Bitcoin (BTC) has renewed speculations from analysts that it could retest its all-high price (ATH) of $58,300 set last month – after it surged to the $55,600 level in the past few days.

It has, however, retraced to $54,673 at the time of writing, according to CoinMarketCap.

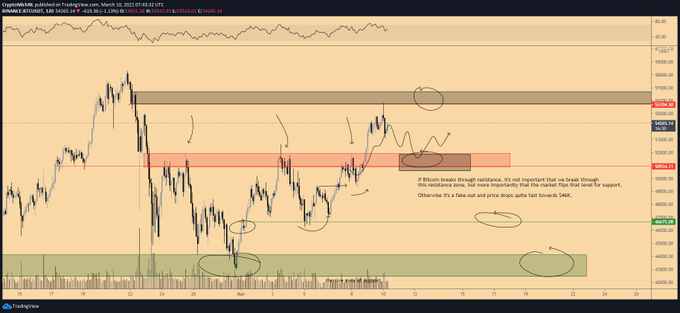

Veteran crypto analyst Michael van de Poppe believes BTC has to hold the $52k level for an upward momentum to be ignited. He explained:

“Beautiful rejection on the $56,000 area for Bitcoin here. If the $52,000 area holds, we can see further sideways action and renewed tests of $56,000. However, once again, $52,000 is critical to hold to avoid further downwards moves.”

The analyst believes that once the $52k level is held, a raging market will emerge, and this will prompt a price momentum that will test the $56,000 resistance before another ATH is set.

BTC’s renewed momentum has been renewed as institutional interest is going through the roof based on big-money moves. This price surge has been pivotal in making Bitcoin skyrocket by 570% in the last 12 months.

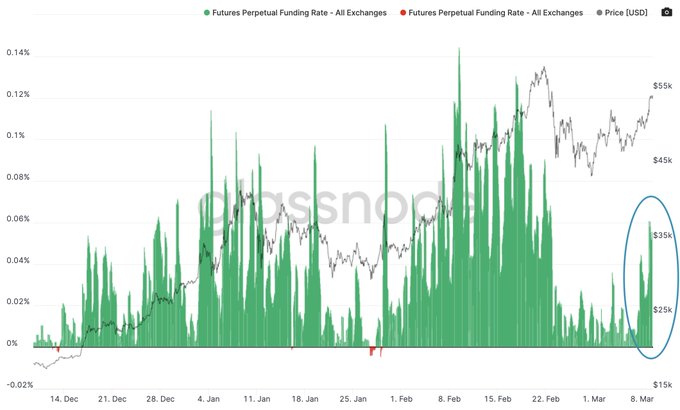

Bitcoin futures perpetual funding rates are warming up

According to Moskovski Capital CEO, Lex Moskovski, BTC futures perpetual funding rate has started gaining momentum, which is a bullish signal. He acknowledged:

“Funding has started to warm up again. Not exactly February’s levels but a notable jump nonetheless. People are getting increasingly bullish.”

An increase in Bitcoin futures perpetual funding rates illustrates that people are using leverage to buy BTC instead of spot buying. As a result, showing the willingness of more users to join the Bitcoin network.

Recently, twenty-five publicly traded companies showcased their financial muscle as they hold a total of 178,855 on their balance sheet worth a whopping $9.6 billion. They include Tesla Inc, Microstrategy Inc, Voyager Digital LTD, Galaxy Digital Holdings, Meitu, and Square Inc, among others.

If the $52,000 support level holds, as alluded to by Michael van de Poppe, Bitcoin may be set for a new ATH in the near future.

Image source: Shutterstock

Credit: Source link