A closely followed crypto analyst is warning of a Bitcoin (BTC) collapse if it fails to hold one key support level.

In a new video update, crypto strategist Jason Pizzino tells his 332,000 YouTube subscribers that Bitcoin’s bull market could be invalidated if it falls more than 27% from the current value on the weekly chart.

“Strength is price action above $44,600, which is the bull market support level. Anything under that level that closes on a weekly or monthly basis is going to be pretty severe consequences for the Bitcoin market. That is my flipping point, that flipping point for the bull and the bear market. Underneath that level, not great signs.”

Bitcoin is trading for $60,707 at time of writing, down 1.7% in the last 24 hours.

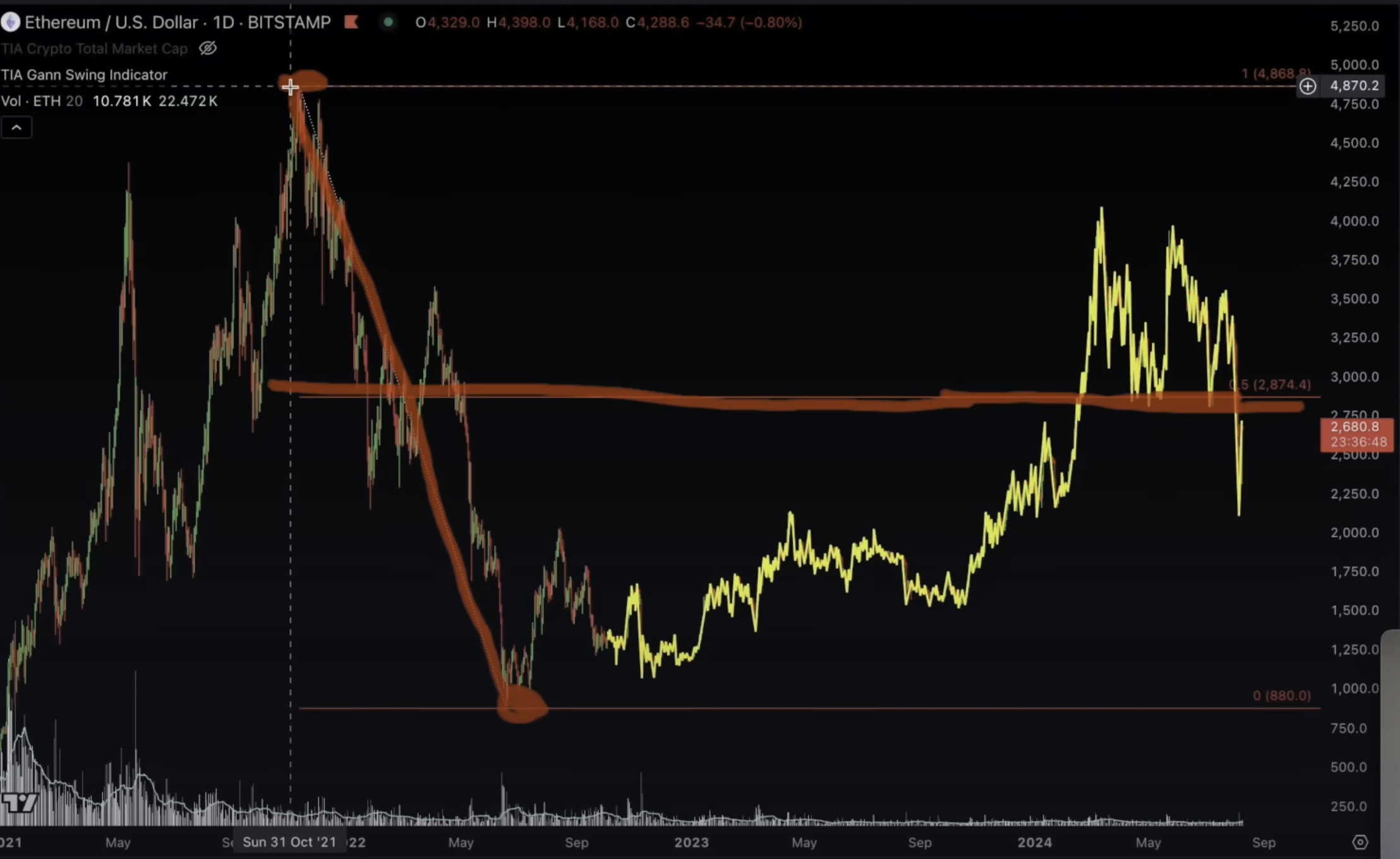

Next up, the analyst says that Ethereum (ETH) could remain in a bullish trend if it convincingly reclaims support at $2,900, the 50% level of the bear market range.

“If ETH can get the closes above $2,900, that’s going to set it up in a much stronger position for this next move forward. If it continues to falter here and get rejected, that’s not a great sign for ETH. You’d probably see further downside again, or at least a test of the lows back at $2,400 to $2,500.”

Ethereum is trading for $2,601 at time of writing, down 2.8% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Credit: Source link