Bitcoin’s daily relative strength index (RSI) has plunged below 20, reaching lows not seen since the March 2020 COVID-19 pandemic crash.

This significant oversold reading is sparking discussion about a potential price rebound.

With this in mind, what are the best cryptos to buy now?

Historically, extreme oversold conditions on the RSI have sometimes preceded notable Bitcoin price recoveries.

The RSI oscillates between 0 and 100 – readings above 70 typically signal an overbought cryptocurrency, while sub-30 levels suggest an oversold one.

This latest RSI drop has caught the attention of cryptocurrency market participants.

Some point to prior instances when major oversold readings were followed by rebounds.

This has fueled speculation about whether Bitcoin could see a price rise in the coming weeks after this indicator reached exaggerated lows.

However, the RSI should be interpreted carefully. Despite potentially signaling turning points, oversold readings do not guarantee future price movements.

Bitcoin remains highly volatile, with prices swayed by numerous macroeconomic and technological developments.

Presently, Bitcoin is trading around $26,118, down 0.30% so far today and 10.91% over the past week.

While the RSI is flashing oversold conditions, analysts advise weighing it as one factor among many when evaluating the cryptocurrency’s direction.

With Bitcoin searching for support and signs of recovery, Rollbit Coin, Wall Street Memes, Monero, Sonik Coin, and Optimism are some of the best cryptos to buy now thanks to their solid fundamentals and positive technical analysis.

Rollbit Coin (RLB) Gains Momentum, Eyeing New Heights

Following a week-long downtrend, RLB is showing its resilience by bouncing off the Fib 0.5 level at $0.13874, staging a significant rally of 18.42% so far today.

Now trading at $0.16417, the cryptocurrency has investors and traders wondering: what’s next?

RLB is comfortably trading above the 20-day EMA of $0.14345, signaling a favorable short-term bullish trend.

Additionally, the 50-day EMA at $0.10248 also underscores a potential medium-term bullish trend, as the price is well above this benchmark.

The RSI offers a glimpse into the momentum behind the coin. An RSI value typically between 30 (oversold) and 70 (overbought), the present value of 59.45, up from yesterday’s 52.29, suggests a continuation of the bullish trend.

Notably, the bounce from the RSI50 line further enhances this bullish sentiment.

The slight movement of the MACD histogram from -0.00443 to -0.00430, although minimal, indicates a slow but potential shift towards a bullish crossover, which could signal a more extended bullish rally in the coming days.

An increase in both Market Cap, up by 17.67% to $531 million, and a rise in the 24-hour volume by 8.34% to $12.5 million, suggest that new capital is flowing into RLB.

This influx is typically a positive sign, as it suggests growing interest and potentially more significant buying pressure.

However, traders should be aware of potential resistance points and immediate support to navigate their trades better.

Currently, RLB faces resistance at the Fib 0.236 level of $0.17794. A decisive break above this level may pave the way for a further upward trajectory.

On the downside, immediate support can be found at the Fib 0.382 level at $0.15626. Traders should monitor this level closely, as a break below might indicate a short-term pullback.

Wall Street Memes: Embrace the Upside Potential of Meme Coins with One of the Best Cryptos to Buy Now

The cryptocurrency market has seen some instability for the past few days, but the community-led Wall Street Memes coin continues gaining traction during its ongoing $WSM token presale.

The Wall Street Memes project has already achieved significant fundraising success so far in its presale.

The token is nearing its $30 million goal, with just one tier remaining before the presale concludes.

Other notable upcoming developments for Wall Street Memes coin include the launch of staking services and exchange listings, scheduled for September 27.

The community-driven project aims to provide a unique cryptocurrency tied to the popular Wall Street Memes brand.

Staking appears to be gaining traction quickly within the Wall Street Memes community.

Within a short span since its introduction, 7% of the presale allocation has been staked, making up a significant portion of the 1,000,000,000 tokens set aside for the presale.

The current staking pool holds over 70 million tokens. While the annual percentage yield (APY) of 283% may decrease as more tokens get staked, it’s expected to remain attractive for early investors.

Stealthily rolled out earlier this week, the staking service is more than just an auxiliary feature.

It’s designed to encourage long-term holding by offering an income stream to token holders, providing an extra layer of price stability.

This strategy has been effective for other tokens like BTC20, which offers a similar stake-to-earn model and has been trading up 80% since its recent launch.

The Wall Street Memes brand brings with it a robust social media presence, boasting more than a million followers across platforms such as Instagram and the newly rebranded X (formerly Twitter).

In May, the team launched the Wall Street Bulls Ordinals NFT Collection, reinforcing its engagement with various crypto assets.

While staking services and upcoming CEX listings dominate the immediate roadmap, insiders suggest that Wall Street Memes has more up its sleeve.

The project reportedly has plans for a major product release, either before or shortly after its token lists on exchanges.

With the crypto market in flux, Wall Street Memes coin seems to be capturing attention without buckling under the sector’s unpredictability.

Visit Wall Street Memes Now

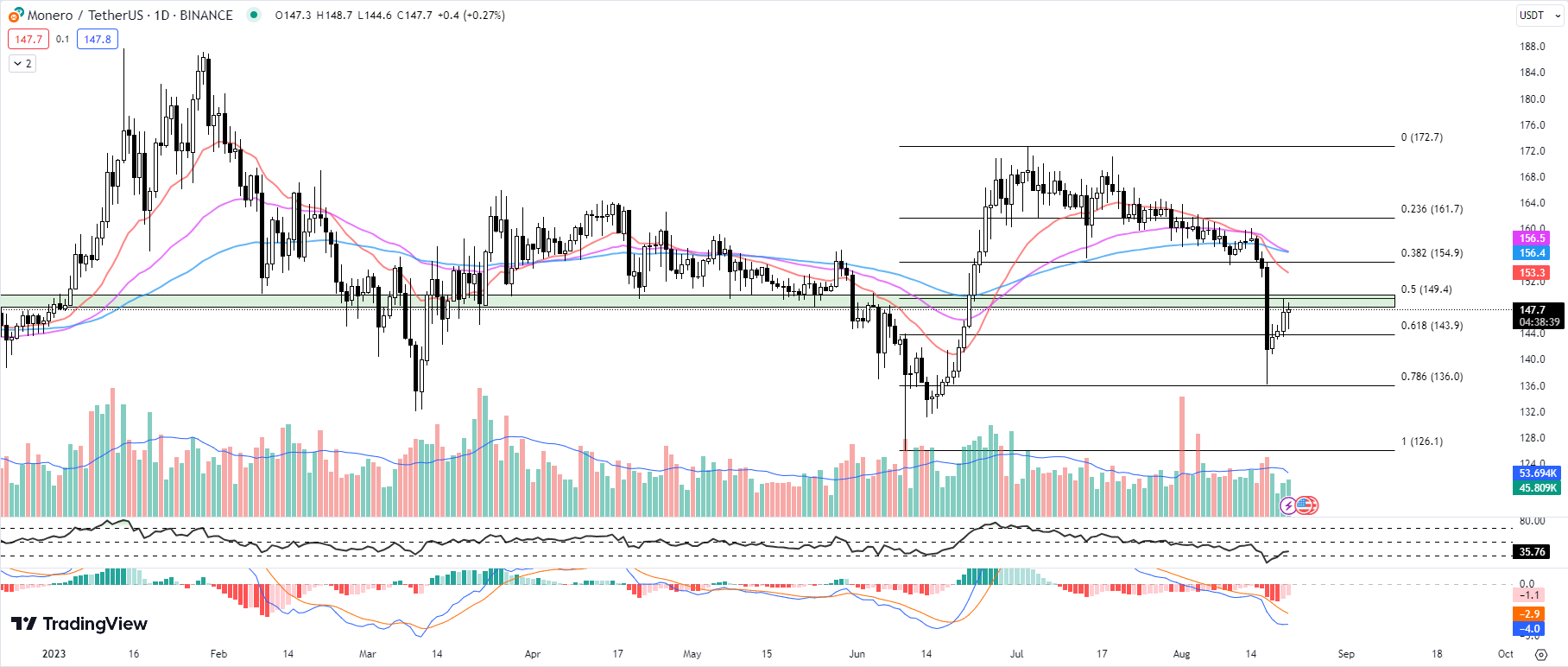

Monero (XMR) Price Rally: Is a Trend Reversal on the Horizon?

Monero (XMR), after retesting and bouncing off the Fib 0.786 level at $143.9 on August 17, is currently experiencing its fourth consecutive day of positive price action.

However, as the cryptocurrency approaches a significant resistance level, traders should tread with caution.

Looking at the moving averages, the 20-day EMA is at $153.3, which is below the 50-day and 100-day EMAs, both hovering around the $156.4 and $156.5 marks respectively.

This suggests that the short-term trend is bearish as XMR is currently trading below these key moving averages.

However, with the recent price rally, XMR is now approaching the 20-day EMA. A break above this key indicator could suggest a possible trend reversal in the near term.

Traders should watch this level closely as it could potentially act as a dynamic resistance.

The RSI currently sits at 35.76. This is an increase from yesterday’s 34.79 reading and could signal that the selling pressure is subsiding, providing a glimmer of hope for bullish traders.

In line with this, the MACD histogram shows a reading of -1.1, marking an improvement from yesterday’s -1.4. This indicates that the downward momentum may be slowing down.

Further encouraging signs for XMR come from its market cap, which is up by 0.18% to $2.7 billion, and the 24-hour trading volume, which has also increased by 4.79% to $63 million. This increased activity could signal growing interest in Monero.

XMR is currently trading at $147.7, up by 0.27% so far today. The immediate price hurdle for the bulls lies in the horizontal resistance zone of $148 to $150, which is in confluence with the Fib 0.5 retracement level at $149.4.

A decisive breakthrough in this resistance zone could trigger a potential rally toward the 50-day and 100-day EMAs.

On the downside, the Fib 0.618 level at $143.9, which previously acted as a springboard for the recent bullish price action, serves as immediate support. A break below this level could see XMR retest the Fib 0.786 level at $143.9.

While the short-term trend for XMR remains on the bearish side, there are signs of potential recovery. Traders should remain cautious and carefully observe these key technical levels.

The coming days will determine whether Monero can sustain its recent bullish momentum or if a further downside is on the horizon.

Sonik Coin ($SONIK): Speeding Ahead as One of the Best Cryptos to Buy Now

A new crypto presale hopes to race ahead of the pack by harnessing nostalgia for a beloved video game icon.

Sonik Coin ($SONIK) seeks to capture the meme coin crown by theming itself around SEGA’s popular Sonic the Hedgehog franchise.

With a maximum supply of 299.8 billion tokens, Sonik Coin is currently in a single-stage presale offering tokens at a fixed price of $0.000014.

The presale has already generated more than $270,000 so far, demonstrating significant initial interest from crypto enthusiasts.

The project hopes to stand out in the crowded meme coin space through its distinct pop culture appeal and ambitions to grow an engaged community.

It plans to incentivize holding by allocating 40% of the supply to staking rewards.

Some crypto industry analysts believe the coin could reach $0.000042 by the end of 2023 if it succeeds in listing on exchanges and launching concept art as planned.

Capitalizing on Sonic’s brand recognition while rewarding holders could create a recipe for growth, they say.

For its part, the Sonik Coin team believes its community-focused approach can power the token to a $100 million market capitalization.

It seeks to blend humor and ambition to replicate the success of other meme coins.

With its distinct pop culture branding, staking rewards, and impressive presale turnout, Sonik Coin appears to be on the fast track to achieving meme coin success.

Visit Sonik Coin Now

Optimism (OP) Exhibits Signs of Price Recovery

Optimism (OP) has been showcasing signs of a potential recovery, with a promising 4.62% rise in price so far today.

It’s currently attempting to surpass the Fib 0.382 level at $1.474 and break out from the resistance provided by the 20-day and 50-day EMAs.

The 20-day EMA, a short-term trend indicator, is at $1.521, while the 50-day EMA stands at $1.508. Both of these are critical markers for OP, as they are presently acting as immediate support levels.

The 100-day EMA, a significant indicator of long-term trends, is at $1.558, posing as the immediate level of resistance.

The Relative Strength Index (RSI) has shown an encouraging increase from 45.91 the previous day to 51.74.

This upward movement suggests a potential RSI50 breakout, indicating a shift towards a bullish market sentiment.

The MACD histogram also reflects a positive trend, with an increase from -0.024 to -0.015.

This reaffirms the bullish momentum, as a rising MACD histogram typically points towards buying pressure.

Interestingly, the market cap has grown by 5.21% to $1.1 billion, with the 24-hour trading volume also witnessing a significant surge, up by 114.84% to $139 million.

This heightened activity could be a sign of increased trader interest in OP, which might further catalyze the price movement.

OP is currently trading at $1.541, marking a 4.62% increase so far today. The resistance levels to watch are the 100-day EMA at $1.558 and the Fib 0.236 level at $1.611.

If OP can succeed in breaking these resistance levels with substantial volume, it could signal the start of a new bullish phase.

On the other hand, the immediate support levels are the 20-day and 50-day EMAs at $1.521 and $1.508, respectively.

If the price dips, these levels could provide the necessary support to prevent further downfall. A more substantial support level can be found at the Fib 0.382 level at $1.474.

It’s still early, but OP is off to an encouraging start that may hint at a broader resurgence if the technical factors stay positive.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Credit: Source link