Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

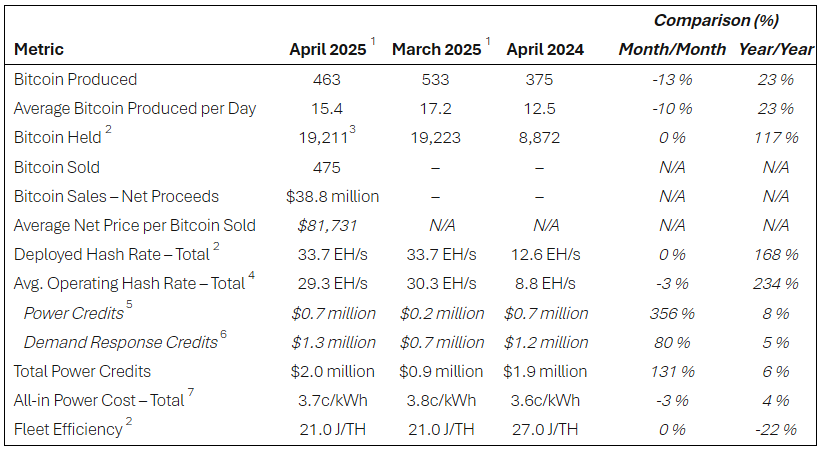

Riot Platforms sold 475 Bitcoin worth $38.8 million in December as profit margins narrow throughout the mining sector. The Colorado firm, the second-largest publicly traded Bitcoin miner by market capitalization, sold the cryptocurrency at an average price of $81,731 per coin, Monday’s operations update disclosed.

Related Reading

Mining Profits Narrow Following Bitcoin Halving Event

The sell-off follows a year since Bitcoin’s fourth halving event, where mining rewards were halved. Miners now get 3.125 Bitcoin per block, down from 6.25, in a pre-programmed cut that happens every four years or so. The self-adjusting cut has tightened margins for mining operations that depend on a continuous stream of new tokens to pay for increasing expenses.

Riot Platforms mined 463 Bitcoin last April, decreasing by 13% from the prior month though it sustained the same level of computing power. The firm tapped the remaining 12 Bitcoin from reserves for finishing the sale.

Source: Riot Platforms

CEO Defends Strategy As ‘Reducing’ Shareholder Dilution

Throughout April, Riot said it made the strategic choice to sell its monthly production of bitcoin to finance continued growth and operations, Riot CEO Jason Les stated in the update. Les said selling Bitcoin lessens the company’s need to raise money by issuing new shares, which would dilute current shareholders’ ownership stakes.

Riot Announces April 2025 Production and Operations Updates.

“Riot mined 463 bitcoin in April as the network experienced two successive difficulty adjustments during the month,” said @JasonLes_, CEO of Riot. “April was a significant month for Riot as we closed on the acquisition… pic.twitter.com/0cSznh5fBM

— Riot Platforms, Inc. (@RiotPlatforms) May 5, 2025

Even with the sell-off, Riot retains 19,211 Bitcoin on its balance sheet. That stash is valued at about $1.8 billion at current prices, demonstrating the company has substantial cryptocurrency holdings even as it sells some to cash out.

Mining Difficulty Increases As Competition Heats Up

The problems that Riot is experiencing are reflective of wider trends in Bitcoin mining. The difficulty level of the network, a measure of how difficult it is to mine new Bitcoin, was nearly a whopping 120 trillion hashes as of May 4. That’s a 35% increase from last year, according to CoinWarz data.

As more miners vie for the same diminished payouts, each operation must increase electricity and equipment expenses in order to receive Bitcoin. This competition has constricted margins throughout the industry, compelling businesses to reassess their cash management practices.

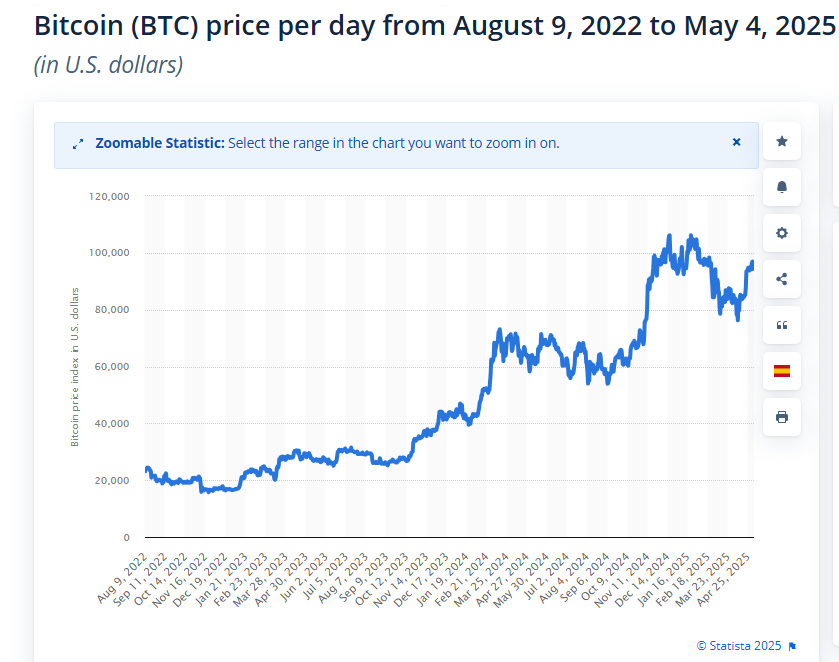

Source: Statista

Related Reading

While Bitcoin has gained 45% in value over the past year and most recently traded over $95,000, it remains below its January peak of $109,000. This price retreat has further pressured mining companies already dealing with higher costs and lower production.

Riot’s move underscores the tightrope Bitcoin miners walk: they have to balance short-term cash requirements with speculation on the future price tag of the most popular cryptocurrency. For the time being, at least one large player is opting for cash upfront over future potential.

Featured image from Riot Platforms, chart from TradingView

Credit: Source link