A widely followed crypto analyst is warning that Bitcoin (BTC) could pull back further before next month’s halving event when miners’ rewards are cut in half.

Pseudonymous crypto trader Rekt Capital tells his 433,000 followers on the social media platform X that Bitcoin has entered a “danger zone” when historically the crypto king has corrected between 20% and 40%.

“It’s been two days since Bitcoin officially entered the ‘danger zone’ (orange) where historical pre-halving retraces have begun. Historically, Bitcoin has performed pre-halving retraces 14-28 days before the halving. Currently, BTC is approximately 26 days away from the halving and has pulled back almost -18% in total since last week.

Whether the retrace bottom is in already or not is uncertain. But what’s clear is this: Bitcoin has just recently entered its ‘danger zone’ time window. Technically, there’s still time for additional downside.”

The trader says Bitcoin’s price pattern is showing similarities to the 2016 cycle, which could indicate a deeper dip ahead before the halving event.

“In 2016, Bitcoin performed its pre-halving retrace approximately 28 days before the halving. In 2024, Bitcoin performed its pre-halving retrace approximately 32 days before the halving. Interestingly, when Bitcoin began its 2016 pre-halving retrace, price initially produced a long downside wick before retracing further.

Recently, Bitcoin has also produced a long downside wick on its pre-halving retrace. Bitcoin will need to continue to maintain these current highs to avoid a 2016-like fate where the initial reaction was strong but short-lived.”

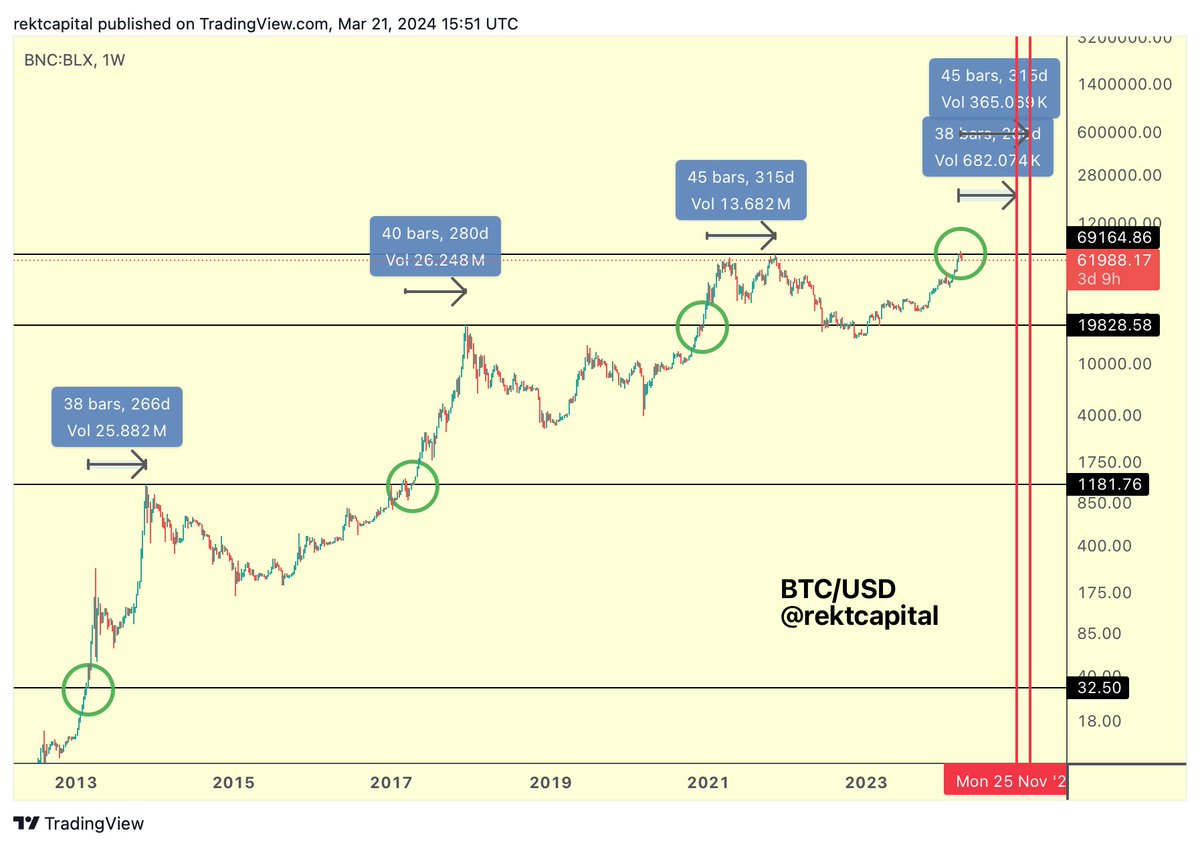

The trader is also predicting when Bitcoin could reach the peak of the current bull market cycle.

“When could Bitcoin peak in this bull market? Bitcoin tends to perform a bull market top 266-315 days after it breaks its old all-time high. Bitcoin broke its old all-time highs last week. The next bull market peak may thus occur in 266-315 days. That’s very late November 2024 or very late January 2025.”

However, the trader says that historically Bitcoin is taking longer to hit peaks each cycle, which could push the peak of the current bull market to December 2024 or mid-February 2025.

“Historically, the amount of days that Bitcoin has spent beyond old all-time highs have increased by approximately 14 days to 35 days…

If we add 14-35 days to the initial bull market peak range of 266-315 days, that would bring the total to 280-350 days. This in turn could push the Bitcoin bull market peak to mid-December 2024 or mid-February 2025.”

Bitcoin is trading for $65,410 at time of writing, down more than 3% in the last 24 hours.

Generated Image: DALLE3

Credit: Source link