Bitcoin (BTC) is priming itself for a big move to the upside even amid higher-than-expected inflation data that came in last week, the founders of Glassnode say.

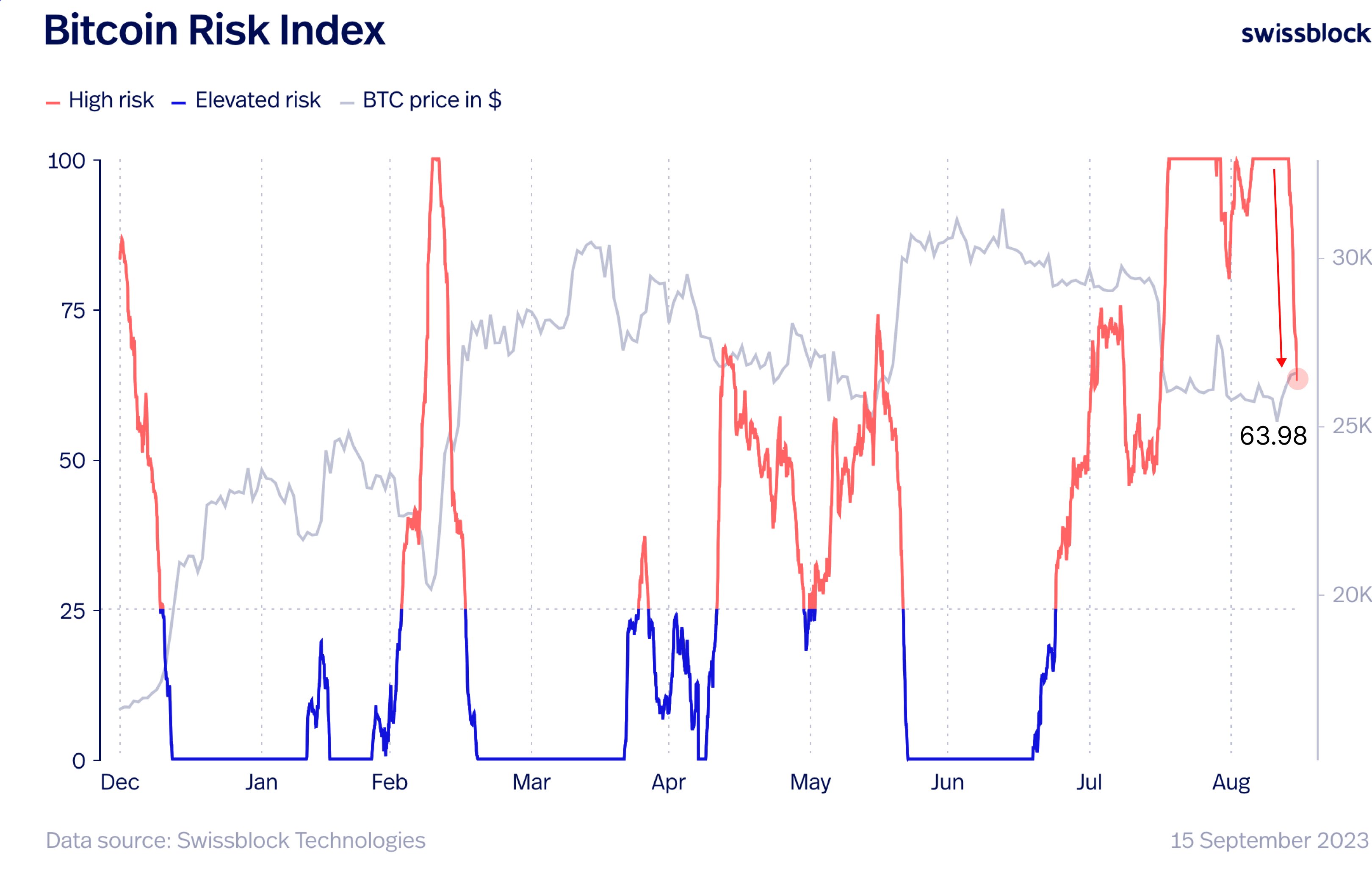

According to Glassnode founders Jan Happel and Yann Allemann, Bitcoin has reclaimed the $26,000 level as support, and BTC’s Risk Signal appears to have taken a nosedive.

BTC’s Risk Signal is a metric from Glassnode that gauges the level of risk of a major price drawdown for Bitcoin.

Say Glassnode founders,

“The US Consumer Price Index (CPI) jump by 0.6% was expected to stir the BTC price, and it has.

Reclaiming support above $26,000, BTC’s now eyeing a breakout past $27,000, potentially exiting a multi-week range.

Risk Signal’s nosedive into the 60s signifies this attitude shift. Profit booking pressure may loom around $27,400 and $28,200, but this climb seems poised as a step before tackling the psychological barrier at $30,000.”

Last week, the U.S. Bureau of Labor Statistics revealed that CPI rose from 0.2% in July to 0.6% in August, and the release of the data coincided with a bump in crypto and equities.

The Glassnode founders, who go pseudonymously as Negentropic on the social media platform X, appear to be forecasting a longer-term rally for Bitcoin to much higher prices.

The analysts share a chart suggesting that BTC has bounced off a large ascending channel and is set to start rising to the upper end of the channel near $150,000 where “greed, euphoria and FOMO (fear of missing out)” could occur.

At time of writing, Bitcoin is trading for $26,538.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and

Surf The Daily Hodl Mix

Check Latest News Headlines

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DreamStudio

Credit: Source link