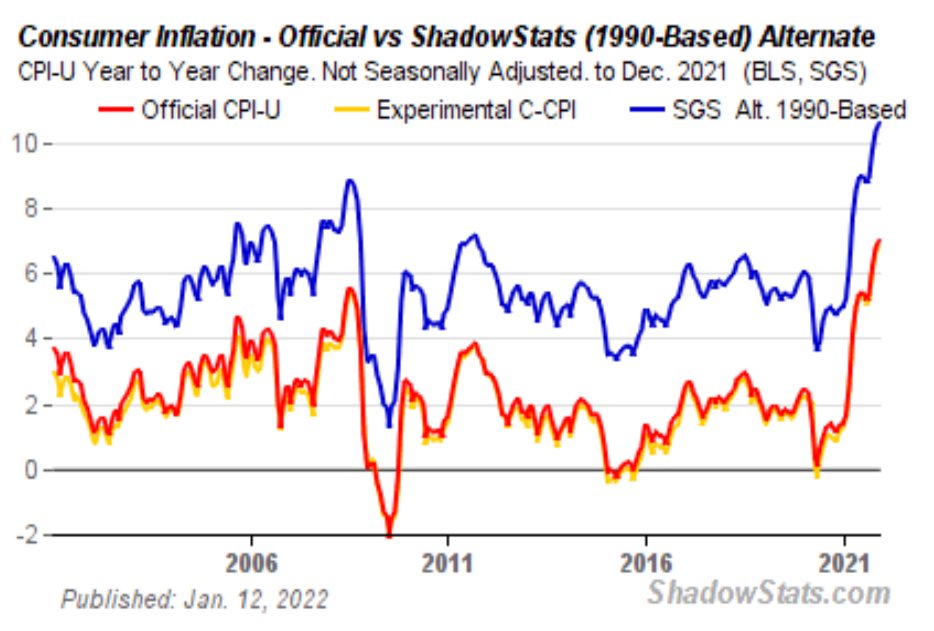

Since abandoning the narrative that inflation was transitory, the US Federal Reserve has tacitly admitted that inflation is here to stay. This was confirmed by the latest consumer price inflation (CPI) print for the 12 months ending December 2021, a 40-year high of 7 percent:

CPI, An Accurate Measure?

The US’ highest CPI print since 1982 proved to be in line with market expectations and, according to the report, was primarily due to supply chain challenges, labour shortages and the ongoing pandemic.

The highest contributors to the CPI basket included energy commodities (48.9%), used vehicles (37.3%), and meat, poultry, fish and eggs (12.5%).

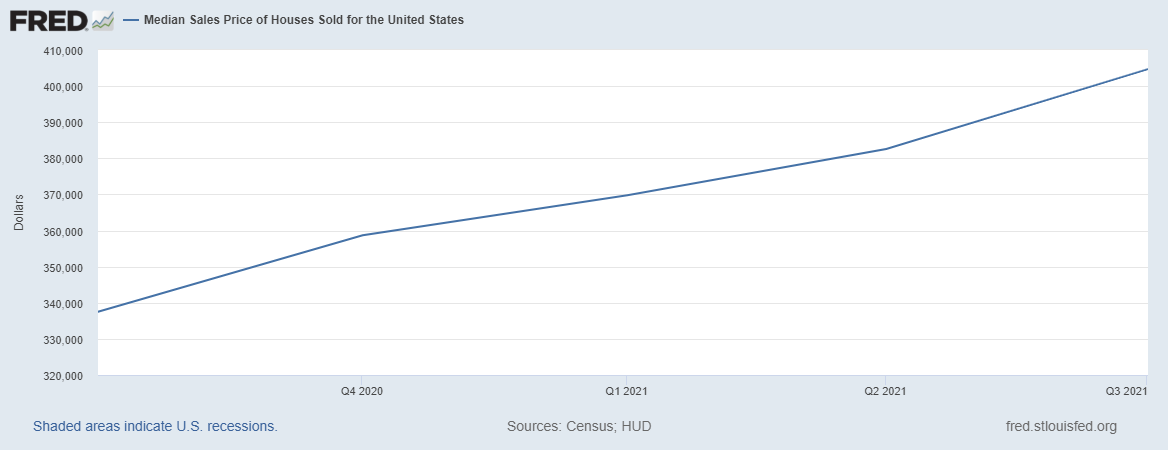

Remarkably, the official increase for shelter was 4.1 percent, a figure many question since it is based not on actual house prices, but rather “owners’ equivalent rent of residences”. As reflected in the graph below, the real growth of the median US house price between December 2020 and December 2021 was, in fact, 20 percent.

It’s no surprise that not everyone agrees on the official inflation figures, particularly since its definition has changed over the years, most notably to exclude the real cost of house price growth.

Shadowstats purports to track real inflation figures and it suggests that inflation, based on the historical and more accurate definition of inflation, has risen by over 10 percent.

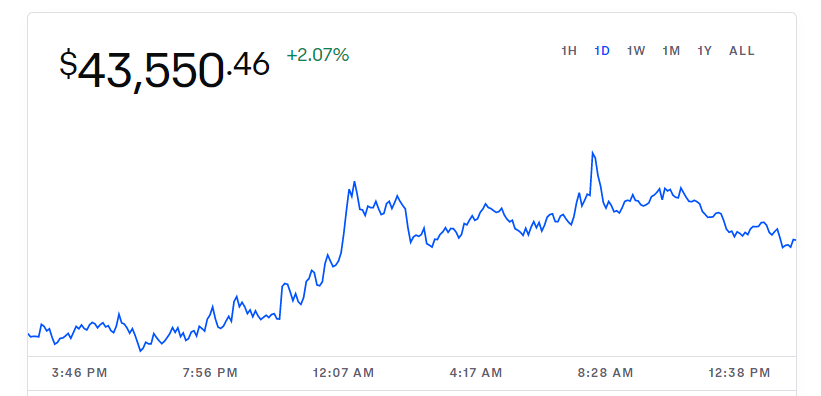

Bitcoin Rises Above $44,000 on the News

January 12’s release of CPI data proved to be in line with market expectations, resulting in the broader crypto market lifting on the news. Bitcoin’s rally, in particular, offered welcome relief to HODLers, who have endured weeks of prolonged losses. On news of the CPI print, crypto’s premier asset rose above the key level of US$44,000.

Bitcoin has no doubt benefited from the Federal Reserve’s loose monetary policy since March 2020 and, given recent pronouncements of impending rate hikes, crypto investors can expect higher levels of volatility in the short to medium term.

Irrespective, for those with a long-term horizon, Bitcoin remains – on a risk-adjusted basis – the best hedge against inflation. One way to look at it is that if it’s good enough for the fund manager who outperformed the S&P 500 for a record 15 years straight, than it ought to be good enough for the average investor.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link