ApeDAO, a decentralised autonomous organisation (DAO) founded by pseudonymous non-fungible token collector KyloRen, is the third-largest holder of Bored Ape Yacht Club (BAYC) NFTs.

Community discontent has led to a vote on the question of whether to dissolve the DAO. Available evidence suggests that soon, the DAO will be no more:

The Backstory

According to Montana Wong, co-founder of creator economy-based product studio Sprise, ApeDAO was established with the goal of becoming the largest holder of BAYC NFTs. The DAO itself is governed by a token $APED, which represents voting rights within the DAO and fractionalised ownership of the DAO’s treasury, which at 11,562 ETH translates to approximately US$31.7 million at the time of writing.

Using these figures, the $APED token ought to be trading at around US$16, however in reality it is closer to US$8. Since August, the floor price of BAYC has risen from 20 ETH to 100 ETH, suggesting a fivefold return. However, $APED holders have seen their values decline from US$10 to US$8 over the same period.

The problem, then, is quite simple. The DAO’s governance token has failed to keep pace with the value of the treasury’s holdings. It’s the equivalent of any listed company having net assets worth US$100/share but finds itself persistently trading at US$50/share.

However, unfortunately for ApeDAO, it seems as if discontent has been brewing for some time, given that the community recently shot down a proposal to “professionalise” the DAO:

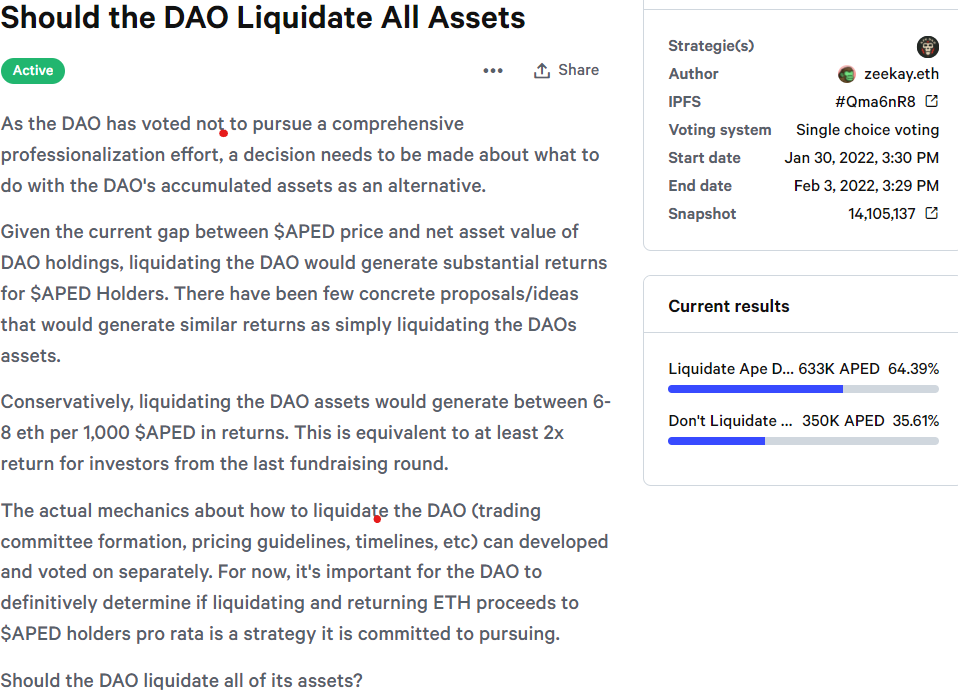

The Proposal

For the reasons listed above, a proposal has been put forward asking whether the DAO should liquidate all assets. At the time of writing, 64.39 percent of $APED holders were in favour of liquidation, although this was down from 82 percent just yesterday:

Assuming the vote is passed as expected, the DAO would need to be liquidated, meaning all of its assets would be sold.

However, since the DAO’s assets are locked up in a multi-sig wallet, requiring four signatures, there is still one major potential roadblock. At present, only one has voted in favour of liquidation. It remains unclear whether the remaining signatories will end up voting in favour of the liquidation and/or release funds by signing the final transaction. As Montana Wong notes:

DAOs are currently all the rage, with one recently being established to buy Blockbuster Video, and another making a failed attempt to buy a copy of the US Constitution.

The lesson in the ApeDAO saga is, however, clear – decentralisation within the context of Web 3.0 appears to be one of degree. In the end, as in this case and in much of the real world, those with power are likely to have the final say, independent of the community’s wishes.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link