- Australian crypto analyst Michael Pizzino’s latest video touches on the current crypto market, which he believes is in a 50/50 consolidation/accumulation phase.

- Several contrasting signals demonstrate that Bitcoin could trend in either direction in the short term.

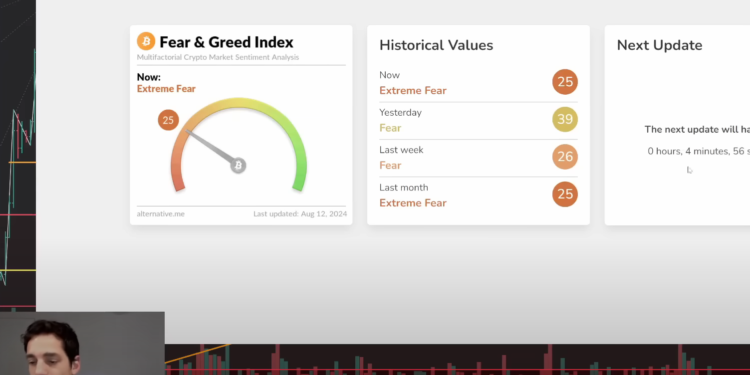

- The popular Fear and Greed Index is reading “Extreme Fear”, often a harbinger of a trend reversal.

- At the same time, investor interest has dropped off as crypto exchanges experience diminishing volume.

The crypto market has been in an…interesting place of late. The price of most assets saw some of the heaviest single-day losses in recent history following poor US jobs data and fears of a recession. However, like it often is, the downward trajectory may have been an overreaction from spooked investors – and since then, Bitcoin has rebounded to above US $60k (AU $90k).

So, where to from here?

Related: Raoul Pal: You’ll Be Sorry You Own Zero Sui, as Price Gains 70% in Past Week

Bitcoin ETF Flows Peak While Another Index Suggests A Market Rebound is on the Cards

Aussie analyst Michael Pizzino weighed in on the current market state, providing viewers with several pieces of analysis around Bitcoin and cryptocurrency as a whole.

Pizzino notes the immense volatility that has flooded the crypto market over the past month – more than usual – something that was also reflected via inconsistent ETF flows. He suggests a recent surge of ETF inflows, likely accumulation following the global market crash, might signal a short-term top for BTC and ETH.

He points out that the spot Bitcoin ETF flows, while forming a peak over the past fortnight, are far less extreme than we saw earlier in the year. This suggests any downtrend is likely to be short-lived, or less damaging than predicted.

Additionally, Michael Pizzino looks at the Fear and Greed Index, traditionally a solid oracle for short/medium-term crypto market trends. His source, from Alternative.me, still signals that the market is in a state of “Extreme Fear” – a reading that is typically followed by a market rebound.

It’s worth noting the current reading has improved to “Fear”, correlating with Bitcoin’s push past US $60k (AU $75k).

Bitcoin Eyes US $61.5k Ceiling As Buying Momentum Fades

From a macroeconomic perspective, conditions are improving for cryptocurrency. The US Dollar’s strength, relative to other assets, is still below important resistance levels and weaker than usual. A strong USD tied to interest rates and foreign trade can be bad for many assets, particularly crypto, as it makes investment more expensive and holding cash more appealing.

Not everything is going smoothly for Bitcoin and friends though. Pizzino looked at crypto exchange volumes, noting that they’ve fallen below US $50b (AU $75b) – suggesting a slowdown in investor participation.

According to Pizzino, Bitcoin needs more buying momentum to breakout of its current consolidation phase. However, the coin’s push past the US $60k resistance level (AU $75k) may kickstart a short-term rally. The next key barrier is US $61.5k (AU $92k), which, if broken, could be the start of something positive for the crypto market.

Credit: Source link