Crypto trader Ali Martinez says the second-largest memecoin by market cap could rally based on the readings of one indicator.

Martinez tells his 31,600 followers on the social media platform X that the Tom Demark (TD) Sequential indicator is signaling a potential long opportunity for Shiba Inu (SHIB) on the weekly chart.

The TD Sequential indicator is used by traders to predict potential trend reversals based on the closing prices of the 13 previous bars or candles. According to Martinez, the last two bullish signals on Shiba Inu from the TD Sequential indicator saw SHIB rally by “118% and 71% respectively”.

“Given the infrequency yet precision of such signals, it’s a pivotal moment to keep a keen eye on SHIB.”

SHIB is worth $0.00000738 at time of writing.

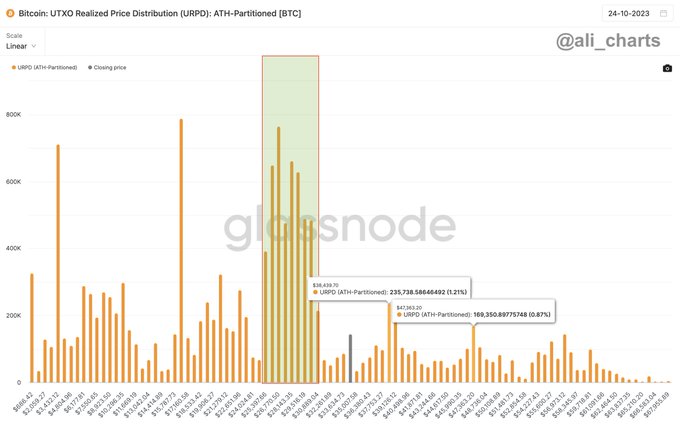

Looking at Bitcoin (BTC), the crypto analyst says that based on the UTXO Realized Price Distribution (URPD) model, the next key resistance levels are about 13% and 38% above the current price. The UTXO keeps track of the number of existing coins that last moved within a given price range.

“Bitcoin built a massive support barrier between $25,000 and $30,000. The UTXO Realized Price Distribution (URPD) model now suggests the next two critical areas of resistance for BTC are $38,440 and $47,360!”

BTC is trading for $34,140 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE-3

Credit: Source link