed. Regarding the former, the US Securities and Exchange Commission’s recent moves to crack down on US-based crypto-staking service providers are provoking fears that major cryptocurrency exchanges may be in the crossfire of further enforcement action this year.

Meanwhile, the recent run of significantly stronger than expected US data (like last week’s jobs and ISM Services PMI figures) has led to markets pricing in a more hawkish Fed tightening profile for this year, undermining hopes that the Fed might be close to being “done” in its battle against inflation. Next week’s US Consumer Price Index inflation numbers will be a key input into the Fed tightening story, with any upside surprises likely to worsen Bitcoin’s woes.

But Investors Still Positive on Bitcoin’s Longer-term Outlook

As noted above, the 180-day 25% delta skew remains above zero, indicating the market’s longer-term view on Bitcoin remains moderately positive. Given the growing list of on-chain and technical indicators that are all now screaming that the bear market of 2022 is likely over, and the fact that, even if the Fed does do a few extra interest rate hikes, the end of tightening still remains in sight, to expect a positive bias for the year continues to make sense.

But that doesn’t mean every month is going to be like January. In crypto, it’s hardly ever a straight line higher.

Credit: Source link