Over the past decade, Bitcoin has evolved from obscure digital collectible held by cypherpunks to globally recognised institutional asset being adopted by countries such as El Salvador as a currency. Over the past decade, its value has skyrocketed and, with a compound annual rate of return of over 200%, it has outperformed all other asset classes by a factor of at least 10.

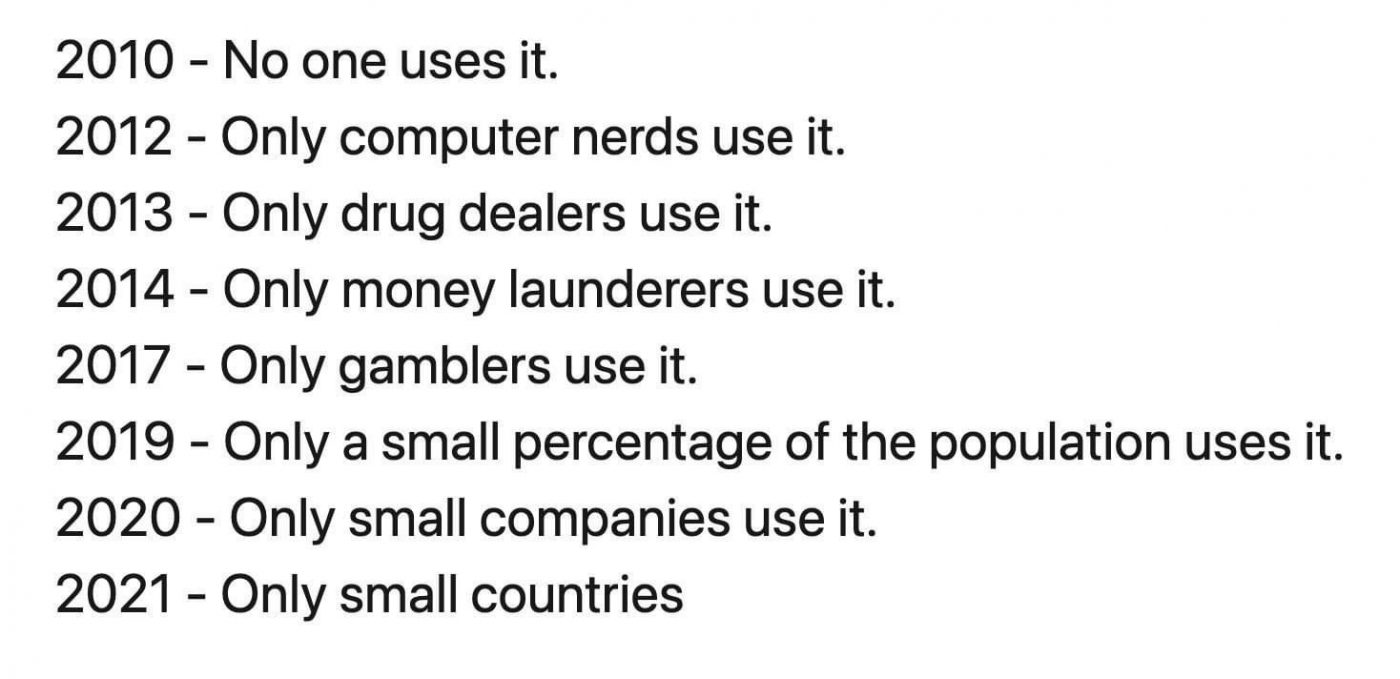

In a tweet by an avid Bitcoin supporter, outlines Bitcoin’s adoption so far.

Given Bitcoin’s meteoric rise into mainstream discourse, it’s worth reflecting on some of its major milestones along the way.

Bitcoin’s Historical Milestones

2008 – The Bitcoin Whitepaper is published by Satoshi Nakamato.

2009 – Bitcoin is launched and towards the end of the year, the first exchange publishes an exchange rate of US$1 = 1,309.03 BTC.

2010 – The first real world transaction in Bitcoin takes place, the infamous 10,000 BTC for two pizzas, valued at $25.

2011 – Bitcoin achieves parity with the US dollar.

2012 – Bitcoin crosses $100 for the first time.

2013 – Bitcoin crosses $1,000 for the first time and the FBI shuts down darknet marketplace Silk Road (the market’s funds have since been returned).

2014 – The biggest exchange at the time, Mount Gox, is hacked with 840,000 Bitcoins stolen, valued at roughly US$460 million.

2017 – Bitcoin forks and reaches a new all time high of $19, 834.

2020 – Bitcoin reaches a new all-time high of $28,949 and institional adoption accelerates. Insurance companies buy bitcoin, the first bitcoin fund is launched, the first bitcoin ETF is launched and MicroStrategy becomes the first listed company to convert corporate treasury into bitcoin.

2021 – Bitcoin reaches a new all-time high of $63, 346. El Salvador becomes the first country to adopt bitcoin as legal tender. A growing number of companies accept bitcoin as payment.

You can view more events on Bitcoin Timeline by TradingView.

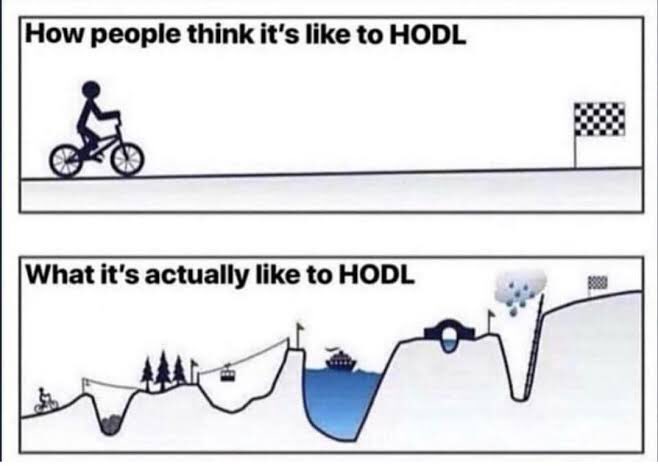

The Path isn’t Straightforward

Despite its exponential growth and increased global recognition, Bitcoin has had to overcome innumerable threats and challenges over the years. Notwithstanding, today it’s arguably as resilient and antifragile as ever.

While bitcoin remains somewhat de-risked relative to its early days, HODLing isn’t easy. If it was, everyone would do it:

Join in the conversation on this article’s Twitter thread.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link