The Bitcoin market is currently on edge as prominent analyst Crypto Rover warns of a potential liquidation event that could negatively affect the short holders.

With Bitcoin trading within a significant consolidation phase, as revealed by Rover, analysis suggests that over $3 billion in short positions could face liquidation should Bitcoin climb back to a specific price mark.

Bitcoin Bears Beware Of This Price Range

According to Rover, the crucial price mark, which is the $71,600 region, is where the $3 billion short liquidation would occur if Bitcoin reclaims it. Rover’s assessment is based on data gathered from CoinGlass, a renowned derivative market tracker, indicating a substantial liquidity accumulation at higher price levels.

The recent warning from Crypto Rover comes amidst a period of turbulence in the crypto market, marked by sharp price movements and heightened trading activity.

Particularly, Bitcoin experienced a sudden decline over the weekend, bringing its price to as low as $62,000 in the zone. However, in the early hours of Monday, the asset showed signs of recovery, briefly reaching a high of $66,797 before retracing to its current price of $64,711.

The market downturn over the weekend witnessed a record number of liquidations, with over $1.2 billion in Bitcoin long positions liquidated in a single day, according to WhaleWire.

JUST IN: Over $1.2 Billion in #Bitcoin longs have been liquidated over the last 24 hours, amid market decline, setting a new record. The previous record was $879M.

Today, more Bitcoin bulls have been liquidated than on any day in the last 15 years.

Another reason why buying up… pic.twitter.com/itnwb7rj1d

— WhaleWire (@WhaleWire) April 13, 2024

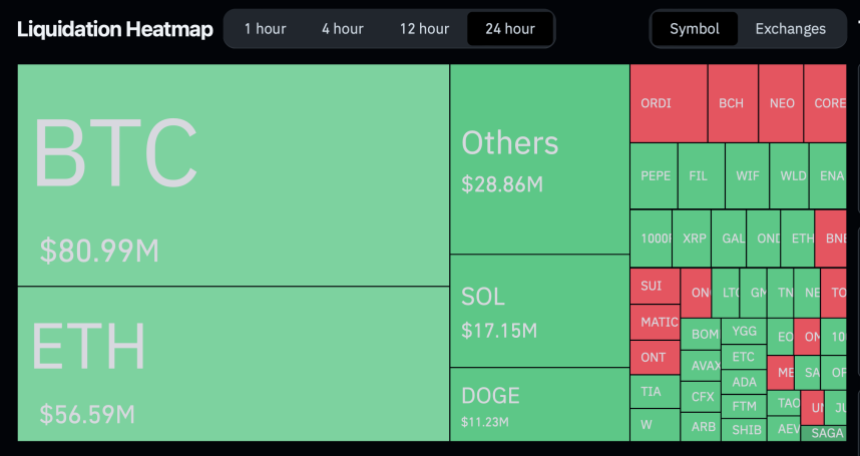

The liquidation hasn’t stopped, as the latest data from Coinglass reveals that in the past 24 hours alone, 89,151 traders have been liquidated, resulting in a total loss of $266.10 million.

Analyst Insights And Market Dynamics

It is worth noting that Bitcoin’s recorded slight recovery comes as Hong Kong regulators granted provisional approval for asset managers to launch spot Bitcoin and Ethereum exchange-traded funds (ETFs).

Crypto analyst Willy Woo has shared his perspective on the potential impact of Bitcoin exchange-traded funds (ETFs) on market dynamics.

According to Woo, introducing the new Bitcoin ETFs could lead to significant price targets, with projections ranging from $91,000 at the bear market bottom to $650,000 at the bull market top.

The new #Bitcoin ETFs brings price targets of $91k at the bear market bottom and $650k at the bull market top once ETF investors have fully deployed according to asset manager recommendations***.

These are very conservative numbers. #Bitcoin will beat gold cap when ETFs have…

— Willy Woo (@woonomic) April 15, 2024

Woo’s analysis underscores the growing institutional interest in BTC, with asset managers expected to allocate a substantial portion of their funds to the cryptocurrency.

However, Woo emphasizes that these projections are conservative estimates, and Bitcoin’s market capitalization could exceed gold as more capital is deployed into the asset.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Credit: Source link