The price of bitcoin (BTC) moved up immediately following the conclusion of a two-day US Federal Reserve (Fed) meeting on Wednesday, with the statement from the meeting saying interest rates will be kept unchanged for now, while the amount of tapering doubled from last month. The Fed signaled that 2022 will see three interest rate hikes.

At 19:10 UTC, BTC traded at USD 49,200, up 3.1% for the past 24 hours and up nearly 3% in the first 10 minutes after the release of the statement. Ethereum (ETH) jumped 4% during the same 10 minutes, moving above USD 3,965.

At the same time, the US S&P 500 stock index responded to the statement from the meeting by trading up 0.4% in a matter of 10 minutes after the statement was released. At the time of writing, the index remains up 0.36% for the day.

“In light of inflation developments and the further improvement in the labor market, the Committee decided to reduce the monthly pace of its net asset purchases by USD 20 billion for Treasury securities and USD 10 billion for agency mortgage-backed securities,” the Fed’s statement said.

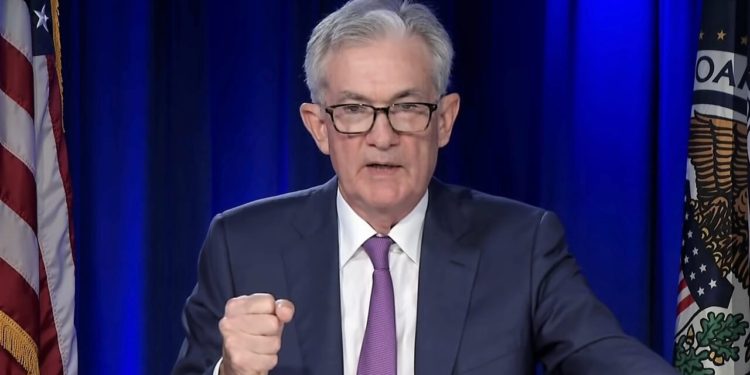

Speaking at a press conference, Fed chair Jerome Powell said that overall inflation is running “well above” the 2% goal, and will continue to be so into next year.

“We are committed to our price stability goal” and will use the tools at our disposal to prevent higher inflation from becoming “entrenched,” Powell said.

Worth noting is that the word “transitory,” which the Fed previously used to describe inflation, has now been removed.

In projections released today, the Fed also said it expects three rate hikes in 2022, followed by two in 2023 and two more in 2024.

The Fed’s move represents a significant adjustment to its policy, which until now has been the loosest in the central bank’s history.

“Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation,” the statement further said. It added that “job gains have been solid in recent months, and the unemployment rate has declined substantially.”

Ahead of today’s statement, Chief Investment Officer of Global Fixed Income at asset management firm BlackRock, Rick Rieder, told CNBC: “I think getting out of the easing business is very much overdue.” If asset purchases are ended earlier, the Fed will have the option of raising interest rates, Rieder explained, saying “I think they can hike rates in 2022. I don’t think there’s a rush.”

The Fed’s decision to double tapering follows the central bank’s stated commitment from last month to maintain an “accommodative stance of monetary policy,” while reducing its monthly asset purchases by USD 15bn each month.

Today’s statement thus represents a doubling of the reductions of monthly asset purchases by the Fed.

However, the Fed also added back then that it is “prepared to adjust the pace of purchases” if the economic outlook changes.

____

Learn more:

– Arthur Hayes Tells Crypto Traders ‘It Pays to Wait,’ Stronger USD Coming

– How Global Economy Might Affect Bitcoin, Ethereum, and Crypto in 2022

– Bitcoin Fluctuates as US Inflation Reaches Its Highest Since 1982

– Interest Rates: Why the Era of Cheap Money Is Finally Ending

– ‘Paper Money’ Hits All-Time Low Against Bitcoin & Other Hard Assets – Pantera’s CEO

– Inflation Scares in an Uncharted Recovery

___

(Updated at 19:38 UTC with additional details.)

Credit: Source link