Real Vision analyst Jamie Coutts says a key Bitcoin (BTC) indicator is suddenly flashing bullish amid fears of another US banking crisis.

The former Bloomberg analyst tells his 18,200 followers on the social media platform X that macro conditions could soon send Bitcoin soaring.

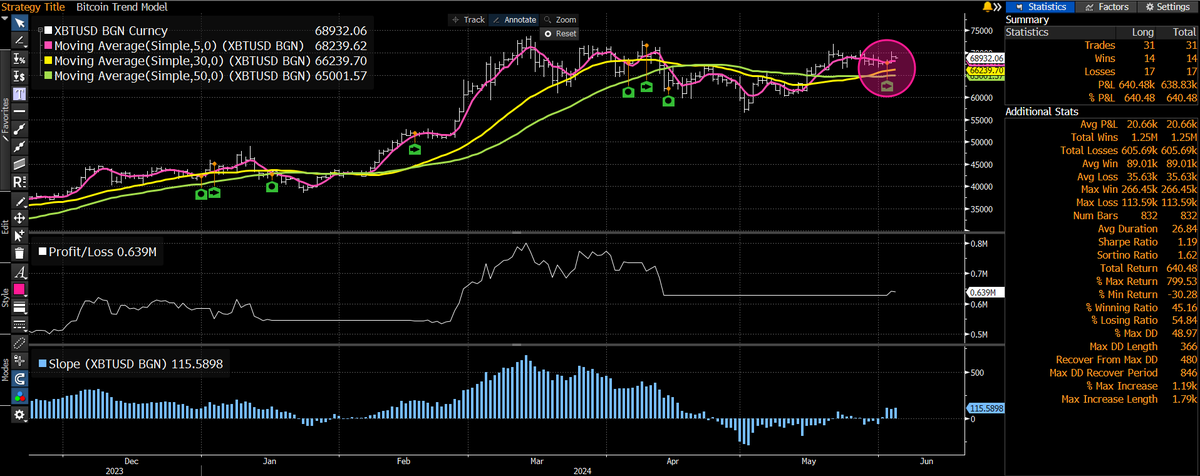

“The Federal Deposit Insurance Corporation (FDIC) has reported that 63 US banks are on the brink of insolvent collapse. This is due to banks sitting on $517 billion in unrealized losses. Meanwhile, after some nice coiling pricing action since March, my boring Bitcoin Trend model triggers. DXY down, Yields and Corp Spreads lower. Can you smell that, son? That’s the smell of central bank liquidity in the air.”

The analyst appears to be using a combination of moving averages, the profit and loss metric, and the Slope indicator.

Coutts suggests that the banking industry’s weakness may cause the Fed to inject liquidity into the markets, which he believes would be bullish for Bitcoin.

In the May 29th Quarterly Banking Profile report, the FDIC said banks are saddled with more than half a trillion dollars in paper losses on their balance sheets, due largely to exposure to the residential real estate market.

Unrealized losses represent the difference between the price banks paid for securities and the current market value of those assets. Unrealized losses can become an extreme liability when banks need liquidity.

The FDIC said that the health of the US banking system is at no imminent risk, but warned persistent inflation, volatile market rates and geopolitical concerns continue to put pressure on the industry.

Bitcoin is trading for $70,889 at time of writing, up 2.6% in the last 24 hours.

Generated Image: Midjourney

Credit: Source link