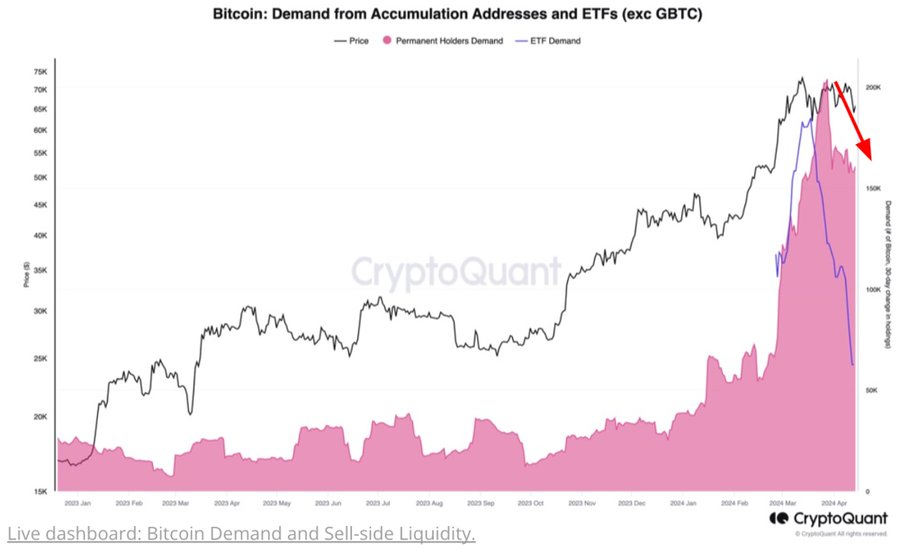

Bitcoin (BTC) demand dropped before the halving, according to the crypto analytics firm CryptoQuant.

The firm notes that investors took profits ahead of the halving event, which happened on Friday night and slashed Bitcoin’s block rewards from 6.25 BTC ($398,134) to 3.125 BTC ($199,067).

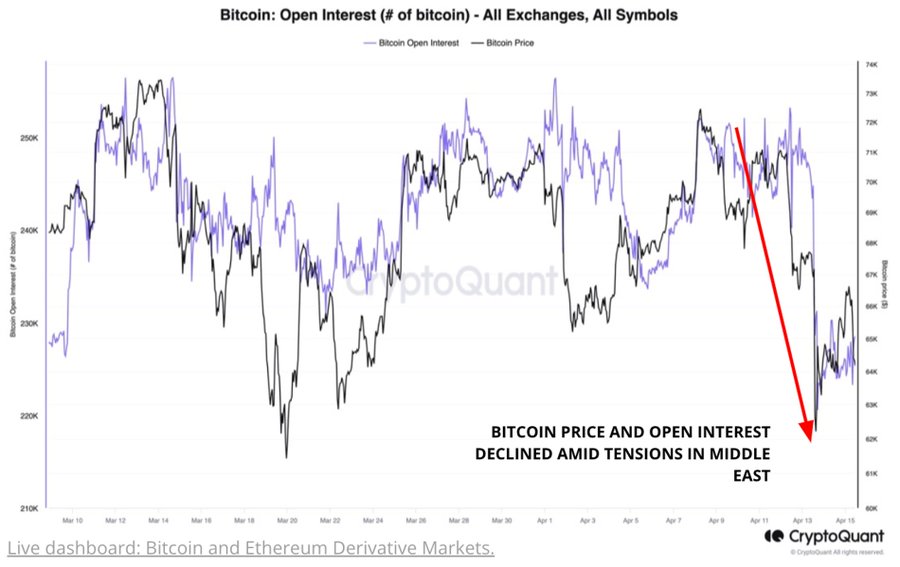

“Traders in the perpetual futures market are locking in gains amid increased volatility and geopolitical concerns.”

The firm suggests that Bitcoin investors could be waiting on the sidelines for the ongoing geopolitical uncertainty in the Middle East to de-escalate.

“In a context of market turmoil amid tensions in the Middle East, traders with long positions have decreased their exposure to Bitcoin and cryptocurrencies in general, which is evident in the taker Buy Sell Ratio declining below one. Taker but sell ratio below one implies that sell orders are larger than buy orders. Prices typically rally along a Buy Sell ratio being above 1, when buy orders dominate sell orders.”

CryptoQuant also notes that large holders and exchange-traded funds (ETFs) have been acquiring less Bitcoin, which the firm attributes to market uncertainties and structural changes caused by the halving.

CryptoQuant notes that one metric appears bullish, however.

“The recent sell-off has reset traders’ unrealized profits, historically a signal of a potential market bottom in bull cycles.

Market participants seem to be recalibrating their positions, leading to a decrease in immediate demand and price stabilization.”

Bitcoin is trading at $63,655 at time of writing.

Generated Image: Midjourney

Credit: Source link