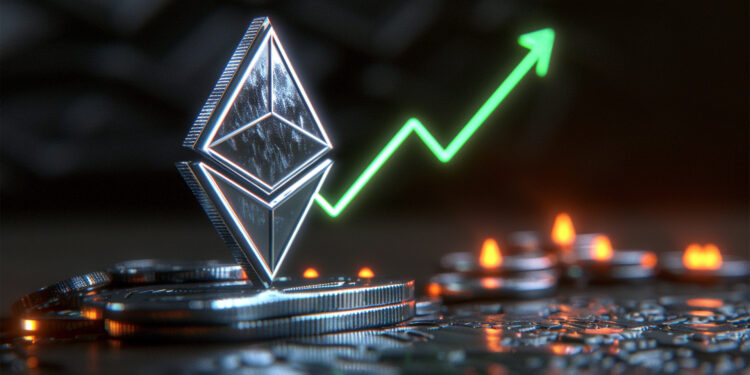

- Ethereum leads the market recovery with a 8% increase, surpassing prices not seen since May 2024 and trading at US$3,661.

- Though not yet surpassing its November 2021 peak of US$4,891, ETH shows strong performance with a year-on-year increase of 79%.

- The ETH/BTC trading pair has risen over 10% in five days, indicating a shifting market sentiment and a resurgence in altcoin interest.

- Analysts attribute Ethereum’s comeback to favourable US crypto policies, stronger ETH/BTC ratios, and growing institutional interest in Ethereum ETFs.

Bitcoin is recovering from a recent 8% dip, but it’s Ethereum that’s leading the rally. ETH gained 8% in the past 24 hours, breaking through highs not seen since May 2024. Currently ETH trades for US$3,661 (AU$5,631), an increase of 79% year-on-year.

ETH still hasn’t managed to break through its all-time high from the last bull-run, when it reached US$4,891 (Approx. AU$7,500) in November 2021.

The ETH/BTC trading pair also reflects the change in sentiment, which is up over 10% in the past five days, reaching 0.038 BTC.

Related: Trump Administration Taps CFTC for Top Crypto Role in Major Overhaul of Digital Asset Oversight

At one point the trading pair even showed a 13% jump, hinting at an altcoin comeback as per analysts at QCP Capital.

After Bitcoin’s dip, Ethereum is staging a comeback, with signs the market is shifting flows to ETH and alts, as evidenced by a 13% surge in the ETH/BTC pair.

QCP Capital

QCP CapitalTrump’s Pro-Crypto Stance Good News for Alts, Including ETH

There are several reasons why Ethereum could finally be staging a recovery. According to Peter Chung and Min Jung, analysts at Presto Labs, three things could explain why “ETH’s disappointing performance this cycle might be nearing its end”.

They said Trump’s pro-crypto stance is arguably even better for altcoins than for Bitcoin, as BTC already had clarity and even a hostile US Securities and Exchange Commission (SEC) classified it as a commodity. Clarity chair Gensler denied basically any other cryptocurrency.

The second reason is a strengthening of the ETH/BTC ratio, which had been down-trending for over two years.

The analysts wrote that the third reason is the growing interest of institutional investors, who may start looking at Ethereum exchange-traded funds (ETFs) after the success of the Bitcoin ETFs.

Some institutional investors—likely those with large gains from BTC ETFs—may be looking beyond the “digital gold” narrative and starting to embrace Ethereum’s “world computer” narrative. The recent inflows into spot ETH ETFs lend support to this shift.

Peter Chung and Min Jung, analysts at Presto Labs

Peter Chung and Min Jung, analysts at Presto LabsRelated: Brazil Poised to Beat United States in Race to Establish Billion-Dollar Bitcoin Reserve

According to a Santiment analysis, Chainlink, Sui, Avax, Toncoin and several others are also seeing massive price increases, making the biggest gains among projects with market caps above US$500 million.

Credit: Source link