Bitcoin (BTC) finds itself in a consolidation state after dropping from the psychological mark of $60,000. The leading cryptocurrency is trading at $57,416 at press time, according to CoinMarketCap.

Market analyst and trader Michael van de Poppe disclosed that BTC needs to hold above the $55K price level for it to rally higher. He explained:

“Bitcoin is still holding up onto this scenario and stuck in a sideways range. As long as $55K holds, I’ll assume we’ll test for new highs.”

BTC recently hit an all-time high (ATH) of $61,700, but ever since, it finds itself struggling to sustain above $60,000. Nevertheless, crypto analyst Joseph Young recently noted that Bitcoin is showing considerable resilience despite unfriendly market forces like the surging 10-year treasury yield.

According to market analysts, Bitcoin might never go below the $1 trillion market capitalization again.

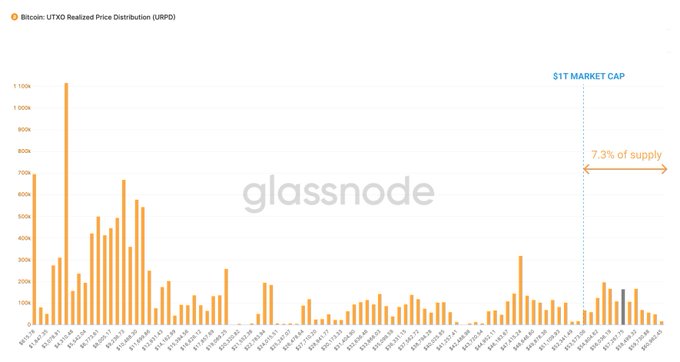

On-chain analyst Willy Woo believes that BTC’s market value will continue holding above the $1 trillion mark, going forward. He acknowledged:

“7.3% of Bitcoins last moved at prices above $1T. This is pretty solid price validation; $1T is already strongly supported by investors. I’d say there’s a fair chance we’ll never see Bitcoin below $1T again.”

Moreover, the next 2-3 years might be a turning point for BTC, as alluded by Deutsche Bank analyst and Harvard economist Marion Laboure.

She elaborated by comparing Bitcoin’s current trajectory to Tesla’s. The analyst said that a consensus about the mainstream cryptocurrency’s future might soon emerge as people have increasingly been monitoring digital currency growth lately, and this interest in cryptocurrencies is expected to carry over the next two to three years.

Time will tell how Bitcoin’s journey to the moon continues to shape up as crypto analyst Carl Martin believes that most people will buy BTC between $100,000 and $500,000 in the current bull cycle. If this is achieved, a price tag of $500,000 will push Bitcoin’s market capitalization above that of gold at $10.9 trillion.

Image source: Shutterstock

Credit: Source link