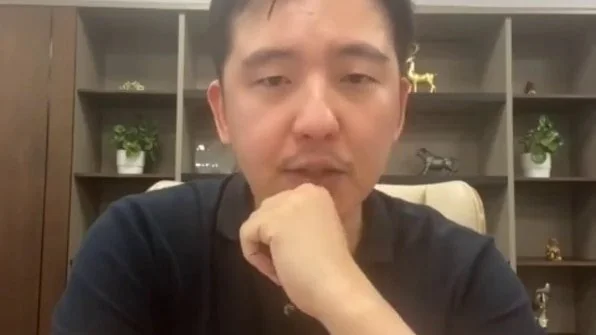

- Australian Sam Lee has been officially accused of leading one of the world’s largest crypto scams.

- The HyperFund scheme allegedly defrauded investors USD $1.89 billion before going bankrupt.

- The scheme offered high returns from mining operations.

- Lee has denied the fraud and claims that he ran a legitimate technology company that was a victim of circumstance.

The man allegedly behind one of Australia’s most notorious Bitcoin scams has officially been charged by the Securities and Exchange Commission (SEC). Aussie Sam Lee is accused of defrauding investors from around the world to the tune of USD $1.89 billion (AUD $2.85 billion) in what would be one of the industry’s biggest Ponzi schemes. The company promoting the scheme – which eventually went bankrupt – was known as HyperFund, HyperTech, HyperCapital and HyperVerse at various stages.

Mining Operations Did Not Exist

The Hyper(Pick any of the relevant suffixes) business model supposedly generated handsome crypto returns to those who purchased memberships. Some subscriptions boasted rewards of 0.5% per day – or 180% per year. The way this profit was “guaranteed” allegedly came from the company’s substantial mining operations. However, after investigation, it appears that the operations never actually existed, and rewards were generated through new investor money. AKA, a Ponzi scheme.

The only thing that HyperFund mined was its investors’ pockets.

Very punny, SEC.

The platform ran for 2 years, between 2020 and 2022, but some customers have claimed that HyperVerse started blocking user withdrawals as early as 2021. Mr Lee has denied all claims of fraud, maintaining that his business was legitimate. He sent a text message via an undisclosed location in Dubai to Australian media outlet the AFR.

It’s embarrassing really…I’ve made it very clear I run a technology company, it’s like blaming a car manufacturer for a bank robbery involving their car.

Sam Lee

Sam LeeHowever, he faces up to five years in prison after being charged with one count of conspiracy to commit securities fraud and wire fraud.

Credit: Source link