Let’s take a closer look at this week’s altcoins showing breakout signals. We’ll dive into the trading charts and provide some analysis to help you.

1. Mina Protocol (MINA)

Mina Protocol is a minimal “succinct blockchain” built to curtail computational requirements in order to run DApps more efficiently. Mina has been described as the world’s lightest blockchain since its size is designed to remain constant despite growth in usage. Furthermore, it remains balanced in terms of security and decentralisation. Mina is working on achieving an efficient distributed payment system that enables users to natively verify the platform right from the genesis block. Its technical whitepaper calls this a “succinct blockchain”.

Mina Price Analysis

At the time of writing, MINA is ranked the 223rd cryptocurrency globally and the current price is A$3.68. Let’s take a look at the chart below for price analysis.

Since the beginning of June, MINA has been in a gentle downtrend. The future likely holds more stop runs and erratic volatility until the chart forms more substantial high-timeframe levels.

A retracement might uncover support near A$3.50, which is the daily high of the last swing low. The high of the wick beginning near $3.02 may also provide support. However, bulls will likely remain wary of the current downtrend, making the low at $2.71 the likely next bearish target.

Just above, the daily gap beginning near $4.10 may provide resistance to bulls, possibly marking a future range high. A push through this level is likely to target the swing high near $5.12 – perhaps running to probable resistance near $5.38. Strength above this level might signal the start of a bullish trend, encouraging bulls to “buy the dip”.

2. Metal (MTL)

Metal (MTL) is the native currency of Metal products and an essential part of the Metal ecosystem. Sending and receiving any crypto to friends on Metal Pay is, according to the team, instant, and feeless. Designed to make cryptocurrency payments fast and easy, users pay zero fees when sending, receiving, buying or selling MTL.

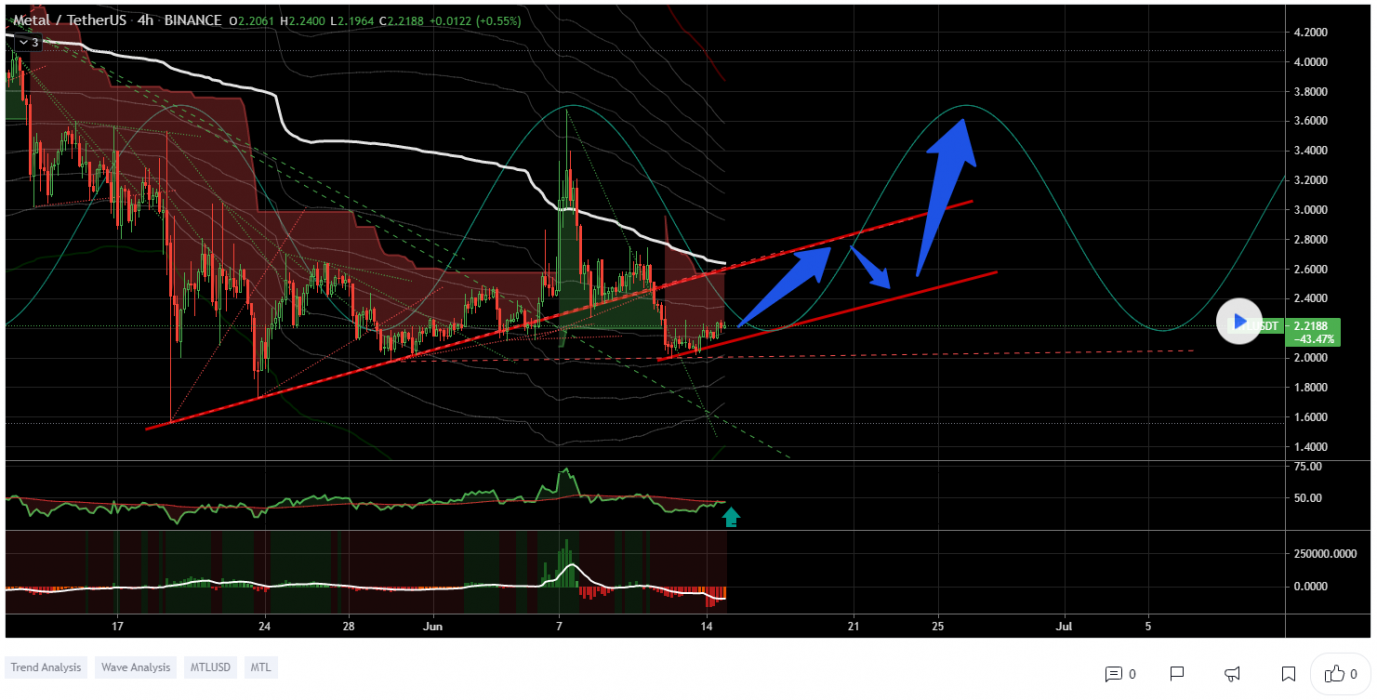

MTL Price Analysis

At the time of writing, MTL is ranked the 190th cryptocurrency globally and the current price is A$2.91. Let’s take a look at the chart below for price analysis.

March 29’s 450% bullish daily candle has since bled near 85%, with the MTL finding a low near $2.02 in mid-May.

Bulls are buying each drop into support near $2.74, with higher lows forming each time. However, the equal lows near $2.56 create an attractive target for a stop run. Still, bulls might buy this dip near possible support beginning at $2.44.

Just over the June monthly open, $3.18 marks the beginning of a probable resistance zone. A breakthrough in this area might target the equal highs near $3.57 before running into possible resistance near $3.75.

A sustained move upward – perhaps from a market-wide bullish shift – could reach the swing high near $4.77 before encountering probable resistance near $4.87.

3. Venus (XVS)

Venus is an algorithmic money market and synthetic stablecoin protocol launched exclusively on Binance Smart Chain (BSC). The protocol introduces simple-to-use crypto-asset lending and borrowing solution to the decentralised finance (DeFi) ecosystem, enabling users to directly borrow against collateral at high speed while losing less to transaction fees. In addition, Venus allows users to mint VAI stablecoins on-demand within seconds by posting at least 200% collateral to the Venus smart contract.

XVS Price Analysis

At the time of writing, XVS is ranked the 144th cryptocurrency globally and the current price is A$33.02. Let’s take a look at the chart below for price analysis.

During five days in May, XVS dumped over 86% before finding support near $25.67. Consolidation above this level has created a series of relatively equal lows, which are likely to be swept before any longer-term bullish trend begins.

In the shorter term, the price might establish support near $32.72 before running the swing high at $37.28. If this bullish move occurs, the price could reach resistance near the June monthly open around $42.94 – and even sweep the swing high near $46.42.

Some support might exist at the daily gap near $20.11. A move this low would also fill the February monthly gap and set the stage for a possible bullish reversal.

If this level fails to hold, the price will likely explore the next monthly gap between $12.30 and $6.21. In this zone, the daily swing low at $8.66 makes a likely target.

Where to Buy or Trade Altcoins?

These three Altcoins have the high liquidity on Binance Exchange, so that could help for trading on USDT or BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy to use popular choice in Australia.

Join in the conversation on this article’s Twitter thread.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link