The co-founder and CEO of market intelligence firm CryptoQuant thinks that Bitcoin exchange-traded funds (ETF) inflows could propel BTC to a new all-time high in the coming months.

Ki Young Ju tells his 332,900 followers on the social media platform X that in a bullish scenario, he sees Bitcoin surging above $100,000 by the end of 2024.

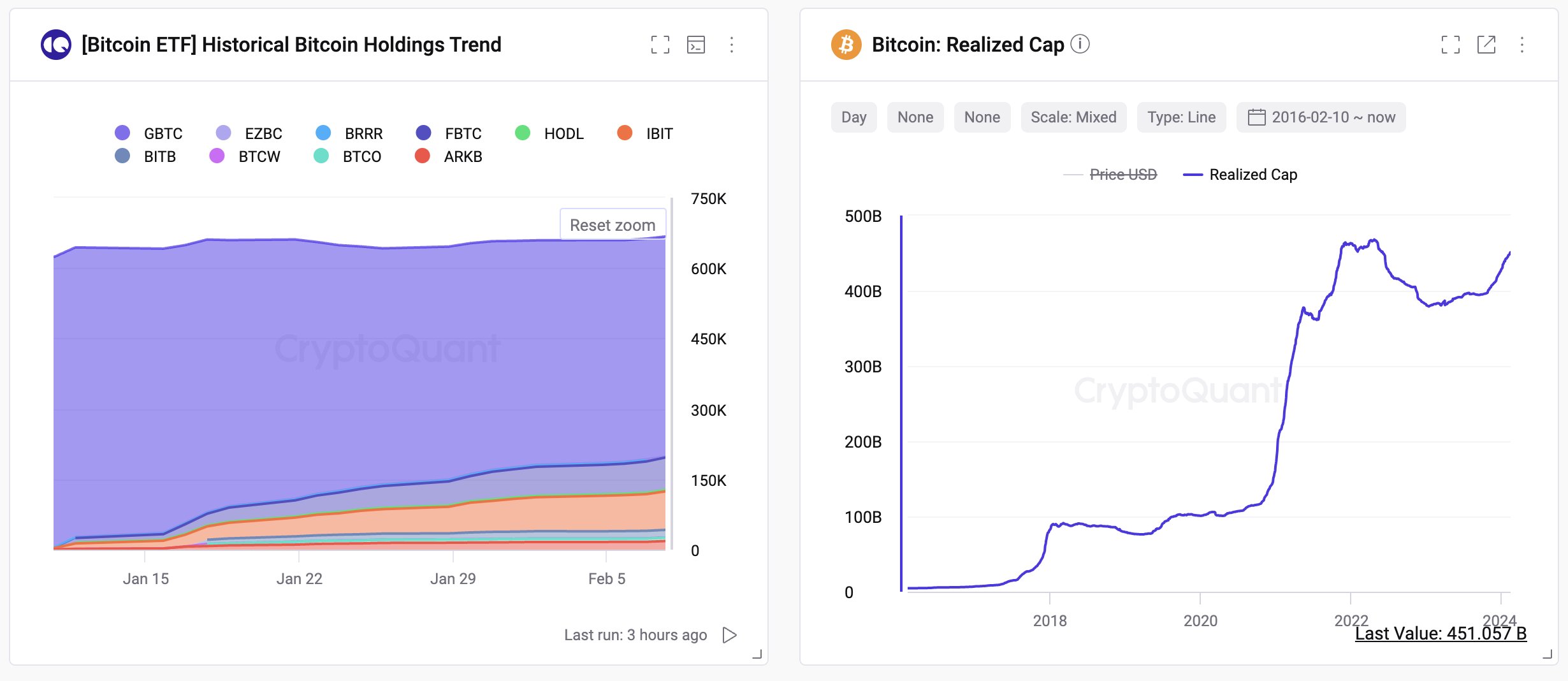

The analyst bases his prediction on two metrics: BTC ETF inflows and Bitcoin’s realized cap, an on-chain metric that attempts to provide a better estimate of the crypto king’s market capitalization by eliminating long-lost and unclaimed coins in the calculation.

Using BTC’s realized cap, the CryptoQuant CEO identifies the potential ceiling and floor prices for Bitcoin this year.

“Bitcoin could reach $112,000 this year driven by ETF inflows, worst-case $55,000.”

Looking closer at the on-chain metric, Ki Young Ju says Bitcoin’s realized cap currently sits at $451 billion. But he says ETF inflows could push BTC’s realized cap to more than half a trillion dollars.

“[The] Bitcoin market has seen $9.5 billion in spot ETF inflows per month, potentially boosting the realized cap by $114 billion yearly.

Even with GBTC (Grayscale Bitcoin Trust) outflows, a $76 billion rise could elevate the realized cap from $451 billion to $527-$565 billion…

With current spot ETF inflow trends, the top price could reach $104,000-$112,000.”

At time of writing, Bitcoin is trading for $48,378, up nearly 2% in the last 24 hours.

Generated Image: Midjourney

Credit: Source link