In a new video update, renowned crypto analyst Michael van der Poppe dissected the current dynamics of the crypto market, emphasizing the potential of select altcoins. VVan der Poppe’s analysis provides a strategic viewpoint for potential investors, focusing on the intricate relationship between Bitcoin’s (BTC) price movements and the broader altcoin market.

Van der Poppe started by acknowledging the mixed performances among altcoins, with some consolidating, others correcting, and a few showing remarkable strength. The crux of his analysis hinges on the intricate relationship between Bitcoin’s market behavior and the resultant impact on altcoins.

He highlighted the current consolidation phase of Bitcoin, noting, “Bitcoin is currently looking at a case of consolidating which means that if Bitcoin is bottoming out… that can be the kickstart of altcoins to start firing up.”

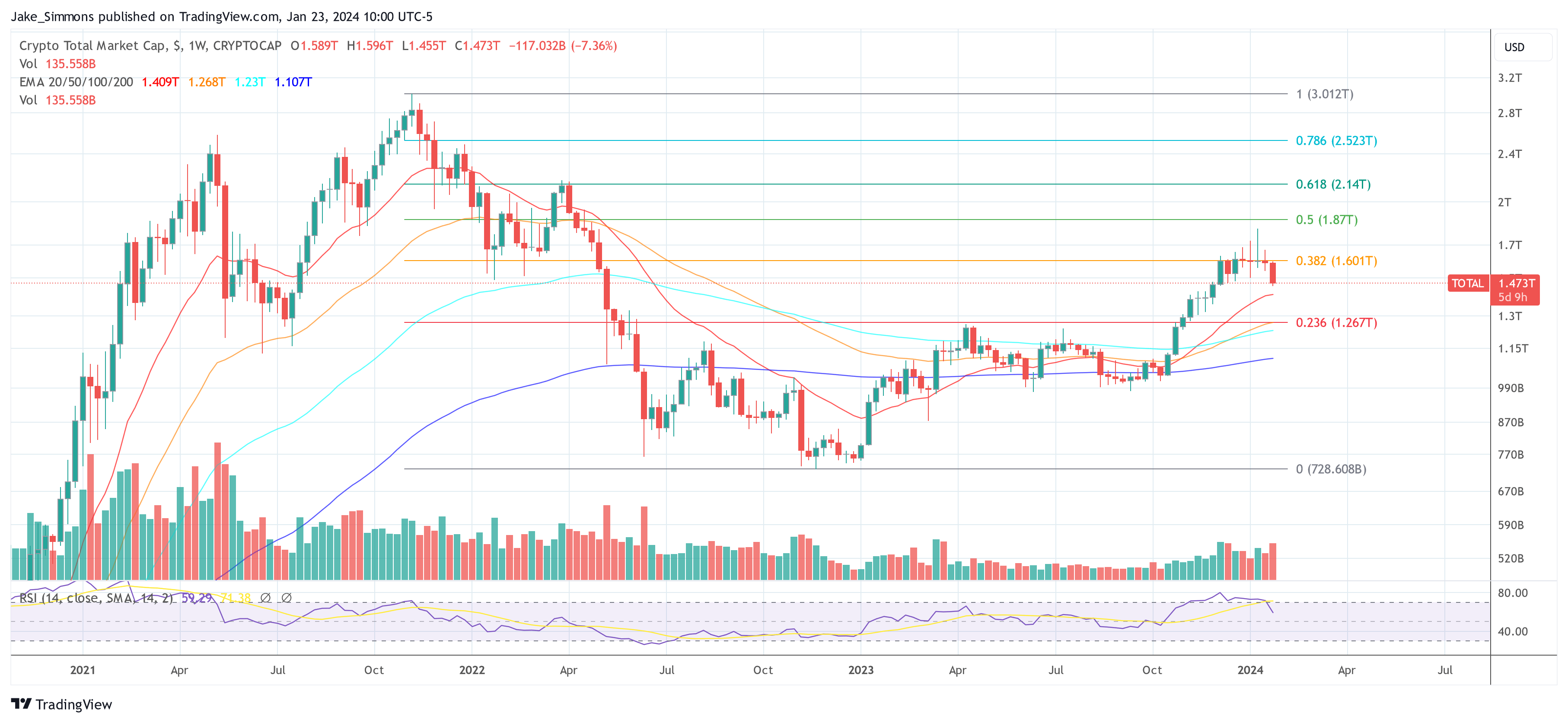

Furthermore, the crypto analyst delved deep into market capitalization metrics, particularly emphasizing the Total 2 market cap (excluding Bitcoin) and Total 3 market cap (excluding Bitcoin and Ethereum), to underscore the latent potential in altcoins. He pointed out, “We are at the levels of March 2022… the total market cap lagging says that we are looking at a case of other cryptocurrencies to start trending outside of Bitcoin.”

Top 3 Altcoins To Buy Now

The first altcoins which van der Poppe picked is Ethereum. He linked ETH’s price movements with broader market events, including the Bitcoin halving and potential regulatory approvals and suggested, “Ether is always going to pick up in a pace that is due to a period of consolidation of Bitcoin.”

He added with regards to the final SEC deadline for an spot Ethereum ETF approval in the US, “the actual date that we need to focus on is May, which probably is going to lead into such a momentum towards these highs.”

With regard to a possible price target in this bull run, the analyst revealed: “I think that at this point ETH is still going to continue running towards the area of 8K and we’re going to find ourselves into a top at that specific level.”

With respect to the 1-week ETH/BTC chart, van der Poppe remarked, “We’re seeing one crucial level that we need to break through 0.06. If we do, I think the range high at 0.0838 is going to be the target. As a matter of fact you can actually say $130 billion needs to be added towards Ethereum. It’s a rally of approximately 43%.

Van der Poppe’s second pick is Chainlink. Highlighting LINK’s technical patterns and its correlation position against BTC in the weekly chart, Van der Poppe highlighted that LINK hit resistance at 0.000448, dropped back down towards 0.0002843 and is now consolidating.

Once this is finished, he expects Chainlink “to rally towards the resistance and start breaking out of this level towards the highs at 0.0009 to 0.0010.” He added, “In terms of BTC value, it’s very likely that it’s going to do a 2x,” emphasizing the potential for significant growth.

In USDT terms, this would mean that LINK goes to $17 to $18. “From $17 to $18, you need to do 2X, which is this range high, which is this level, which we can expect Chainlink to go to before we have a pretty substantial correction in the entire market,” he added.

The analyst’s third altcoin is Arbitrum. Focusing on ARB’s recent price actions and potential for a significant rally, Van der Poppe identified key entry points, stating, “Anywhere in this ballpark between $1.67 and $1.50 is where you want to get yourself into an entry point.” He underlined the potential growth, saying, “If there’s going to be another impulse taking place, it is going to $3.50 or $5.”

At press time, the total crypto market cap stood at $1.473 trillion after being rejected at the 0.382 Fibonacci retracement level.

Featured image from iStock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Credit: Source link