The on-chain analytics firm Glassnode has explained that Bitcoin tends to reach a potential top when the long-term holders show this pattern.

Bitcoin Long-Term Holders Have Been Ramping Up Distribution

In a new report, Glassnode discussed the influence that the BTC long-term holders have on the cryptocurrency’s supply dynamics. The “long-term holders” (LTHs) here refer to the Bitcoin investors who have been holding onto their coins for more than 155 days.

The LTHs comprise one of the two main divisions of the BTC user base based on holding time, with the other cohort known as the “short-term holders” (STHs).

Historically, the LTHs have proven themselves to be the persistent hands of the market. They don’t quickly sell their coins regardless of what is happening in the broader sector. The STHs, on the other hand, often react to FUD and FOMO events.

As such, it’s not unusual to see the STHs participating in selling. However, the LTHs showing sustained distribution can be something to note, as selling from these HODLers, who usually sit tight, may have implications for the market.

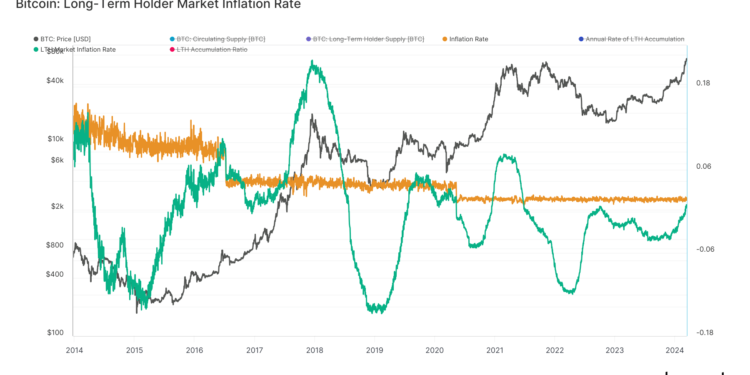

There are many different ways of tracking the behavior of the LTHs, but in the context of the current discussion, Glassnode has used the “LTH Market Inflation Rate” metric.

As the report explains:

It shows the annualized rate of Bitcoin accumulation or distribution by LTHs relative to daily miner issuance. This rate helps identify periods of net accumulation, where LTHs are effectively removing Bitcoin from the market, and periods of net distribution, where LTHs add to the market’s sell-side pressure.

Now, here is a chart that shows the trend in the BTC LTH Market Inflation Rate over the past several years:

The value of the metric seems to have been on the rise in recent days | Source: Glassnode

In the chart, the analytics firm has also attached the data for the asset’s Inflation Rate, which is basically the amount that the miners are introducing into the circulating supply by solving blocks and receiving rewards for them.

When the LTH Market Inflation Rate equals 0%, these HODLers are accumulating amounts exactly equal to what the miners are issuing.

This implies that the indicator below the 0% mark suggests the LTHs are pulling coins out of the supply, while it being above is a sign that they are either distributing or just not buying enough to absorb what the miners are producing.

The graph shows that historically, the cryptocurrency’s price has tended to reach a state of equilibrium and potentially even a top when the LTH distribution has peaked.

The LTH Market Inflation Rate has been increasing recently, but it’s yet to reach any significant levels. As for what this could mean for the market, Glassnode says:

Currently, the trend in the LTH market inflation rate indicates we are in an early phase of a distribution cycle, with about 30% completed. This suggests significant activity ahead within the current cycle until we achieve a market equilibrium point from the supply and demand perspective and potential price tops.

BTC Price

Bitcoin has retraced most of its recovery from the past few days, as its price has now declined to $63,800.

Looks like the price of the asset has witnessed a drawdown again | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Credit: Source link