Bitcoin could be in for a quick rebound back above the $30,000 level in the coming days if it follows in the footsteps of a historic trading pattern that looks to be unfolding.

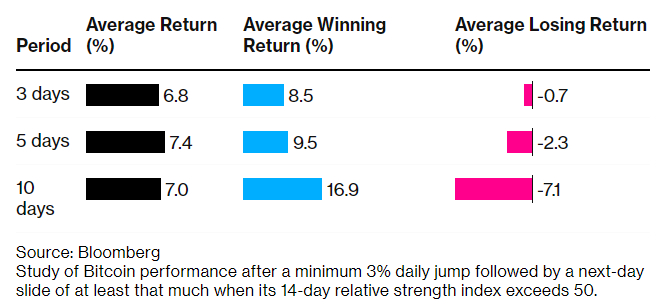

According to an article released by Bloomberg, after Bitcoin has jumped by at least 3% one day only to then give back the entirety of this gain the next day during a broadly bullish period for the cryptocurrency, it typically rebounds by around 7% within a three-to-10-day period.

For reference, Bitcoin jumped 3% on Tuesday, before dropping 5% on Wednesday, meaning it is in the early stages of trading in line with this historic pattern.

If Bitcoin was to see a quick 7% jump from Wednesday’s close near $28,800, it would be back to just below $31,000.

According to Bloomberg, the above pattern has played out 17 times during bullish market periods over the last five years.

Bullish market periods were defined as Bitcoin’s 14-Day Relative Strength Index being above 50 (it was above 50 on Wednesday, but fell just below 50 on Thursday).

Is Bitcoin About to Bounce?

While the above analysis from Bloomberg suggests that there might be some reason for optimism about an incoming Bitcoin price bounce, chart analysis is sending a more pessimistic signal, at least for the very near-term price outlook.

Bitcoin was last down just over 1.0% on Thursday and trading near $28,500, having now fallen below its 21-Day Moving Average (at $29,054) and an uptrend from the late-March lows.

From a technical perspective, that means the door is now open to a test of a downtrend linking late-March/early-April highs, which would come into play in the $28,000 area.

Was Bitcoin to fall below here, it would be odds to test support in the $26,500 area in the form of the 50DMA and a support-turned-resistance zone from mid-March.

A drop back to key long-term support-turned-resistance in the $25,200-400 area is also potentially on the cards.

Will Bulls Buy the Dip?

While significant uncertainty remains about how many more times the US Federal Reserve will lift interest rates and when it will start cutting them, one thing seems certain – the end of the Fed’s tightening cycle looks to be close as US inflation and economic growth decelerate.

That implies that macro is unlikely to return as a major headwind to crypto markets in 2023, as was the case in 2022.

That, combined with continued crypto adoption, progress towards legislation (the EU just passed a landmark crypto bill) and a litany of on-chain, technical and market cycle indicators all screaming that last year’s lows marked the end of the crypto bear market, means that the Bitcoin bull market is likely to remain alive and well in 2023.

As such, expect bargain hunters and dip-buyers to be waiting eagerly on the sidelines to jump in each time Bitcoin posts significant price dips, just as was the case during mid-March.

A drop back to the $25,000s could mark such an opportunity for the longer-term bulls, and would mark a near-20% drop from earlier monthly highs above $31,000.

Whether Bitcoin can bounce back above $30,000 within the next ten days as Bloomberg’s price pattern analysis suggests remains to be seen.

But the longer-term outlook remains robust.

Credit: Source link