Bitcoin (BTC) is headed for a sell-side liquidity crisis, according to the co-founder and chief executive of analytics platform CryptoQuant.

Ki Young Ju tells his 336,400 followers on the social media platform X that Bitcoin bears “can’t win this game” until spot Bitcoin exchange-traded fund (ETF) inflow stops.

“Last week, spot ETFs saw netflows of +30,000 BTC. Known entities like exchanges and miners hold around 3 million BTC, including 1.5 million BTC by US entities. At this rate, we’ll see a sell-side liquidity crisis within 6 months.

Bitcoin is currently in the price discovery phase. Once a sell-side liquidity crisis happens, its next cyclical top may exceed our expectations due to limited sell-side liquidity and a thin order book.

This could occur once accumulation addresses reach around a total of 3 million BTC.”

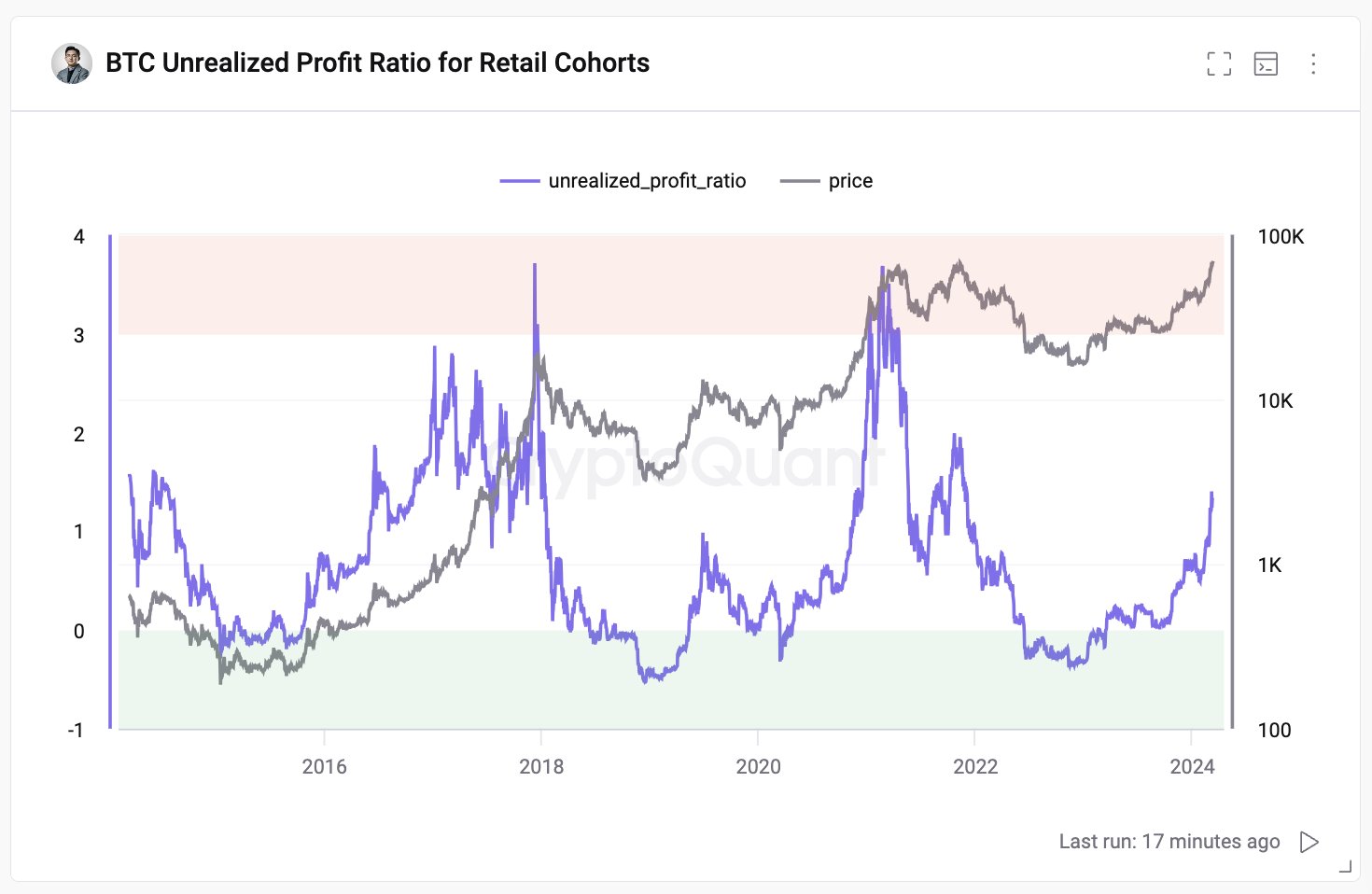

Young Ju also says the current market is “halfway to Bitcoin euphoria.”

“Retail on-chain activities are definitely active but don’t indicate a cyclical top.

Bitcoin is in the price discovery phase, so it’s important to determine whether we’re at the cyclical top.”

Bitcoin is trading at $71,487 at time of writing. The top-ranked crypto asset by market cap set a new all-time high of $72,733 on Tuesday morning and is up more than 12% in the past week.

Generated Image: DALLE3

Credit: Source link