One of the main crypto headlines today involves Franklin Templeton seeking regulatory approval for a Bitcoin ETF.

Financial services company Franklin Templeton filed an application on Tuesday for a Bitcoin exchange-traded fund (ETF), the latest major firm looking to bring a crypto ETF to market.

Given the latest developments on crypto-related ETFs, what are the best cryptos to buy now?

The proposed Franklin Bitcoin ETF would trade on the Cboe BZX Exchange and use Coinbase as its Bitcoin custodian, according to a filing with the Securities and Exchange Commission (SEC).

It would benchmark the CF Benchmarks Bitcoin Price Index, which aggregates pricing data across major cryptocurrency exchanges. Franklin Templeton, founded in 1947, declined to comment on the filing.

The asset manager joins BlackRock, Fidelity, and others in seeking regulatory approval for a Bitcoin ETF after a federal appeals court ruled unanimously last month that the SEC wrongly denied a Bitcoin ETF application from Grayscale.

The court said the denial was “inconsistent” with the SEC’s past approval of Bitcoin futures ETFs.

Industry observers have described the approval of a Bitcoin spot ETF as a “holy grail” that could draw substantial investments from traditionally conservative institutions.

The SEC has previously denied such proposals over concerns about potential manipulation in Bitcoin markets. To address those worries, BlackRock and Fidelity partnered with Nasdaq and NYSE respectively to monitor Bitcoin markets for manipulative activities.

Meanwhile, Franklin Templeton’s filing did not mention plans for a surveillance partner.

Bitcoin prices briefly rallied above $31,000 following the BlackRock and Fidelity filings last month but have since declined from those highs.

The SEC has yet to approve a spot Bitcoin ETF, but the recent court decision and barrage of applications from major financial firms have boosted optimism that crypto ETFs could soon become a reality. Still, the timing and outcome of any SEC ruling remains uncertain.

Beyond the Bitcoin ETF hype, Kaspa, Wall Street Memes, Optimism, Bitcoin BSC, and Injective are some of the best cryptos to buy now given their solid fundamentals and/or favorable technical analysis.

Momentum Oscillators Align in Favor of Continued Kaspa (KAS) Gains

Kaspa (KAS) is demonstrating a bullish trend that may be indicative of a potential rally. The cryptocurrency is rising by 7.60% so far today, after holding steady within the support zone of $0.038877 to $0.041021 for the past five days.

Now, KAS is currently trading at $0.042607, moving towards the immediate resistance at the Fib 0.786 level of $0.045105.

Looking at the moving averages, the 20-day Exponential Moving Average (EMA) at $0.038345, the 50-day EMA at $0.037388, and the 100-day EMA at $0.033734, all are below the current price. This alignment of EMAs below the current price is a strong bullish signal, suggesting the asset is in an uptrend.

The RSI is showing a significant increase from yesterday’s 55.11 to today’s 62.25. It is a momentum oscillator that measures the speed and change of price movements.

An RSI above 50 indicates a potential bullish trend. The current RSI suggests that the buying pressure for KAS is increasing, indicating a potential continuation of the upward trend.

KAS’s MACD histogram has also shown a positive divergence. The MACD histogram has increased to 0.000827 from yesterday’s 0.000668, indicating a rise in bullish momentum.

KAS traders should keep a close eye on the immediate resistance at the Fib 0.786 level of $0.045105. If KAS manages to break this resistance, it could trigger further upward movement.

On the flip side, the horizontal support zone of $0.038877 to $0.041021 combined with the Fibonacci 0.618 level of $0.039788 provides a solid floor in the event of a price correction.

Wall Street Memes Set to Launch on September 27, One of the Best Cryptos to Buy Now

A new cryptocurrency project tied to the viral 2021 WallStreetBets movement prepares to launch later this month. Wall Street Memes, after raising over $25 million in presales, will release its token on September 27.

With founders from the WallStreetBets Reddit forum known for coordinated GameStop stock surges, Wall Street Memes looks to bring a similar community ethos to crypto. The project has already attracted retail investors and figures like Elon Musk.

Over 30% of the one billion token supply has already been staked through Wall Street Memes’ staking platform, offering a 63% annual percentage yield to encourage long-term holding. This staking resembles the model of BTC20, a cryptocurrency built for stability amid market downturns.

Wall Street Memes has a sizable social media following, with over one million retail investors engaged across platforms. The organization first rose in 2021 as a vocal supporter of the meme stocks phenomenon driven by individual traders.

The founding team also has proven crypto experience, having previously launched a 10,000-piece NFT collection that sold out fast and generated $2.5 million in sales last year.

The Wall Street Memes token will launch on Ethereum and Binance Smart Chain, with presale purchases available in ETH, BNB, or USDT.

With meme coin interest still strong, the project’s WallStreetBets ties make it noteworthy as the crypto market evolves.

Visit Wall Street Memes Now

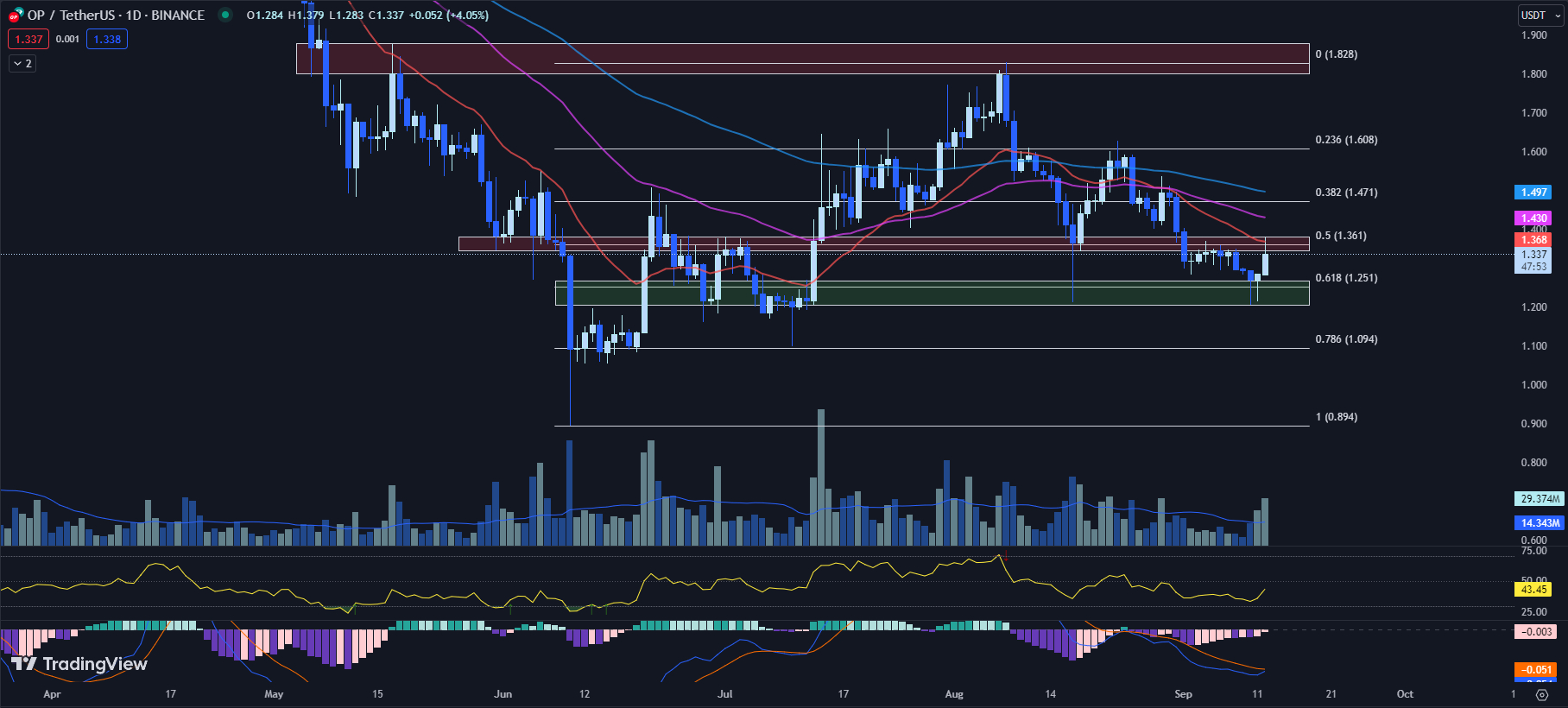

Optimism (OP): Bullish Signals Amidst Bearish Trend

The Optimism (OP) cryptocurrency has extended its gains from yesterday, with a 4.05% increase so far today to the current trading price of $1.337. This positive shift has been reflected in a number of key technical indicators, which traders can use to inform their next move.

OP’s 20-day EMA currently stands at $1.368. This is less than its 50-day and 100-day EMAs, which are at $1.430 and $1.497 respectively.

The fact that the shorter-term EMA is below the longer-term ones suggests that the coin’s price has been experiencing a bearish trend. However, the recent price rise indicates that this trend could be reversing.

This shift towards optimism is also visible in the RSI. OP’s RSI has risen from 35.94 to 43.45, indicating a growing bullish sentiment among traders.

Despite this, the RSI remains below 50, signifying that the market is not yet oversold and there is still room for upward price movement.

The MACD histogram has moved from -0.008 to -0.003. This move closer to zero signals a potential bullish MACD crossover, implying a positive momentum and a potential buying opportunity.

In terms of trading volume and market cap, Optimism has seen significant growth. The market cap has swollen by 4.74% to hit $1 billion, while the 24-hour trading volume has surged by 29.84% to reach $123.8 million. This increased activity in the market could be a precursor to a larger price movement.

Turning now to support and resistance levels, OP is facing a horizontal resistance zone of $1.346 to $1.380, which coincides with the Fib 0.5 level of $1.361 and the 20-day EMA of $1.368. Traders should watch these levels closely as a successful break above this zone could trigger a strong bullish rally.

Conversely, if the price reverses, OP has an immediate support zone of $1.206 to $1.268, which aligns with the Fib 0.618 level of $1.251. A fall below this zone could indicate a bearish turn, prompting traders to consider selling or shorting.

While the recent price movements of Optimism present a promising picture, traders should closely monitor the aforementioned technical indicators and price levels.

These will provide key insights into the potential future movements of OP, guiding informed and strategic trading decisions.

Bitcoin BSC Presale Soars Past $1.4 Million: Don’t Miss Out on One of the Best Cryptos to Buy Now

Investors are lining up for a chance to return Bitcoin to its early days – at least in terms of pricing.

The new token Bitcoin BSC (BTCBSC) offers Bitcoin at 2011 prices under $1 through a presale that has already attracted over $1 million in contributions. But BTCBSC has grander ambitions than just affordable Bitcoin.

Unlike the energy-intensive proof-of-work model that Bitcoin uses, Bitcoin BSC will employ a more eco-friendly proof-of-stake mechanism for verifying transactions on BSC. This results in a faster, more efficient, and greener operation compared to legacy Bitcoin.

Bitcoin BSC also provides staking rewards to investors, with an annual percentage yield of 380% as of writing. While this rate will decrease as more people participate in staking, projected returns still eclipse the crypto industry average of 3-5% APY.

Bitcoin BSC’s robust staking incentives help explain its presale is rapidly gaining traction, as it has successfully raised over $1.4 million since launching on September 5.

With the token currently priced at $0.99, some crypto analysts advise participating in the presale early to maximize gains before it sells out.

The project’s fresh ideas and lucrative staking proposition demonstrate why investors are jumping on the Bitcoin BSC bandwagon early.

They seem eager to tap into this new paradigm in crypto. With industry enthusiasm building steadily, Bitcoin BSC looks well-positioned to climb the market cap ranks.

Visit Bitcoin BSC Now

Injective (INJ): A Tug of War between Bulls and Bears

Despite trading higher earlier today, Injective (INJ) still faces challenges from bearish forces. INJ is currently trading at $6.813, up 2.39% so far today. However, if it fails to hold this level, a steep decline could be in store.

The EMAs are aligning in a potentially bearish manner. The 20-day EMA sits at $6.953, slightly above the current price of INJ. This could act as a resistance level and potentially push the price lower.

Meanwhile, the 50-day and 100-day EMAs are on the brink of a crossover. At $7.291 and $7.268 respectively, a cross would set up the EMAs for a bearish alignment, signaling a potential downswing in the price.

However, the RSI tells a different story. Notably, the RSI has jumped from yesterday’s 36.20 to 42.18. This upward movement in the RSI could be an indication of increasing buying pressure, which could potentially push the price upwards.

Adding to the bullish narrative, the MACD histogram has flipped from yesterday’s -0.002 to 0.011. This newly formed bullish MACD crossover suggests that the momentum could be shifting toward the bulls.

The market cap and volume data further complicate the picture. The market cap has risen by 3.07% to $570 million, and the 24-hour trading volume is up by 51.08% to $37.6 million. This increased activity might suggest a growing interest in INJ.

Injective (INJ) faces an immediate resistance at the 20-day EMA of $6.953. If the bulls manage to cross this level, the next obstacle would be the reverse Fib 0.382 level of $7.140, which was retested earlier today when INJ set an intraday high of $7.182.

On the flip side, a significant support zone lies between $6.365 and $6.634. This range, in confluence with the reverse Fib 0.236 level of $6.472, serves as a buffer zone. A failure to hold this support could trigger a further fall to the next horizontal support zone, ranging from $5.389 to $5.769.

Injective (INJ) is currently embroiled in a tug-of-war between the bulls and the bears. Traders should monitor the aforementioned indicators and levels closely for a clearer signal of the direction INJ might take next.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Credit: Source link