Bitcoin has extended its recent stretch of positive returns by cracking the all-important US$50,000 psychological barrier. As user growth continues to skyrocket and investors find themselves firmly in positive territory, bitcoin bulls appear confident of a strong surge in the remaining months of 2021.

Within the past 35 days, bitcoin has bounced back some 70 percent from its lows. One of the main reasons offered by analysts relates to growth in long-term HODLers.

Record Levels of HODLers

On-chain data suggests we are now seeing record numbers of long-term HODLers. According to lead Bitcoin analyst at Ark Invest, Yassine Elmandjra, the number of short-term bitcoin holders is at an all-time low – a record 84 percent of bitcoin’s supply has not been moved in over three months.

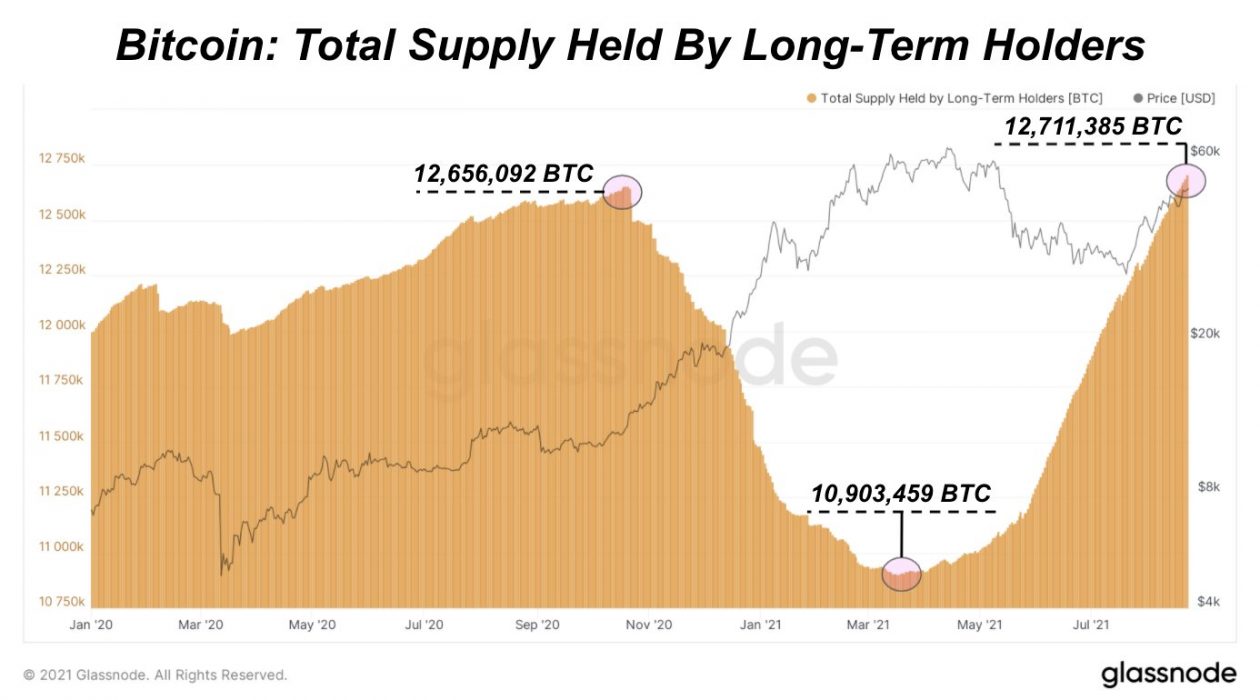

A potentially more intuitive visualisation of this trend is outlined in the chart below. Notice the precipitous decline in long-term holders from November 2020 to May 2021 when the price went from around US$15,500 to US$58,000.

Bitcoin’s Next Moves

Should the pattern outlined in the chart above repeat itself, we may be looking at a bitcoin price between US$150,000 and US$200,000. This would be more or less in alignment with Pete Humiston of Kraken Intelligence’s assessment:

Another approach to consider is the weekly moving average convergence/divergence (MACD) indicator for BTC/USD, which has now flipped from red to green. Historically, this has been a reliable indicator of the trajectory of an asset.

The last time a bullish crossover occurred, BTC/USD saw a 5.5x price increase – from US$11,500 in October 2020 to all-time highs of US$64,500 just six months later. Should that play out again, bitcoin may end up over US$220,000 by the end of the year or early 2022.

The inimitable Bitcoin OG Max Keiser would seem to concur:

Of course when it comes to forward price projections, experienced investors generally advise those new to the space not to get overly focused on the short-term price fluctuations, both up and down. What matters, they say, is an asset’s long-term trajectory.

Notwithstanding, bitcoin bulls would be forgiven for being somewhat excited at present. HODLing through 2021 has certainly not been a walk in the park.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link