Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

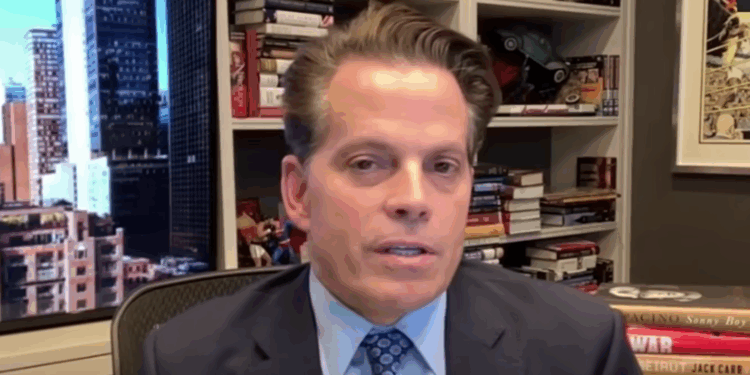

Bitcoin blasted back through the psychologically charged $100,000 threshold for only the second time in its 16-year history, reclaiming a level last seen in February. As the world’s first stateless money ticked higher, SkyBridge Capital founder Anthony Scaramucci told podcast host Anthony “Pomp” Pompliano that sovereign wealth funds are already accumulating the asset and are poised to scale those purchases dramatically once Washington finishes writing the rules of the road.

Sovereigns Are Pouring Billions into Bitcoin

Scaramucci, whose new Little Book of Bitcoin chronicles his own conversion from skeptic to evangelist, said overseas officials are quietly adding the digital asset even before the United States clarifies stablecoin legislation, bank-custody guidance and broader tokenization rules.

Related Reading

When asked if sovereigns are buying Bitcoin secretly, Scaramucci answered: “I think they are buying it, I think they’re buying it on the margin,” he said, adding that regulatory green lights will unleash a massive wave of capital inflow. “I don’t think it’s going to be a gigantic ground swell of buying until we green light legislation in the United States,” he stated. This, in Scaramucci’s view, will make “people worth 10, 20, 30 trillion dollars buying a half-a-billion dollars of Bitcoin, buying a billion dollars of Bitcoin.”

🇺🇸 ANTHONY SCARAMUCCI JUST CONFIRMED THAT ALL SOVEREIGNS ARE BUYING BILLIONS OF #BITCOIN

THIS IS WILD!!! 🚀 pic.twitter.com/AInDVGR6Jh

— Vivek⚡️ (@Vivek4real_) May 8, 2025

The former White House communications director framed today’s discreet allocations as a rational response to an increasingly erratic policy environment. With tariffs ricocheting through global supply chains and the dollar’s primacy “controlling the global economy,” he argued, officials outside the United States are searching for insurance against what he called “executive-policy behavior.” “We may need to be decoupled from one sovereign currency,” Scaramucci said, predicting that gold’s record highs and Bitcoin’s resilience during this year’s stock-market slump stem from the same instinct for self-protection.

Related Reading

He stopped short of predicting that Bitcoin will replace the dollar, but he insisted that sovereign accumulation is the precondition for an eventual seven-figure price tag. “If you want to see a million-dollar Bitcoin, that’s when somebody at a sovereign says, ‘Okay, this is part of the infrastructure of the world’s financial-services architecture.’” In that scenario, he expects official portfolios to target 1%-3% allocations—enough, in his view, to lift Bitcoin’s market capitalization toward gold’s $20-30 trillion domain.

Digital Gold Will Win

For now, the “digital gold” thesis appears to be holding. While global equity indices have fallen 5%-8% since the latest tariff salvos, Scaramucci noted, Bitcoin is “roughly where it was at the beginning of the year.” Thursday’s breakout above $100,000 underscores that relative strength.

SkyBridge itself has ridden that wave. Scaramucci reminded listeners that he began buying Bitcoin for his flagship fund around $20,000, calling the position “quite beneficial to our performance.” Independent fund-database figures show the $1.7 billion vehicle returned 43% in 2024, outpacing its hedge-fund benchmark by more than four-to-one—results Scaramucci attributes chiefly to the Bitcoin stake. “This is the best idea I have seen in my career,” he said. “I knew the risks of not jumping in were far greater than playing it safe.”

Generational dynamics are reinforcing those flows. While older asset-managers still lean toward bullion, Scaramucci said, younger allocators already treat Bitcoin as an heirloom asset. “My grandchildren will end up having Bitcoin as a store of value,” he predicted.

Still, he cautioned that widespread institutional adoption will not occur until the United States clarifies its regulatory stance. “If we green-light legislation before the end of the congressional term … then I will tell you that there’ll be large blocks of buying,” he said. Absent that clarity, purchases will remain incremental—yet even incremental flows from trillion-dollar institutions can tally in the billions.

At press time, BTC traded at $103,077.

Featured image created with DALL.E, chart from TradingView.com

Credit: Source link