Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum saw a dramatic turnaround this week, bouncing over 21% from its recent low of $1,380 in just hours. The sharp recovery came in response to an unexpected shift in macroeconomic policy: US President Donald Trump announced a 90-day pause on reciprocal tariffs for all countries—except China, which now faces a steep 125% tariff. The news sent a ripple through global markets, sparking a short-term rally in risk assets, including crypto.

Related Reading

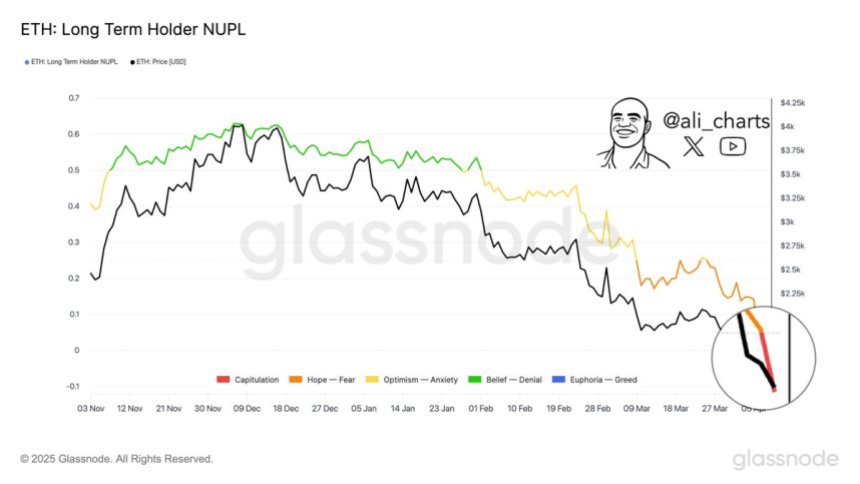

Ethereum, which had been under heavy selling pressure for weeks, appears to have found temporary relief. According to Glassnode data, long-term Ethereum holders are starting to fold, offloading positions at a loss after months of decline. Historically, these moments of long-term holder capitulation have often marked bottoming phases and preceded meaningful rebounds.

While short-term volatility remains elevated, some analysts view this setup as a potential opportunity zone, especially for contrarian investors looking to accumulate during peak fear. The market now watches to see if ETH can hold its gains or if broader uncertainty will drag prices back down. One thing is clear: the next few days could be pivotal for Ethereum’s trend heading into the second half of 2025.

Ethereum Finds Relief Amid Chaos, But Market Remains On Edge

Ethereum is now at a pivotal crossroads after enduring weeks of relentless selling pressure and uncertainty. The recent surge from sub-$1,400 levels has offered a glimmer of hope, as bulls begin to push back against the downtrend. This bounce follows aggressive volatility not just in crypto but across global equities, with price action rocked by continued geopolitical unrest and macroeconomic instability. US President Donald Trump’s unpredictable stance on tariffs remains a wildcard, keeping global markets on edge.

Since peaking in late December, Ethereum has shed over 60% of its value, triggering growing concern that a full-scale bear market may be unfolding. Many investors have already exited positions, while others remain sidelined waiting for clarity. Still, some see opportunity.

According to top analyst Ali Martinez, long-term Ethereum holders have now entered what’s commonly referred to as “capitulation” mode—a stage when even the most patient investors begin to fold under pressure. Martinez believes this could present a rare window for contrarian buyers. “For those watching risk-reward dynamics, this phase has historically marked prime accumulation zones,” he shared on X.

While Ethereum’s path forward is still uncertain, current sentiment suggests that a critical test is underway—one that could determine whether this recovery has legs, or if further pain lies ahead.

Related Reading

Bulls Look To Confirm Recovery With Key Breakout

Ethereum is showing signs of short-term strength as it forms an “Adam & Eve” bullish reversal pattern on the 4-hour chart. This classic technical formation, which starts with a sharp V-shaped low followed by a rounded bottom, often signals a potential breakout if price action holds and follows through. For Ethereum, reclaiming the $1,820 level is the first step to confirm this bullish structure.

If bulls can push ETH above this level with conviction, the next key challenge lies at the 4-hour 200 moving average (MA) and exponential moving average (EMA), both of which converge around the $1,900 mark. A decisive breakout through this zone would validate the recovery setup and could kickstart a more sustained move higher.

Related Reading

However, failure to reclaim the $1,800 level in the coming days may keep ETH stuck in a consolidation range. If rejected, price could remain rangebound between current levels and the lower support area near $1,300, where ETH recently bounced. For now, all eyes are on how price reacts to the resistance levels ahead, as bulls aim to regain control and shift the short-term momentum in their favor.

Featured image from Dall-E, chart from TradingView

Credit: Source link