Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

As Bitcoin and Ethereum hover near critical resistance levels, market sentiment is shifting rapidly. Analysts are now calling for an incoming Altseason, with bullish momentum building across the board, even as macroeconomic uncertainty continues to rattle global markets. Despite rising treasury yields and geopolitical tensions, crypto assets are showing strength, and altcoins appear poised to benefit next.

Related Reading

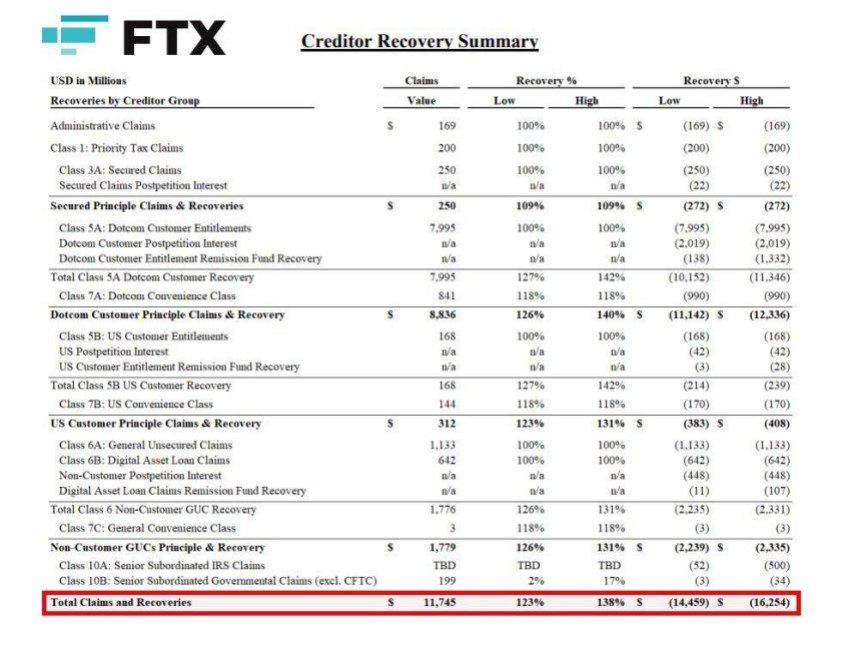

Top analyst Axel Bitblaze has spotlighted May 30th as a potentially defining moment in this cycle. This week, over $5 billion in stablecoins will be distributed to FTX creditors—a massive injection of liquidity representing nearly 2% of the entire stablecoin supply. Unlike previous events, this capital is expected to stay within the crypto ecosystem.

Most of these investors remained in crypto despite the FTX collapse. Now, as they regain access to their funds, many are likely to rotate that capital back into the market. With Bitcoin targeting $120K and Ethereum challenging the $3,000 level, the stage is set for capital to flow into high-beta altcoins and push for an Altseason.

Altcoins Setup Strengthens Ahead Of $5B FTX Liquidity Injection

The FTX collapse in late 2022 was a brutal event, marking the climax of the previous bear market. It triggered mass panic, billions in liquidations, and the final capitulation that ultimately set the bottom of the cycle. While devastating in the short term, it paved the way for recovery. Now, nearly two years later, May 30th may become the most important day of this new phase.

FTX is distributing over $5 billion in stablecoins to creditors this week—a long-awaited step in the bankruptcy process. These payouts represent nearly 2% of the total stablecoin supply and will hit the market in one large wave. But this isn’t just idle money returning to passive holders. Most of these users remained in crypto through the storm. They didn’t leave—they adapted, held, and now, they’re getting liquidity back in the middle of a bullish setup.

The timing couldn’t be better. Ethereum is pumping, flirting with a critical resistance level that, if broken, could confirm a major move for altcoins. Bitcoin is hovering near its all-time highs, altcoins are gaining serious traction, pro-crypto narratives are heating up in Washington, and regulatory progress is finally in motion. Everything is aligning at once.

Bitblaze explains that this $5B return of capital could be the exact catalyst the market needs. In his view, this sudden injection of liquidity could send Bitcoin toward $120K—and unlock the altseason traders have been waiting for.

Related Reading

Ethereum Eyes $2,700 Breakout As Altseason Momentum Builds

Ethereum (ETH) is currently trading at $2,638, consolidating just below a key resistance zone at $2,700. After a sharp rally in early May, ETH has held its gains and formed a solid base above the 34 EMA ($2,331) and key moving averages. The 200-day SMA, sitting at $2,697, now acts as a critical ceiling for price action. A clean breakout above this level would mark the first major reclaim of the long-term trend line since the bull cycle resumed, potentially unlocking a powerful continuation for ETH and the broader altcoin market.

Volume has remained steady throughout this consolidation phase, indicating buyer interest and positioning ahead of a decisive move. ETH’s structure shows higher lows and strong bullish follow-through, suggesting that momentum is building just beneath the surface.

Related Reading

If Ethereum can close above $2,700 with conviction, it would not only confirm a breakout but could also trigger broader market rotation into altcoins. Historically, ETH breaking above major resistance levels has been a strong leading indicator for altseason. With Bitcoin hovering near ATHs and macro conditions favoring digital assets, ETH’s next move could be the spark that ignites a new wave of altcoin rallies across the board.

Featured image from Dall-E, chart from TradingView

Credit: Source link