An address associated with failed crypto lending platform Celsius has moved millions of dollars worth of Ethereum (ETH) to an exchange, according to on-chain data.

Citing data obtained from blockchain explorer Etherscan, on-chain data tracker Lookonchain says that Celsius moved 5,160 ETH worth approximately $10.49 million to institutional crypto trading platform FalconX.

According to Lookonchain, Celsius, which filed for bankruptcy in July of 2022, possibly “wants to sell some assets with the rising prices.”

Ethereum is trading at $2,033 at time of writing, up by nearly 80% year-to-date.

In the first half of the year, Celsius also moved 428,000 staked Ether (STETH), worth $780 million at the time, from the liquid staking solution Lido Finance.

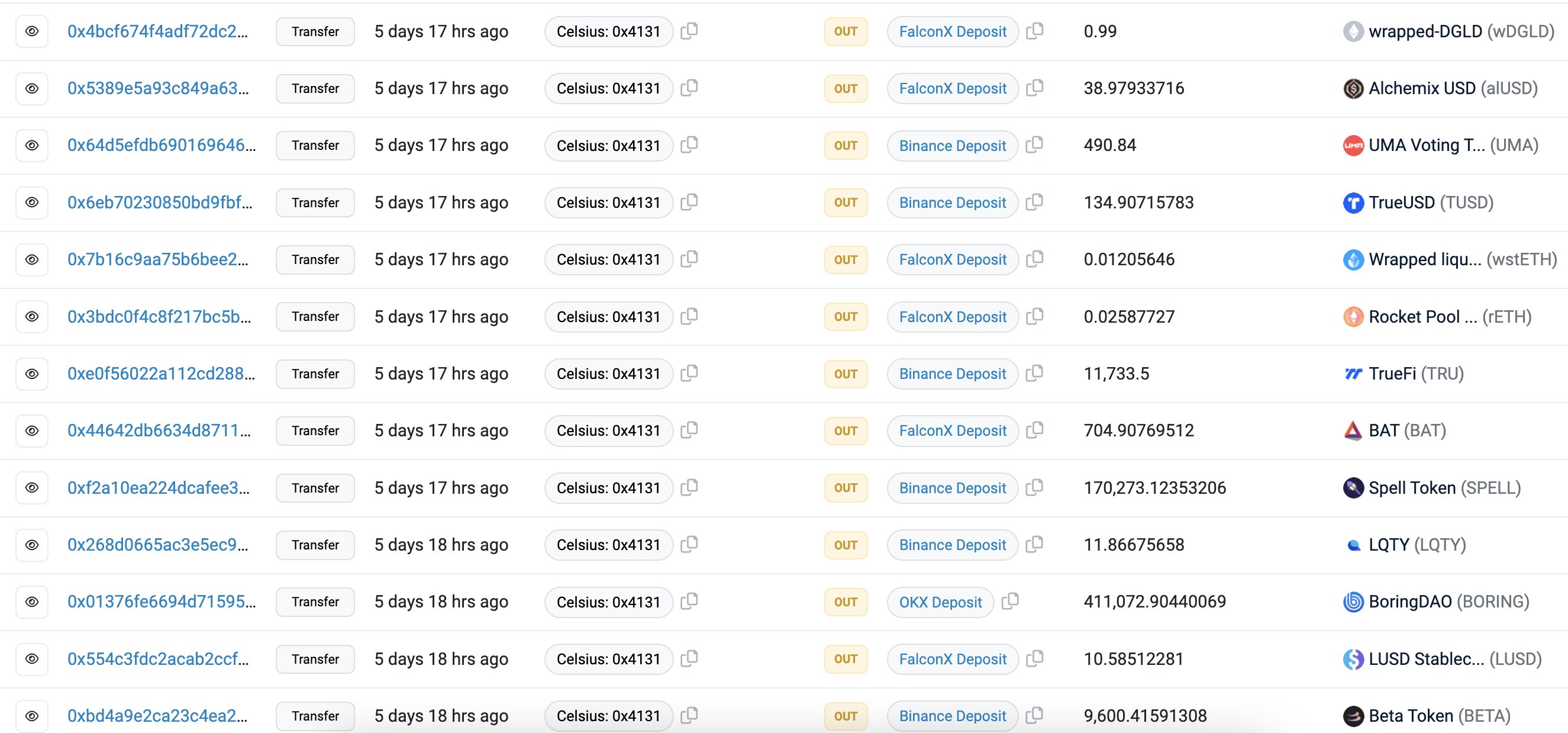

Lookonchain further says that Celsius also moved various tokens to FalconX as well as Binance and OKX crypto exchanges five days ago. The tokens include various stablecoins, the governance token of the Abracadabra DeFi platform Spell (SPELL) and the utility token of the Brave browser Basic Attention Token (BAT).

The large transfer of Ethereum by the bankrupt crypto lender comes days after a judge approved Celsius’ bankruptcy plan. The bankruptcy plan will see Celsius converted into a crypto mining and staking firm owned by the creditors.

The outfit will be known as NewCo and is expected to have a $1.25 billion balance sheet, of which 36% will be liquid crypto. Some or all of the liquid crypto will be staked on the Ethereum network and will potentially bring in “anywhere from $10 to $20 million per year”.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Credit: Source link