- K33 report highlights Ethereum’s potential comeback driven by positive spot ETF news.

- Bitcoin faces significant sell pressure from Mt. Gox funds and government sales.

- Long-term investors and analysts favour Ethereum, predicting substantial fund inflows and price appreciation.

Research firm K33 has just released a report outlining a comeback for Ethereum. The report highlights that positive news around the Spot Ether exchange-traded funds (ETFs) could function as a catalyst for the price of Ether.

On the other hand, Bitcoin is facing significant sell pressure from re-distributions of Mt. Gox funds which are imminent. Additionally, several governments have been selling Bitcoin seized during busts of illegal activities.

Related: Coinbase Partners with US Marshal Service for Enhanced Crypto Custody Solutions

While initially the newly listed Ether funds may face sell pressure – much like the Bitcoin funds did post trading start – many analysts see strong long-term demand for the funds. Predictions rank from US$5bn (AU$7.5bn) inflows in the first six months to US$15bn (AU$22.5bn) in the first 18 months.

Long-Term Investors Favour Ethereum Over Bitcoin, Research Shows

Analytics platform IntoTheBlock said long-term Bitcoin holders are reducing their BTC holdings, whereas Ethereum holders are increasing their positions. 78% of ETH is currently held by HODLers who have been in their positions for over 12 months.

This suggests that with an increasing interest in Ether funds (once approved), the price will continue to appreciate, with some suggesting US$4K (AU$6K) ETH soon.

Renewed Altseason To Lift Other Assets Too

Analyst Michaël van de Poppe even went so far as to declare a new altseason might be upon us, which would see many assets rally, not only ETH.

He said the recent FED meeting – the “most hawkish” in a year – has turned sentiment bearish on crypto according to Jerome Powell’s speech.

Meanwhile, treasury bond yields have decreased significantly, indicating that markets anticipate rate cuts rather than continued rate hikes. Therefore, multiple rate cuts are expected, contrary to the single cut predicted by the FED.

Van de Poppe added that in October 2023, as yields peaked, altcoins experienced a significant rally.

Since then, multiple altcoins did a 5-10x against Bitcoin, after which Bitcoin started to take over the show and continued its strong run, and Bitcoin pairs were completely hammered.

Michaël van de Poppe

Michaël van de PoppeThe analyst points to LINK which saw a correction in the first half of 2022 and subsequently rallied 120% in the second half. And, Chainlink repeated this in 2023, when it saw a second half growth of 150%.

Related: Ancient Ethereum Whale Moves 7,000 ETH to Exchange Kraken

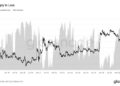

Based on the OTHERS/BTC chart below, he believes the bottom for altcoins compared to BTC may be in.

Credit: Source link