Leading crypto analytics firm Santiment says that the largest Tether whales have been gobbling up the stablecoin USDT in the past six months.

Santiment notes that the top 100 USDT addresses have added $1.67 billion worth of the top stablecoin by market cap over a six-month period, indicating a nearly 10% rise in buying power.

The analytics firm says that if USDT whales continue boosting their buying power, it could increase the chances that Bitcoin (BTC) surges past $40,000.

BTC is trading at $36,933 at time of writing.

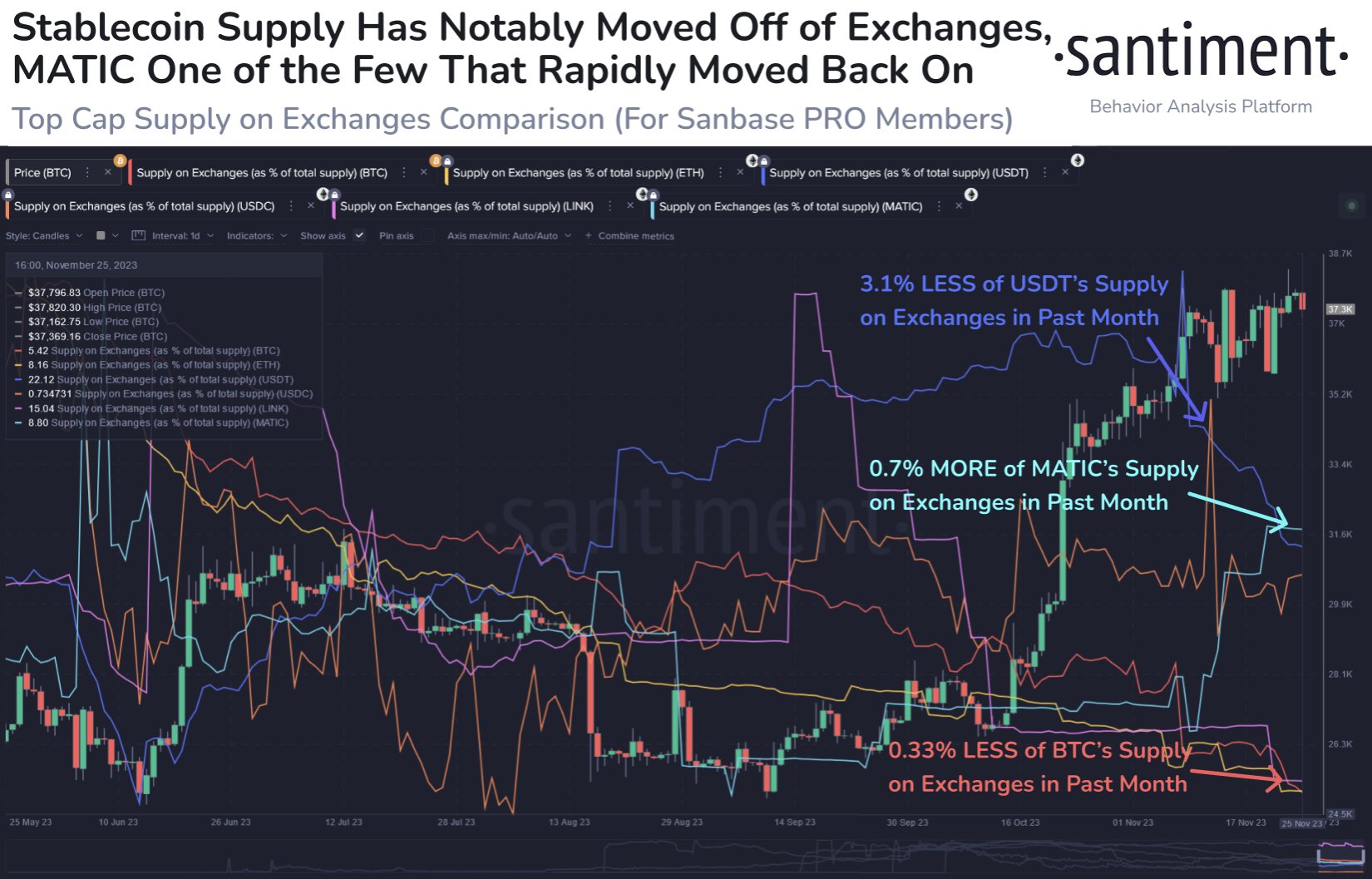

Santiment also notes that 3.54% of USDT’s entire supply and 0.72% of USDC‘s supply moved to exchanges between August 19th to October 16th. According to the analytics firm, another round of USDT and USDC deposits to exchanges could precede more rallies for the crypto markets before the end of the year.

“These transfers were the predecessor to the crypto-wide rally from late October to mid-November. After a cooldown, USDT and USDC returning to exchanges will be crucial to seeing market caps continuing to increase for a big final five weeks of 2023.”

USDC is the second-largest stablecoin by market cap.

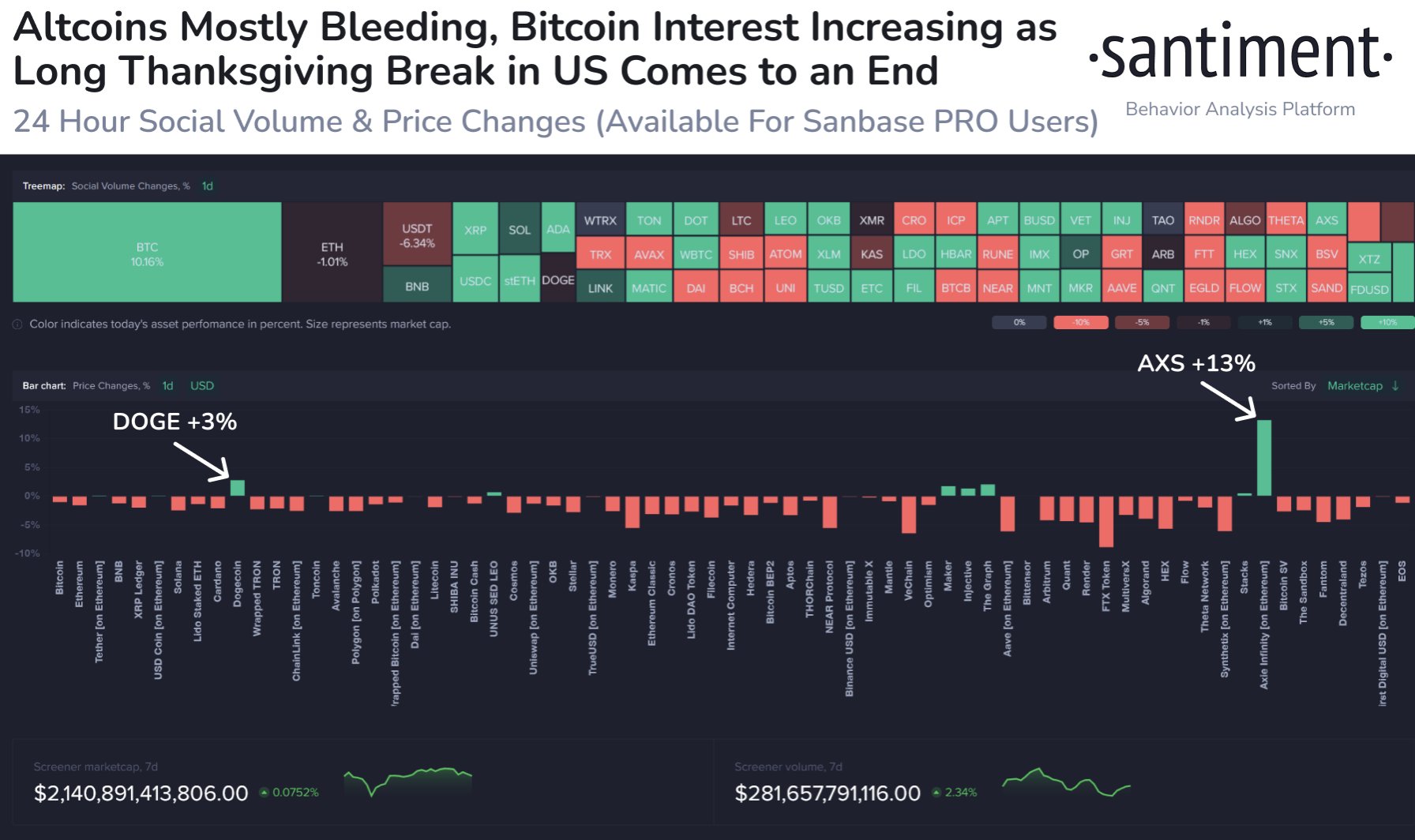

Looking at the sentiment surrounding the crypto markets, the analytics firm says that traders are starting to flash signs of fear after a widespread retracement in the altcoin markets.

“Fear sentiment is creeping in after two-thirds of the top 100 altcoins have retraced over the past week. Particularly in the past hours, several have lost a large chunk of their November profits. If FUD (fear, uncertainty and doubt) becomes prominent, buy-the-dip opportunities should be worth exploring.”

Generated Image: DALLE3

Credit: Source link