While Bitcoin’s price action is determined by multiple variables, on-chain data provides useful clues of the direction in which the market may be heading. The latest data from leading on-chain analysts suggests that some sharp upwards price action may be just around the corner.

Bullish Signals

Despite bitcoin being up 263 percent over the past 12 months, bitcoin bulls have undoubtedly had their conviction tested in 2021. From China banning bitcoin mining to seemingly endless sideways movement to persistent fear gripping the market, it hasn’t been smooth sailing for the king of crypto. However, on-chain analytics are offering some positive signs for the coming months.

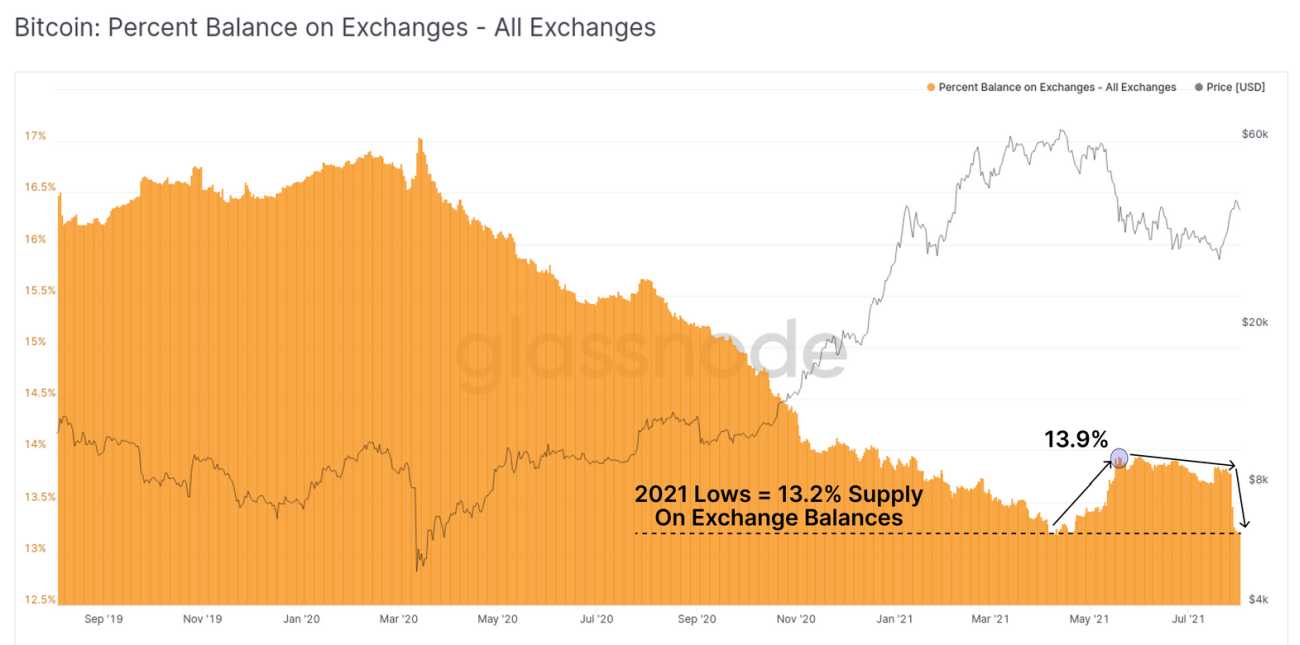

For starters, the last week of July saw 100,000 bitcoins leaving exchanges, as well as hitting a 2021 low of 13.2 percent of circulating supply left on exchanges. As a reminder, outflows typically indicate a shift towards long-term holders.

In addition, compared to the US$260 million in losses from the previous week, gains were almost 10 times higher.

Lastly, a useful lagging indicator highlighted by on-chain analyst Will Clemente is the supply shock ratio. Note how the price below lags materially behind the purple line. This indicates that bitcoin may well be under-valued at current prices with a potential price rise on the horizon.

Where is Bitcoin Going?

While bitcoin has previously trended within the parameters of the four-year halving cycles, in a recent episode of the Wolf of All Streets podcast, analyst Willy Woo suggested this may no longer be the case and that we may be in the “last cycle”.

He argues that as the market has matured, miners have increasingly less influence on sell pressure and therefore prices. Going forward, it is possible that the market price will be more a function of macro supply and demand, than the four-year halvings.

While price predictions abound and are likely to be inaccurate, it does appear as if the market is slowly moving in a bullish direction.

At the time of publication, Bitcoin is up almost 6 percent on the week and trading at US$43,465.83.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link