Bitcoin Mining Network Hits New Record Hash Rate

According to Bitcoin mining data tracking website MiningPoolStats, Bitcoin’s hash rate hit a new record high earlier this week. According to the website, the network reached the milestone of computing three hundred quintillion (300,000,000,000,000,000,000) hashes per second (300 EH/s).

Bitcoin’s hash rate is viewed as a proxy of the processing power allocated to securing the Bitcoin network by its army of miners. A rising hash rate is viewed as a sign of network adoption, as well as that the network is growing more secure.

The achievement was separately confirmed by Bitcoin mining company Braiins. They defined the real-time network hash rate as “the estimated total network hash rate based on API-reported hash rate values for all mining pools and estimated hash rate values based on blocks found for miners and pools who are not reporting their real-time hash rate”.

One Twitter user responded with a warning that it might not be wise to pay too much credence to the “daily hash rate since statistically it’s not a true representation of hash rate”. “I would always look at the 7 day hash rate or at LEAST the 3 day,” they recommended. “Still – it’s exciting,” they added, referring to the hash rate hitting a new record high.

While not usually looked at as an indicator of whether Bitcoin is entering a bull market, a rising hash rate is news that any Bitcoin owner will want to hear, as it is evidence of the growing strength of the network despite 2022’s brutal price drop.

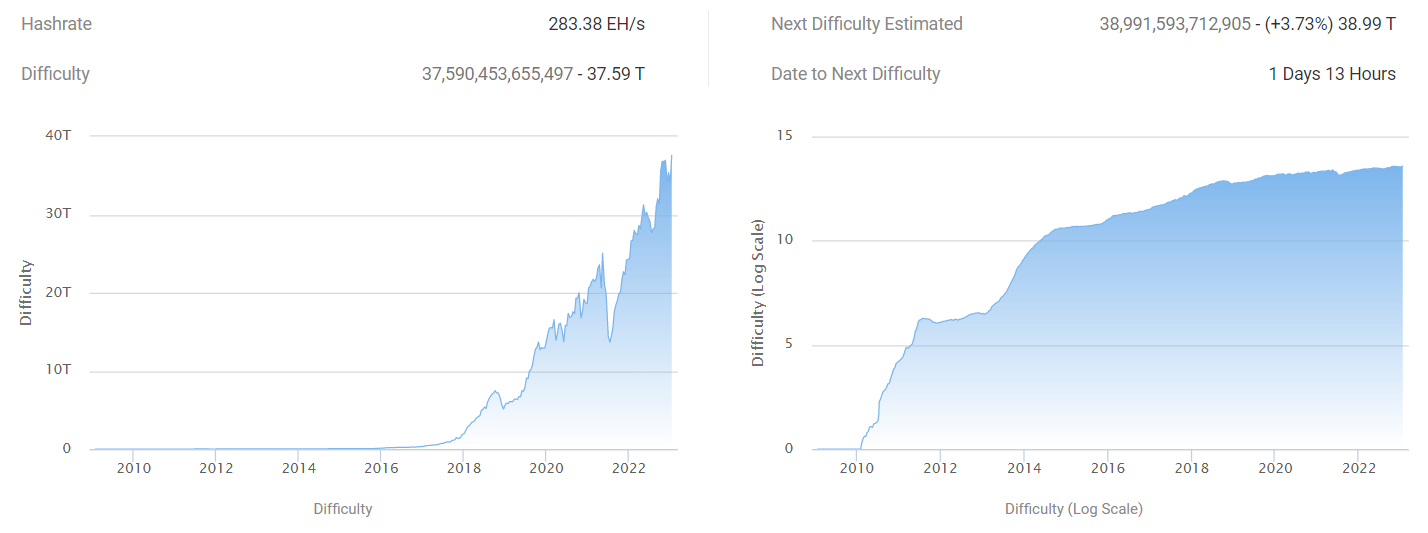

Other websites estimated the Bitcoin network’s hash rate at slightly lower levels. Blockchain.com estimated it at around 274 EH/s earlier this week, while BTC.com’s latest estimate for the network’s has rate was 283.38 EH/s.

Mining Difficulty Also Set to Rise

Mining difficulty is set to rise as the computing power of the Bitcoin network surges. The next difficult adjustment occurs in just over one day and is expected to push the difficulty of successfully mining a block higher by 3.7% to a new record high of 38.99 trillion.

Rising mining difficulty is a nod to the fact that miners are engaging in fiercer competition than ever to mine blocks, enticed by the latest rebound in Bitcoin’s price from last year’s lows in the $15,500 area to current levels around $23,000.

Bitcoin miner BTC flows to exchanges recently also hit a new three year low, according to on-chain data cited by crypto analytics platform Glassnode. This can be taken as a sign that miners are less eager to sell their BTC, perhaps a show of faith that the latest rebound in Bitcoin’s price could be the start of a longer-term recovery back to levels last seen in early 2022.

Indeed, a growing confluence of on-chain and technical indicators, as well as an apparently easing macro backdrop as financial conditions ease on falling US inflation/stuttering growth, suggest that last year’s sub-$16,000 dip may have ultimately been the Bitcoin bottom for the next market cycle.

Credit: Source link