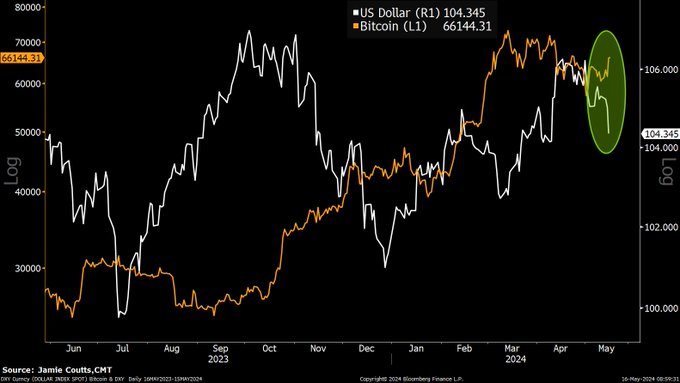

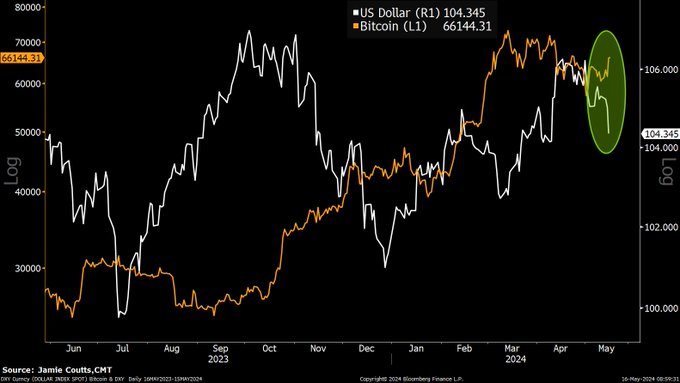

Real Vision analyst Jamie Coutts is saying that the performance of the US dollar against other major currencies will impact the price of Bitcoin (BTC).

Coutts tells his 16,300 followers on the social media platform X that the US Dollar Index (DXY), a measure of the US dollar’s value compared to a basket of six dominant global currencies, is currently trading in a range.

According to Coutts, Bitcoin could rally if the DXY falls by around three percent from the current level.

“A break below 101 would be rocket fuel for Bitcoin.”

The DXY is trading at 104.52 at time of writing.

According to the Real Vision analyst, the DXY falling would send Bitcoin surging by approximately 127%.

“Risk assets love dollar weakness.

The DXY holds the key to the Bitcoin cycle as it prices in market expectations on liquidity in real-time. And liquidity is coming.

Watch the 101/102 level on DXY. If that breaks, then we should see approximately $150,000 BTC this cycle.”

Earlier this month, Coutts opined on a reverse scenario warning that an upward move by the US dollar index would send Bitcoin to levels last recorded in February.

“With money supply actually expanding again, if the DXY turns bullish (i.e. weakens), then you have the macro/liquidity signal for BTC and it will be off to the races.

However, 106/107 on the DXY remains the bogeyman level, which if broken, would likely see a fall into the low $50,000 range.”

Bitcoin is trading at $66,189 at time of writing.

Featured Image: Shutterstock/AleksandrMorrisovich

Credit: Source link