Today, US-based major crypto exchange Coinbase filed to go public via USD 1b direct listing on the Nasdaq Global Select Market under the symbol COIN this year.

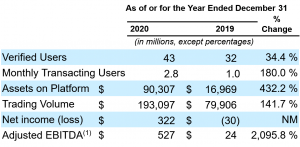

In the filing with the US Securities and Exchange Commission, the company said it had 43m verified users last year and 2.8m monthly transacting users. Also, they claim that they work with 7,000 institutions and 115,000 ecosystem partners in over 100 countries.

The company said its goal is to become the primary financial account for their retail users and the one-stop shop for institutions’ crypto asset investing needs. They admitted that the company competes against a growing number of decentralized and noncustodial platforms too.

As of December 31, the company said it had USD 90bn worth of assets on the platform and registered USD 456bn lifetime trading volume.

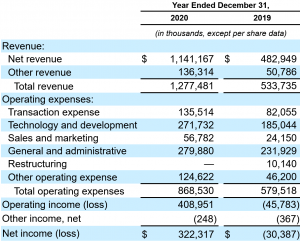

Coinbase added that, since inception through December 31, 2020, they generated over USD 3.4bn in total revenue, largely from transaction fees. For the year ended December 31, 2020, transaction revenue represented over 96% of their net revenue.

“You can expect volatility in our financials, given the price cycles of the cryptocurrency industry. This doesn’t faze us, because we’ve always taken a long-term perspective on crypto adoption. We may earn a profit when revenues are high, and we may lose money when revenues are low, but our goal is to roughly operate the company at break-even, smoothed out over time, for the time being. We are looking for long-term investors who believe in your mission and will hold through price cycles,” according to CEO and Founder Brian Armstrong, 38, who was paid USD 1m in salary last year or USD 59.5m in total with other compensations such as options awards, per the prospectus.

Per the company, now they directly integrate with over 15 blockchain protocols, support over 90 crypto assets for trading or custody, and offer a suite of subscription products and services “that have enhanced the customer value proposition and power of our platform.”

“Retail users are now engaging with multiple products — across the four quarters ended December 31, 2020, on average, 21% of retail users who invested also engaged with at least one non-investing product per quarter,” they said.

The company aims to grow more stable revenue from subscription products and services, and expects that they will contribute a larger portion of their total revenue. Coinbase said they experienced 126% annual growth in revenue from these products and services from 2019 to 2020.

Consolidated statement of operations data

____

Key business metrics

Coinbase also said they plan to continue to make acquisitions and investments, add support for new crypto assets each quarter, and over time they expect to add other forms of crypto assets, such as security tokens, crypto assets that represent a traditional security.

“We will continue to build support for new and novel features of blockchain protocols, enabling us to offer a broader suite of financial services unique to the cryptoeconomy. Examples of protocol features include staking, on-chain governance, decentralized identity, and others unique to each blockchain protocol,” the company said.

Credit: Source link