- Bitcoin has enjoyed a strong weekend, pushing up 10% thanks to the US Fed’s promise of interest rate cuts coming in September.

- The global market has in general calmed since the early-August crash, with fears of a recession appearing overstated.

- Aussie analyst Jason Pizzino mirrors these thoughts, arguing that intense human emotion has driven wild market swings rather than a sustainable economic downturn.

- He also believes that Bitcoin is well-placed to break out of its current consolidation phase as 2024 enters its twilight.

Ever since Covid-19 sent the economy spiralling (and then skyrocketing… and then spiralling again), doomsayers across the board have been warning the world about a recession. Until recently, Bitcoin had mostly ignored these cries to post its highest-ever price point in 2024. Things looked a little sketchy earlier in August, when a global market crash sent the price of assets across all classes plummeting.

But with the US Federal Reserve Chair Jerome Powell promising September rate cuts, fears of a recession may turn out to be overstated. The crypto market rebounded on the news, with Bitcoin pushing up nearly 10% since the announcement.

This sentiment is echoed by Aussie analyst Jason Pizzino, who believes that Satoshi Nakamoto’s cryptocurrency might be ready to re-test previous highs with a potential breakout.

Related: CryptoQuant Analyst: Coming Months Won’t Be “Boring” as Bitcoin Bull Rally Nears

Market Fear Overstated as Emotion Drives Short-Term Swings

Jason Pizzino’s latest video argues that Bitcoin has broken out of a key resistance level at US $61.5k (AU $90.5k), which represents a 50% swing level.

Over the past few days, BTC investors have tested the important top-level on three separate occasions before finally pushing past and closing at US $64k (AU $94k). These moves have been mirrored by the stock market, with the Dow Jones and Nasdaq both moving upward on the basis of potential interest rate cuts in the United States.

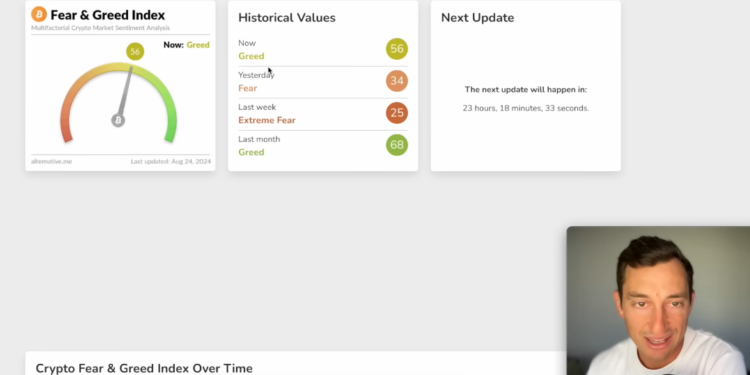

Pizzino suggests that the intense market movements over the past month in either direction have been due to human fear and greed overreacting to certain macroeconomic triggers.

Human emotions get really excited when they hear certain things… and then that dies off… The exact same thing happened two-three weeks ago…everything was imploding, it was a massive sell-off throughout the entire market and we’re expecting a recession…now it’s all in the past, the recession’s over…

Jason Pizzino

Jason PizzinoBitcoin’s positive movement over the past week, paired with strong recovery from major stock indices, has gone a long way to “wiping out that fear of recession”, according to Pizzino. Renewed investor confidence could go a long way to stabilising the crypto market and helping BTC achieve new heights in the back half of 2024.

Consolidation Phase May Still Have Time to Run, But Signs are Positive

According to Pizzino’s analysis, Bitcoin’s consolidation phase may still be in full swing, despite positive signs the coin may be breaking out into a bullish cycle.

The Aussie analyst believes the market needs to see at least “two more daily closes [above US $61.5k]” to really cap off the market’s accumulation state.

Related: CoinGecko Report Shows Most Crypto Users Spend Time on These Three Platforms

This ranging cycle, based on previous cycle data, could be in play until at least mid-September, and may last all the way to mid-October. Pizzino believes the price point here might move between just below Bitcoin’s all-time high and US $50-55k.

But as trading volume starts to return to the market, Pizzino suggests that Bitcoin could gain enough momentum to push into its new all-time high as we move into the last quarter of 2024.

Credit: Source link