CryptoFees data shows that Bitcoin daily fees averaged $10.65 million from November 16 to November 18, surpassing Ethereum’s average fee of nearly $7 million for the same period.

Until 2024, the US Securities and Exchange Commission (SEC) is deferring decisions on several Bitcoin ETF applications, despite the market’s increasing optimism about the approval of a spot Bitcoin exchange-traded fund (ETF) in the US.

This hesitation has coincided with a remarkable surge in the top crypto’s average transaction fees, soaring over 1,000% to reach a peak of $18.67 on November 16, according to BitInfoCharts data.

The average daily transaction fees for BTC, totaling $37,370, have seen a reversal with Ethereum. This change comes in the wake of heightened activity related to Ordinals on the Bitcoin network.

Bitcoin has outpaced Ethereum in daily fees in the last five days. Source: BitInfoCharts

This fluctuation underscores the dynamic nature of transaction fees in the cryptocurrency space, with Bitcoin experiencing notable shifts in its fee landscape.

Contrary to worries about the potential deterrent effect of elevated transaction fees on Bitcoin users, on-chain data suggests a contrasting trend.

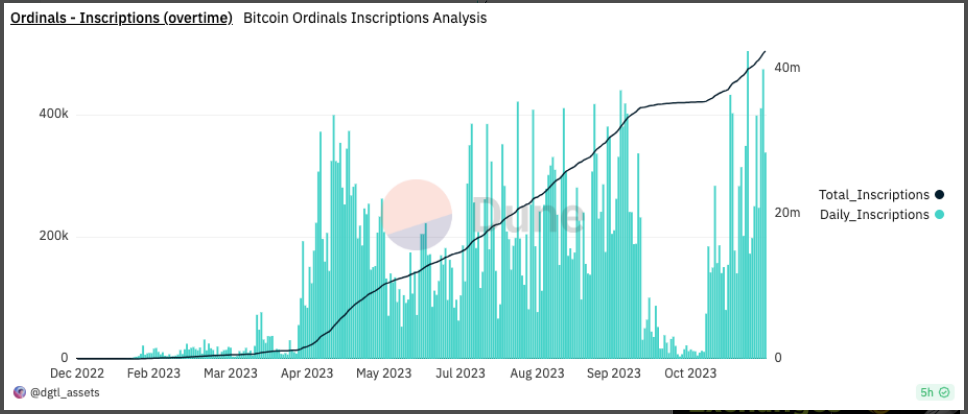

From late October, Ordinals inscriptions increased by almost 6 million. Source: Dune Analytics

Widespread Adoption And Growing Addresses

Recent data from IntoTheBlock reveals a notable surge in Bitcoin adoption, hitting a new yearly high at 67.62% this week.

This increase in adoption is reflected in the uptick of newly created active addresses, signaling a substantial influx of new participants into the market.

Bitcoin retakes the $37K territory. Chart: TradingView.com

Ordinals Gathering Momentum

Additionally, the volume of Bitcoin held by long-term investors has reached an unprecedented high, with over 1 million addresses now possessing more than 1 unit of Bitcoin.

This data indicates a growing and robust interest in Bitcoin, despite concerns about transaction fees, as evidenced by both increased user participation and a rise in long-term holdings.

Since October 24, the network has redistributed approximately 800 BTC in fees, equivalent to $30 million, as a result of the production of nearly 6 million Ordinal assets.

Following ORDI’s (the second-largest BRC-20 token by market capitalization) debut on Binance on November 7, the increase in Ordinals inscription activities gathered momentum.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Freepik

Credit: Source link