Against a backdrop of negative macro sentiment and a shift towards risk-off assets, the crypto market plunged this week – including Bitcoin, albeit to a lesser degree. It didn’t stop there, however, as Monday evening saw Bitcoin drop further to below US$33,000, a level analysts argue puts it firmly into oversold territory:

Relative Strength Index (RSI) in Brief

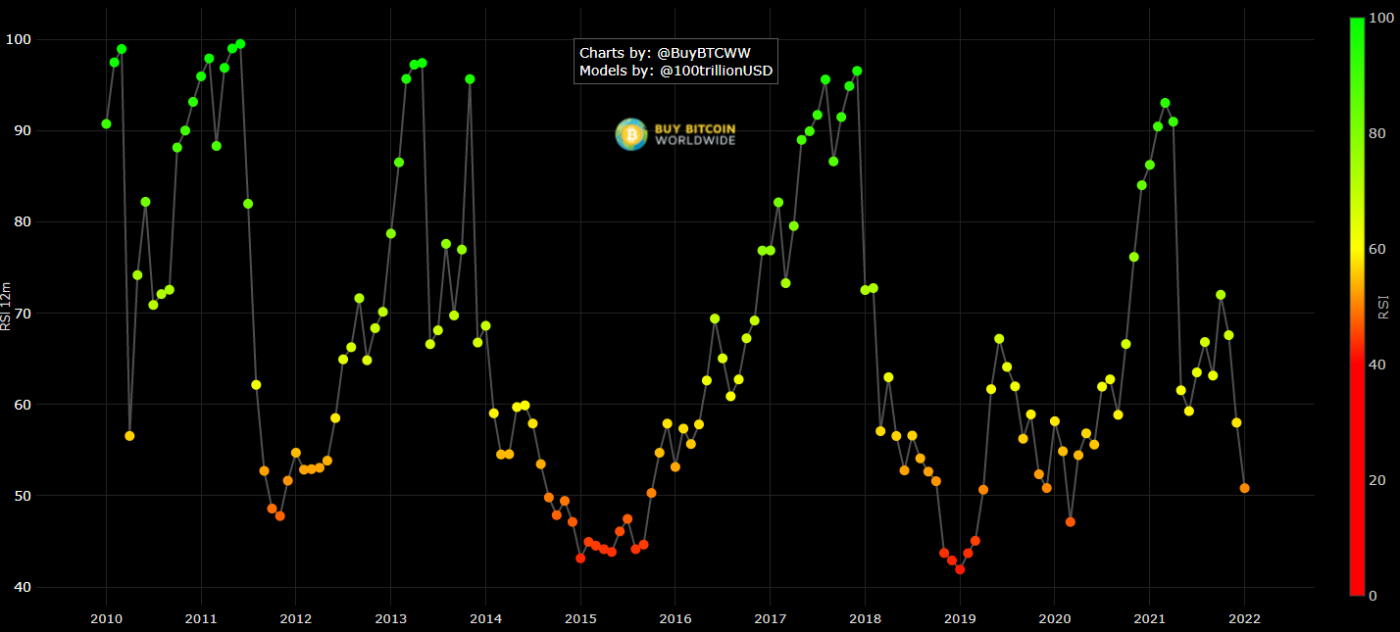

The RSI is a momentum indicator used in technical analysis to indicate levels at which an asset is overbought or oversold. It helps traders plot their entry and exit points, and spot general market trends.

In traditional markets, an RSI value of 70 percent or above is considered overbought, whereas oversold is when the value is 30 percent or below.

Of course, these are just rules of thumb and within the context of Bitcoin need to be considered along with a host of other variables, including on-chain data and fundamentals.

The Upside of a Price Collapse? Bitcoin’s RSI Looks Good

While the initial Bitcoin collapse was driven largely by negative macro winds, the subsequent dip below US$33,000 was mostly attributable to capitulation in the futures market. This was something on-chain analyst Will Clemente foresaw after the initial slump:

The good news of a more than 50 percent correction from Bitcoin’s all-time high is that crypto’s premier asset is now trading at levels that analysts consider “oversold”, as measured by the RSI. Historically, this has represented a good buying opportunity:

As illustrated in the chart below, Bitcoin’s current RSI is close to levels last seen during the pandemic-led meltdown in March 2020.

Twitter user Bitwatch suggests that the latest RSI levels may indeed be a buy signal:

Be fearful when others are greedy, and greedy when others are fearful.

Warren Buffett, the “Oracle from Omaha”

Based on the most recent Bitcoin Fear and Greed Index, if Warren were a Bitcoiner, we know what he’d be doing.

At the time of publication, Bitcoin has since recovered and is trading at US$36,346.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link