Bitcoin is steady when writing, floating above immediate support levels and inches away from reclaiming the all-important local liquidation line at around $66,000. Even as the broader crypto community expects buyers to step in and push prices higher, there are exciting developments that buttress this outlook.

Billions Worth Of BTC Pulled From Exchanges

According to exchange data shared by one analyst on X, BTC holders increasingly pull their coins from exchanges.

On July 5, when prices tanked, pushing the world’s most valuable coin close to $50,000, a staggering $3.8 billion BTC was moved from exchanges.

Once this happened, prices rapidly bounced back, rising from as low as $53,500 to $65,000 recorded earlier this week. Though prices have been moving horizontally above $62,500 recently, more BTC is being withdrawn. On July 16, BTC owners pulled another $3.4 billion of the coin.

Related Reading

Even though there is no clear impact on prices, if past performance guides, it is likely that prices will edge higher like they did after the collapse to $53,500.

Usually, analysts interpret exchange outflows as positive for price. Whenever coin holders move assets to non-custodial wallets, they want to take control of their coins. As such, they might be unwilling to sell.

Their decision helps support prices since they won’t sell on demand if they wish to, like if they held them on crypto platforms like Binance or Coinbase. Moreover, with fewer BTC readily available on exchanges, bulls tend to benefit due to increased scarcity.

Is Bitcoin Preparing For Another Leg Up Above $72,000?

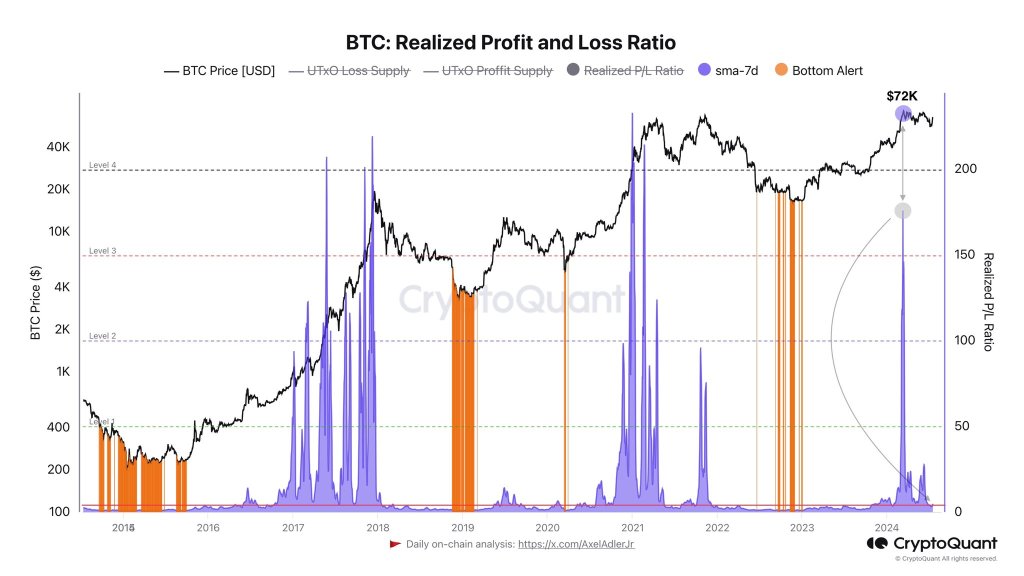

Beyond this development, another analyst notes that the Realized Profit and Loss Ratio metric has fallen and stands at multi-month lows. The metric is used to gauge market sentiment, mainly influenced by profit and loss at any point in time.

This decrease suggests that investors who wanted to exit at highs have already taken profit. For now, traders must wait for these metrics to rise, perhaps to multi-month highs, ideally above $72,000 and $74,000, before profit-taking resumes.

Related Reading

Bitcoin has also reclaimed its average cost basis of short-term holders (STHs) as prices recover above $62,000. Those who bought within the last 155 days are now in the money. They are likely holding and expecting more gains in the coming sessions before realizing profits.

In the past, whenever the average cost basis is surpassed, CryptoQuant analysts say prices tend to rise by over 30%.

Feature image from DALLE, chart from TradingView

Credit: Source link