Despite Bitcoin’s breakout performance in 2020, much of the gains have been erased over the past three months as Bitcoin slid 43 percent amid a barrage of relentless FUD relating to China and environmental concerns.

While the grounds for such concerns can be challenged, there is mounting evidence that Bitcoin may be turning the corner.

A Difficult Bull Market for HODLers

Based on Bitcoin’s halving cycle and subsequent price movements, we ought to be somewhere near the middle of a bull market. Given that Q2 2021’s performance was the worst in eight years, even the most bullish of HODLers have had their conviction tested in the face of persistent, and seemingly coordinated, FUD.

Four Reasons for HODLers to be Optimistic

Throughout this latest round of FUD, Bitcoin has been enormously volatile, with ongoing support seemingly around the US$30,000 mark. However, a number of indicators suggest this may indeed be the bottom and that there is cause for optimism in the near term.

#1 Puell Multiple Signals Only 5th Buying Opportunity in Bitcoin’s History

This metric explores market cycles from a mining revenue perspective by looking at the supply side of Bitcoin’s economy – Bitcoin miners and their revenue. Miners are considered sellers by necessity since their operating costs tend to be fixed in fiat terms. When the value of Bitcoin mined and entering the ecosystem is too large or too small by historical standards, it can provide an opportunity for investors.

Notice below how the indicator has slipped into the green, last seen in March 2020. For long-term HODLers, now seems to be the time to accumulate.

#2 Long-Term HODLers Continue to Accumulate

As Crypto News Australia reported earlier this year, long-term HODLers tend to be sellers when a market top is near and buyers when there are material price dips. Over long periods, this has proven to be a solid investment strategy.

As short-term HODLers capitulated in droves during May and June, long-term HODLers continued to accumulate, as highlighted in the chart below.

#3 Funding Rates Shifting Away from Negative Territory

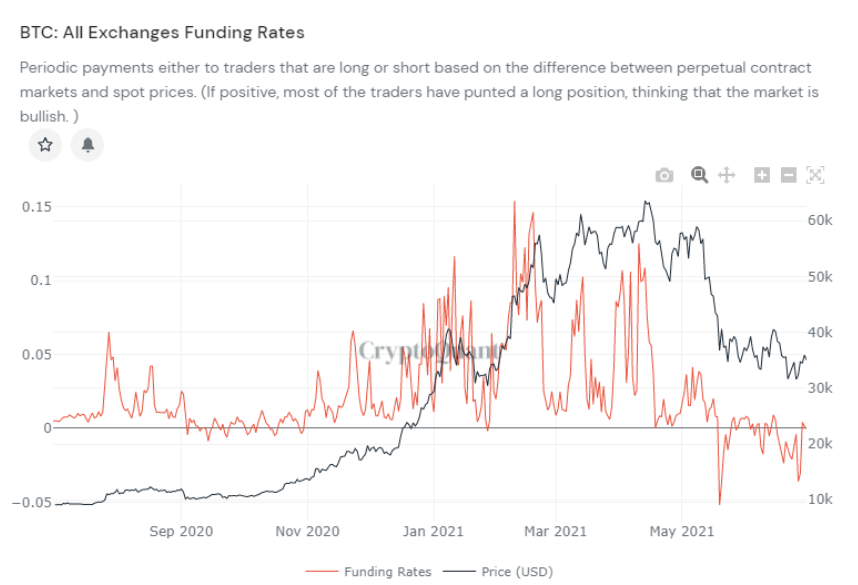

Funding rates are payments between traders to make the perpetual futures contract price close to the index price, representing the sentiment of traders on the positions they take in the perpetual swaps market. In the simplest of terms, positive funding rates are indicative of bullish sentiment whereas negative funding rates imply many traders are bearish.

Based on the chart below, funding is gradually moving into positive territory, a historically optimistic indicator for short- to medium-term price movements.

#4 Bitcoin NVT Ratio Shows Bitcoin is Undervalued

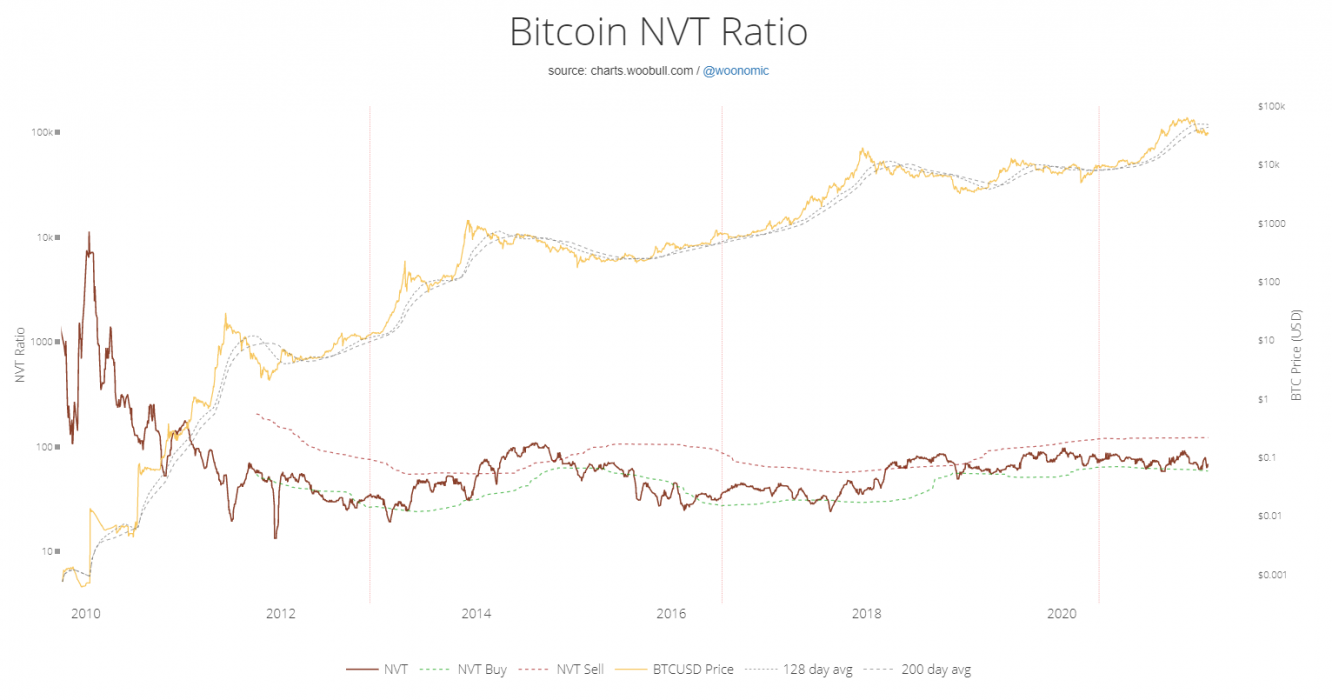

The Bitcoin NVT ratio is equivalent to a traditional price-to-earnings ratio used to assess whether a stock is under- or overvalued.

Based on the chart below by respected Bitcoin analyst Willy Woo, the current price of Bitcoin is operating along the lower bounds of undervalued (marked by the green dotted line). The upper bounds (i.e a strong sell indicator) is the red dotted line, indicating Bitcoin would be overvalued at around US$121,000.

When in Doubt, Zoom Out

If you entered the Bitcoin market for the first time in the past six months, this most recent correction would undoubtedly have been difficult to stomach. That said, it is worth remembering that anyone who has invested in Bitcoin for a period of greater than 3.25 years has made money.

The strategy employed by successful accumulators has been remarkably simple – don’t use leverage, dollar-cost average, and have a long-term horizon of four or more years.

Bitcoin’s logarithmic price chart clearly demonstrates that long-term holders tend to be rewarded. Short-term price volatility, however, is the price they have to pay to enjoy exceptional long-term returns.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link