A market intelligence firm says that hackers from North Korea are using Russian crypto exchanges known to launder money to move stolen digital assets.

In a new blog post, crypto analytics platform Chainalysis says on-chain data reveals that hacking groups linked with North Korea are using Russian crypto exchanges to launder funds stolen from the exploitation of decentralized app project Harmony (ONE) earlier this year.

“In the wake of a historic arms meeting between Kim Jung-un and Vladimir Putin, on-chain data reveals disturbing information: Democratic People’s Republic of Korea (DPRK)-linked hacking groups are increasing their use of Russia-based exchanges known to launder illicit crypto assets.

This development comes as independent sanctions monitors are raising alarms about North Korea’s evolving tactics in cyber warfare. A forthcoming United Nations report warns that DPRK is using increasingly sophisticated cyberattacks to fund its nuclear missile programs, with ‘state-sponsored’ hacking groups targeting cryptocurrency and financial exchanges worldwide.

Chainalysis data shows that $21.9 million in cryptocurrency stolen from Harmony Protocol was recently transferred to a Russia-based exchange known for processing illicit transactions.

Additionally, Chainalysis has evidence that shows that DPRK entities have been using Russian services, including this exchange, for money laundering since 2021. This latest action marks a significant escalation in the partnership between the cyber underworlds of these two nations.”

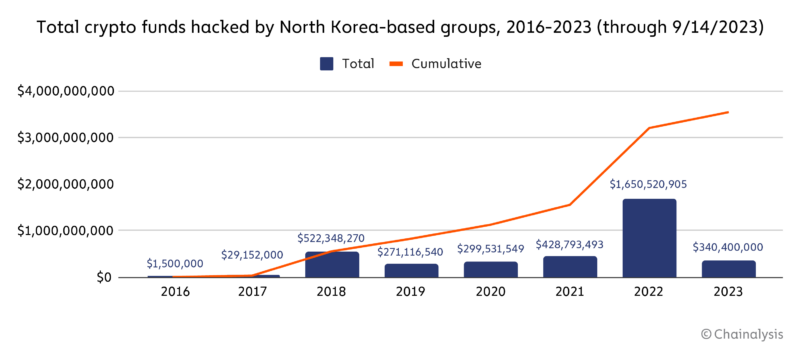

Chainalysis’ data goes on to show that North Korean hacking groups have been less prolific in 2023 compared to last year. However, the crypto analytics firm notes that they put up “catastrophically high” numbers in 2022.

“According to Chainalysis data, the value of stolen cryptocurrency associated with DPRK groups currently exceeds $340.4 million this year, compared to over $1.65 billion in stolen funds reported in 2022.

While North Korea-linked hackers are on pace to steal much less cryptocurrency than they did last year, it’s important to acknowledge that the catastrophically high figures from 2022 created an unusually high bar to surpass.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and

Surf The Daily Hodl Mix

Check Latest News Headlines

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Credit: Source link