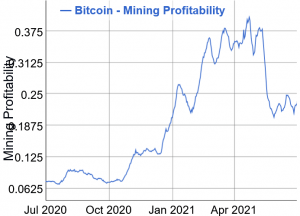

On Saturday, Bitcoin (BTC) mining difficulty saw its largest drop in the history of the network, falling to the level not seen in more than a year and improving profit margins of BTC miners at the time when Chinese miners are leaving the industry (or the country) and their western peers are trying to improve their image. (Updated on July 3, 06:45 UTC with data about the adjustment.)

Bitcoin mining difficulty, or the measure of how hard it is to compete for mining rewards, dropped by 27.94%, to 14.36 T.

This is the third drop in a row and is the highest one ever, followed only by the 18% correction seen in October 2011.

The mining difficulty reached its all-time high of 25.05 T in mid-May.

The mining difficulty of Bitcoin is adjusted around every two weeks (or every 2016 blocks, to be precise) to maintain the normal 10-minute block time. However, the 7-day simple moving average block time on July 1 was 16.8 minutes, the highest it’s been since December 2009. It’s been consistently rising since mid-June as hashrate, or the computational power of the network, has been dropping since June 9 due to a regulatory crackdown on BTC miners in China. Between then and July 1, the 7-day simple moving average hashrate is down 41%.

In the past week, miners have been spending more coins than they’ve been holding – more so than in the previous three months, according to ByteTree.

___

At 11:27 UTC on Friday, BTC trades at USD 33,241 and is down by 1% in a day, increasing its weekly losses to 4%.

“Block time, a leading indicator of future adjustments is already confirming faster, so it might be that we see difficulty adjustments start adjusting up as early as the next adjustment,” Edan Yago, Founder of Bitcoin-based DeFi provider Sovryn, said in an emailed comment, adding that “Bitcoin mining is such a competitive market that no mining equipment will stay idle for long.”

Meanwhile, based on a survey of the network by the recently formed Bitcoin Mining Council, the Bitcoin mining sector has reached a 56% sustainable power mix in Q2 of 2021, “making Bitcoin one of the cleanest industries in the world,” as one of the Council’s founders, the MicroStrategy head Michael Saylor said.

The first voluntary survey focused on two metrics, electricity consumption and sustainable power mix, with the BMC collecting sustainable energy information from over 32% of the current Bitcoin network, per the press release.

However, these results came with criticism from the Cryptoverse natives who are arguing that the methodology survey hasn’t been disclosed, while the sample size is too small, in addition to the ongoing mining crackdown in China making some major shifts in the hashrate distribution.

Others, however, argue that the sample size is relevant enough, while the survey was for the second quarter, which doesn’t necessarily factor in the crackdown.

The press release did mention it, however, as Darin Feinstein, founder of BTC miners Blockcap and Core Scientific, noted that the survey comes at “a pivotal moment” when mining operations are being further decentralized with the miners leaving China.

According to Nic Carter, Partner at Castle Island Ventures, “securing disclosure from 32% of hashrate is incredibly impressive” and “now we have bottom-up data for 1/3 of the network.”

Even so, Carter “encourage[s]” the Council to publish additional methodology, as the mentioned figure of 56% sustainable power “relies on a bunch of assumptions of the rest of the world.”

Saylor said he is “pleased to see that the Bitcoin mining industry has come together, voluntarily, to provide critical information to the general public and policymakers, especially as it pertains to clarifying common misconceptions about the nature and scale of Bitcoin energy usage.”

This is the first quarterly release, with many more expected to come, Saylor said.

___

Learn more:

– A Closer Look at the Environmental Impact of Bitcoin Mining

– Green Investments Help Bitcoin Miners Amid Possible Regulatory Crackdown

– Bukele Teases Volcano-powered Bitcoin Mining Center as Exchange Arrives

– Ethereum, Litecoin, DOGE Miners Run Fewer Rigs Amid Bitcoin Hashrate Drop

– Traditional Investors Sending an ESG Sign Important to Bitcoin Miners Too

– World Bank Accused Of Ignorance & Hypocrisy As It Refuses to Help El Salvador

___

(Updated at 14:23 UTC with a comment from Edan Yago.)

Credit: Source link