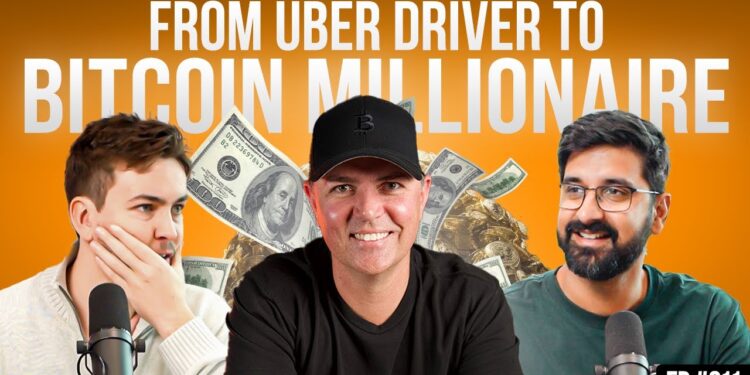

- Entrepreneur and investor Matthew Fraser details the power of compounding Bitcoin over time to secure a prosperous financial future.

- Fraser explains his journey, which ranges from being in debt after several failed business ventures, through to how he turned his life around as a Bitcoin millionaire.

- These successes were achieved through Fraser’s own entrepreneurial e-commerce business and by compounding profits into various types of investments, including Bitcoin.

Fraser explores his financial journey on the Tapping Into Crypto podcast. He highlights the highs and lows of his experience, while providing his perspective on how Bitcoin can be utilised as a powerful financial tool.

The current monetary system is one which Fraser describes as working against the ordinary person. Fraser says it’s important to ask how the ordinary person can surpass the obstacles in life to build wealth, where your financial status is not just plateauing or going backwards. In a world with rampant inflation, it’s a fair question to ask.

Fraser believes Bitcoin is the answer, and that using your Bitcoin to compound more Bitcoin over time is a feasible path to wealth.

If accounting for Co-founder and Chairman of MicroStrategy Michael Saylor’s 29% compounding interest theory, Fraser proposes that a $100,000 investment into Bitcoin over a 20 year period, while contributing $1000 a month, could net around $321m.

Such figures are staggering and based on several assumptions. However, Fraser notes that when examining similar figures for buying Bitcoin in the past, such estimates no longer seem unrealistic. Whether the proposed figures manage to outpace claims of expected diminishing returns on Bitcoin remains to be seen.

Related: Saylor Snaps up Bitcoin on the Dip as MetaPlanet’s Purchase Outstrips Strategy

Fraser also details how one could consider taking control of their superannuation funds, or at least a portion of the funds, to invest in Bitcoin. However, this process can be nuanced.

Fraser mentions his free podcast and education group the Crypto Collective helps to provide such information. He also mentions how your Bitcoin can work for you in lending protocols to compound further over time. Though such initiatives do contain an element of risk.

The Journey of Fraser

Fraser’s journey did not start without setbacks. There was a time when he was driving for Uber and nearly $1m in debt after a series of unsuccessful entrepreneurial ventures involving e-commerce platforms such as Amazon.

However, after one venture experienced substantial success, Fraser now had a highly successful business selling medical devices through Amazon.

Fraser recommends spending time and/or money to educate oneself on business matters. For Fraser this included entrepreneurial ventures involving Amazon, as well as Bitcoin. Fraser then started investing in a number of sectors, including property and Bitcoin/crypto.

Possessing high conviction is key according to Fraser, as this is what helps to stay calm on days when volatility can be brutal. Fraser mentioned losing $1.2m in a one month time period in the crypto markets, but not realising this loss on paper allowed him to stay calm.

This may not always be the case with altcoins, something Fraser has reduced his exposure to over time, as his conviction in Bitcoin has grown. Fraser recommends to only invest what you can afford into Bitcoin, utilising extra funds that you may have available, and to never invest money which you may need for things like rent.

Related: Bitwise CIO’s “Dip Then Rip” Theory Sees BTC Gain Up to 190% Within a Year

Credit: Source link