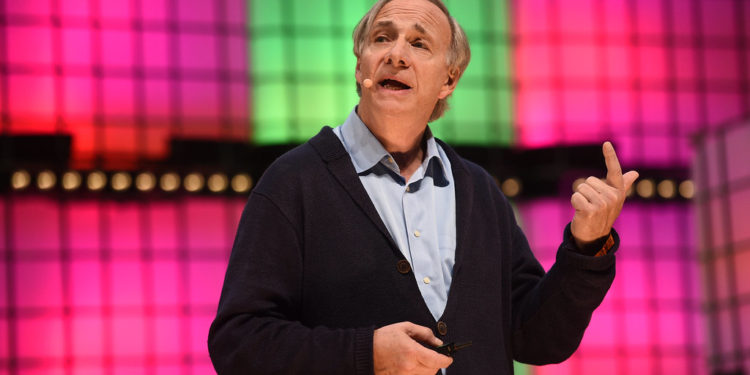

Ray Dalio, founder of Bridgewater Associates (one of the world’s largest hedge funds), has revealed that he holds some Bitcoin (BTC).

The entrepreneur and fund manager, who has previously expressed concern about the possibility of heavy regulation of Bitcoin, now seems to have acquired some.

Bitcoin Over Bonds

Both Dalio and Stanley Druckenmiller, also a billionaire hedge fund manager, have pessimistic views of the dollar and have taken positions in Bitcoin.

The elephant in the room is inflation. It may become so obvious that the Fed has to move, and the longer they wait to move, the bigger the bubble will be and the bigger the reaction.

Stanley Druckenmiller

With views like these pervading the air, many people are looking for an alternative to the dollar. Dalio mentioned during an interview with CoinDesk that retailers might prefer buying bitcoin over bonds due to inflation. This poses a risk to government and since “it goes into bitcoin, and it doesn’t go into credit, then [governments] lose control of that.”

Dalio also mentioned that Bitcoin’s “greatest risk is its success” such that governments, fearing competition from Bitcoin to state monetary systems, could crack down on its owners.

One of the great things, I think, as a worry is the government having the capacity to control almost any of them, including bitcoin, or the digital currencies,

Ray Dalio

An Asset To Combat Inflation

One of the perceived uses of Bitcoin is that it could act as an asset that fights inflation, and in an inflationary future where “cash is trash” Bitcoin might catch on as a store of wealth. Due to the ongoing printing of money and harsh economic position due to the COVID-19 pandemic and various other factors, the power of the dollar has decreased.

You need to borrow money? You have to print that. You need more money? So, taxes go up and that produces a dynamic. Now I can keep going on about what happens in that dynamic. It may be capital controls. … I painfully learned in 1971 that it causes stocks to go up. It causes… gold, bitcoin, real estate, everything to go up, because it’s really going down in dollars. And that’s the part of the cycle we’re in.

Ray Dalio

In countries like Argentina, Bitcoin has seen a major increase in use due to the devaluation of the Argentine Peso (ARS), causing a major reduction in the buying power of people in the country. For them Bitcoin is a solution to store their wealth. If someone had 100 ARS in 2019 versus 100 ARS worth of BTC, that BTC investment would be considerably higher now. In the last 10 years the Argentine Peso has devaluated almost 95% against the US dollar.

Dalio also spoke at Consensus, a massive online blockchain seminar on Monday regarding money, monetary policy & Bitcoin. Being part of an event like this shows that there is an interest in the technology and a willingness to share information and knowledge with individuals in this space.

Join in the conversation on this article’s Twitter thread.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link