Despite today’s macroeconomic developments, the price of Bitcoin continues to move sideways and seems likely to stay on this path. The number one crypto by market cap has seen its volatility drop to fresh lows as its price is trapped at current levels.

At the time of writing, Bitcoin trades at $26,600 with sideways movement in the last 24 hours. Over the past seven days, the cryptocurrency has recorded some profits but has been unable to break above or below the $28,000 to $30,500 range.

A New Normal For Bitcoin? Volatility Likely To Decline Until This Changes

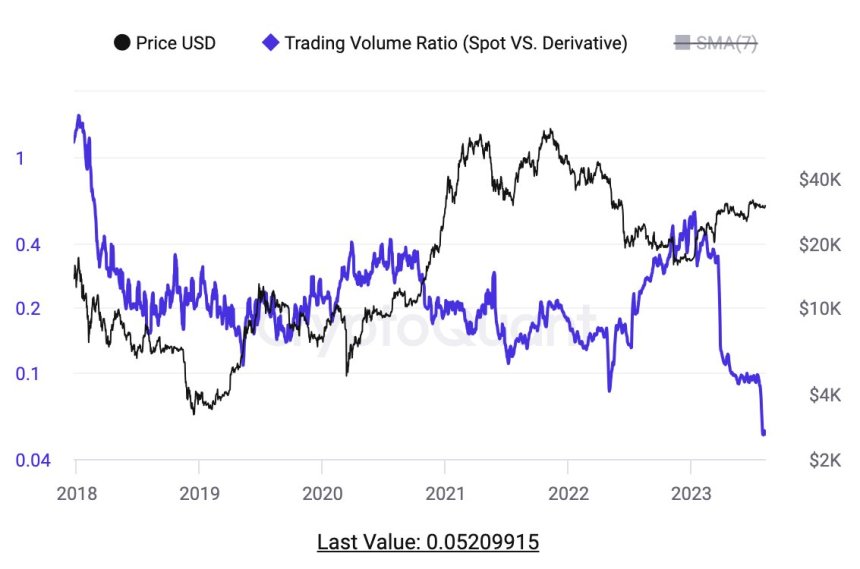

Analyst Dylan LeClair pointed out that operators in the derivatives sector have dominated the current Bitcoin price action. In that sense, the BTC spot-to-derivative trading volume ratio followed volatility and declined to all-time lows.

As seen in the chart below, this ratio shows that the spot market has been suppressed by the derivatives sector, with traders “chopping each other to oblivion.” LeClair stated the following:

(…) spot bears have mostly run out of coins & spot bulls are either fully deployed or are sidelined TradFi waiting for ETF approval.

With the U.S. Federal Reserve (Fed) out of session until September and low uncertainty in the short term, the price of Bitcoin seems poised to keep chopping around its current levels.

In this environment, derivatives traders will likely profit from selling volatility via different financial instruments. Data from the derivatives platform Deribit shows an uptick in call (buy) contracts on the options sectors for October to December expiry.

A report posted by this platform from Rogue Trader Academy highlights the need for a catalyst to push BTC out of its current range. The market is positioning itself for a Bitcoin spot Exchange Traded Fund (ETF) approval in Q4, 2023, thus why players on the options markets are accumulating calls.

Selling volatility has been a profitable strategy in July. Still, as the metric hovers around historical lows, traders become more resilient to dump their contracts on the derivatives sector, further suppressing BTC’s price. Rogue Trader Academy stated:

(…) those selling volatility (gamma sellers) are growing hesitant to offload at such historically low implied vol levels, especially with significant economic data like the US Consumer Price Index (CPI) on the horizon for this week.

In this low volatility, low liquidity environment, only a catalyst will push BTC beyond $30,000 and beyond $40,000 by the end of the year. Something seems apparent in this context: Bitcoin seems ahead of any bullish narrative and likely to outperform in the sector for the remainder of 2023.

Cover image from Unsplash, chart from Tradingview

Credit: Source link