- BitMEX founder, Arthur Hayes, said he expects crypto markets to slump around the Bitcoin halving later this month.

- Hayes said a combination of factors, including quantitative tightening by the US Fed and over-blown expectations around the halving, will cause crypto markets to drop dramatically in April.

- In the medium term though, Hayes predicts the halving to be bullish for crypto and he expects the market to start to recover in May.

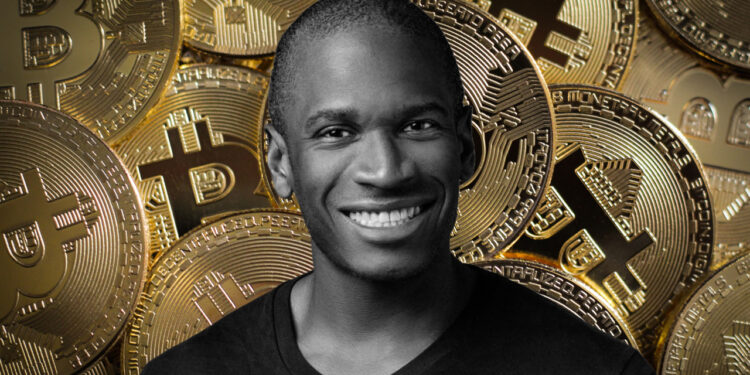

Arthur Hayes, the co-founder and former CEO of crypto exchange BitMEX, predicts a major slump in the crypto markets in the lead up to, and just after, the Bitcoin halving—which is expected to happen later in April 2024.

In an article posted to Medium, Hayes said a confluence of factors, including reduced US dollar liquidity and crypto market dynamics, will combine to see large drops in most cryptocurrencies around the Bitcoin halving. He’s exited many of his “shitcoin positions” and said he’ll stop trading crypto until at least May, when he expects the market to start picking up again.

Related: Anthony Scaramucci Predicts Wild Run For Bitcoin Post Halving, 10X Incoming?

Hayes: Conditions Are Right For A Big Pullback

Hayes makes the case that following the recent termination of the Bank Term Funding Program (BTFP), which was set up to prevent banks from failing in the wake of the COVID crisis, the US Treasury has essentially been covertly printing money by easing capital requirements on banks.

The goal of this approach, he argues, is to maintain government bond yields below the GDP growth rate—a situation which he says ensures “stonks, crypto, gold, etc., will continue advancing in fiat currency terms.”

So what’s the problem? The US Government is apparently creating policy to ensure our memecoins moon? Well, Hayes said some upcoming events could change that, including:

- Tax payments for the 2023 financial year that become due on April 15th. He expects these payments to be relatively large due to strong stock market performance. This will remove a lot of US dollar liquidity from the economy.

- The US Federal Reserve’s aggressive quantitative tightening (QT) in March and April, which is essentially reducing the supply of money by allowing US$95 billion of US Treasuries and mortgage backed securities to mature without being reinvested.

The precarious period for risky assets is April 15th to May 1st. This is when tax payments remove liquidity from the system, QT rumbles on at the current elevated pace, and Yellen has yet to start running down the Treasury General Account. After May 1st, the pace of QT declines, and Yellen gets busy cashing checks to jack up asset prices.

With the rate of QT expected to slow in May, and most of the tax payments also being made by then, Hayes believes we should see a return to improved conditions for “stonks and crypto”.

If you are a trader looking for an opportune time to put on a cheeky short position, the month of April is the perfect time to do so. After May 1st, it’s back to regular programming … asset inflation sponsored by Fed and US Treasury financial shenanigans.

Arthur Hayes, Co-founder and Former CEO of BitMEX

Arthur Hayes, Co-founder and Former CEO of BitMEXBitcoin Halving To Disappoint In Short-Term

Hayes also expects the impact of the Bitcoin halving, which is due to happen on April 20, to be underwhelming in the short-term. He said that often when established narratives—like the ‘Bitcoin halving mean prices pump’ narrative—take hold, the exact opposite tends to happen:

The narrative of the halving being positive for crypto prices is well entrenched. When most market participants agree on a certain outcome, the opposite usually occurs. That is why I believe Bitcoin and crypto prices in general will slump around the halving.

Arthur Hayes, Co-founder and Former CEO of BitMEX

Arthur Hayes, Co-founder and Former CEO of BitMEXOf course, anything could happen, particularly in the notoriously volatile and unpredictable world of crypto — as Hayes colourfully puts it, “could the market defy my bearish inclinations and continue higher? F**k yeah. I’m perennially long as f**k crypto, so I welcome being wrong.”

Credit: Source link