- Founder of BitMEX, Arthur Hayes, predicts Bitcoin could top US$1 million this cycle—driven largely by continued money printing in the US.

- Hayes also says the result of the US presidential election will be fairly meaningless for crypto, as regardless of the result, both candidates will continue to print money, driving up the price of crypto.

- The BitMEX founder also says the SEC leadership is irrelevant as long as the politics around crypto remains the same, if Gensler was replaced you’d just see a new leader implementing the same policies for political reasons.

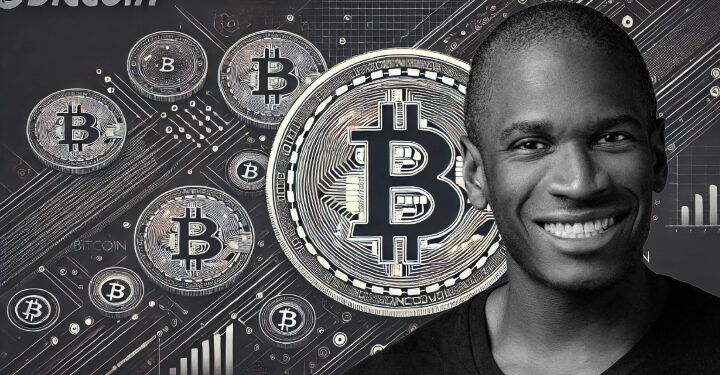

Arthur Hayes, the colourful crypto thought leader and founder of crypto exchange BitMEX, says this cycle’s bull run is going to be huge—predicting the price of Bitcoin will run into the hundreds of thousands of dollars, perhaps even cracking one million dollars.

Speaking in an interview with DL News, Hayes also shared his thoughts on politics and the broader economy. He said that no matter who wins this year’s presidential election in the US, crypto prices will go up, Gary Gensler is basically irrelevant, and a Bitcoin strategic reserve would be an excellent idea for the US.

Related: Arthur Hayes Says Zoom Out and Focus on Broader Trends, Highlights Bitcoin as Superior Safe-Haven Asset

Bitcoin Could Surpass US$1 Million This Cycle, Says Hayes

When asked his thoughts on Bitcoin’s price, Hayes was straight to the point saying he thinks Bitcoin will explode this cycle:

The Bitcoin price in this cycle is going to go very, very high. Hundreds of thousands of dollars, maybe $1 million.

Arthur Hayes, Founder of BitMEX

Arthur Hayes, Founder of BitMEXHayes added that we’re entering a period of drastic change to the global monetary system and the legacy system will fight to resist the changes heralded by crypto:

There’s so much debt that needs to be rolled over. We’re entering a period where the global monetary architecture is completely changing. We don’t know what it’s going to be, but the people who have made the most of the last 80 years are going to be very resistant to change.

Arthur Hayes, Founder of BitMEX

Arthur Hayes, Founder of BitMEXElection Result Not That Important

On the US election result Hayes said it’s basically irrelevant for crypto, suggesting that even if Trump wanted to implement crypto-friendly policies, the administrative arm of the government could block his efforts:

So while it’d be great if Trump got elected and he did all these things, I think he might run into the same problem he ran into his first term. You can say all these nice things and try all these policies, but if the entire government organisation is opposed to them, then nothing gets done.

Arthur Hayes, Founder of BitMEX

Arthur Hayes, Founder of BitMEXHayes says a lot of this government opposition to pro-crypto policies will come from agencies staffed with former employees of the big banks and other TradFi institutions. He argues that even though the crypto industry is making large political donations it can’t compete with the influence wielded by the likes of JPMorgan and Citibank:

I don’t think you’ve (the crypto industry) donated enough to outpace a JPMorgan, a Morgan Stanley, a Citibank, a Goldman Sachs. And if you think about who is staffed and all of these agencies, it’s all people who came from these banks.

Arthur Hayes, Founder of BitMEX

Arthur Hayes, Founder of BitMEXHayes doesn’t think pro-crypto policies will drive growth of crypto anyway. He thinks fiat money printing will. And according to Hayes, regardless of who gets elected—a lot of money printing is going to happen:

Both the Trump administration or Harris administration will print the money. They do it in different ways. But the money will be printed. And so your crypto is going to go up — the path could be very wonky, but at the end of the day, we know where it’s going.

Arthur Hayes, Founder of BitMEX

Arthur Hayes, Founder of BitMEXHayes: Gensler Irrelevant, Bitcoin Reserve Great Idea

As for the leadership of the SEC, Hayes says it’s basically irrelevant. The BitMEX founder says that even if current SEC Chair Gary Gensler was replaced, nothing would change as long as the politics around crypto remain the same:

It’s just the politics. And you could replace him with somebody else. Gary Gensler’s not the problem. The SEC isn’t the problem either…People are getting all worked up about Gary Gensler, but he kind of is irrelevant.

Arthur Hayes, Founder of BitMEX

Arthur Hayes, Founder of BitMEXRelated: Senator Lummis Presents Official Strategic Bitcoin Reserve Bill

On the proposal that the US establishes a strategic Bitcoin reserve, Hayes believes it’s a solid idea but very unlikely to happen: “Oh, it’s a great idea. The US should weaken the dollar and buy Bitcoin and gold at the end of the day. It would solve a lot of their problems…I find it almost impossible that that will get done, even if Trump is elected,” Hayes said.

Credit: Source link