Amidst an atmosphere of suspense and anticipation, Bitcoin has been making waves again. A recent surge in trading volume has propelled the premier cryptocurrency beyond the $26,000 mark, leaving many investors and market analysts curious about the forces at play.

As of now, Bitcoin stands at $25,881, experiencing a subtle rise of nearly 0.10% in the past 24 hours.

Leading the pack, Bitcoin maintains its #1 position on CoinMarketCap, boasting a staggering market capitalization of approximately $504.17 billion USD.

With a current circulation of around 19.48 million BTC coins, it’s noteworthy to mention that the maximum supply is capped at 21 million, underscoring the asset’s inherent scarcity.

Bitcoin Price Prediction

Bitcoin’s price trajectory is manifesting an upward momentum, surpassing the $26,000 mark. Despite the nascent signs of recovery, Bitcoin grapples with the formidable resistance at $26,500.

Yet, its resilience was evident as it maintained levels above the critical $25,350 support. The market’s bullish sentiment played a crucial role in elevating the price beyond the $25,850 resistance threshold.

Subsequently, the currency transcended the $26,000 barrier, breaking past a significant bearish trend line, evident around the $25,940 resistance on the BTC/USD pair’s hourly chart.

This trajectory propelled it toward the $26,500 resistance, where some selling pressure was observed.

The asset achieved a peak around $26,487, with the current phase reflecting a consolidation of its gains.

Notably, there was a minor pullback below the 23.6% Fibonacci retracement level, calculated from the recent ascent spanning from $25,609 to $26,487.

Currently, Bitcoin commands a position well above the $26,000 benchmark and is bolstered by the 100 hourly Simple Moving Average.

An imminent resistance lingers around $26,400, followed by a significant barrier at $26,500. Should the asset conclude above this point, we may witness a commendable price escalation.

The subsequent significant resistance is poised at $27,000, beyond which the bulls may further solidify their position, potentially driving the price to challenge the $28,000 zenith.

However, if Bitcoin falters at the $26,500 hurdle, we might anticipate a minor retracement. Immediate cushioning can be expected near the $26,100 level.

Further support stands at approximately the $26,000 mark, aligning with the 50% Fibonacci retracement from the recent rally spanning $25,609 to $26,487.

Should there be a pronounced decline below this threshold, it could amplify bearish tendencies, potentially pulling the asset down to levels of $25,500 or even as low as $25,350.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

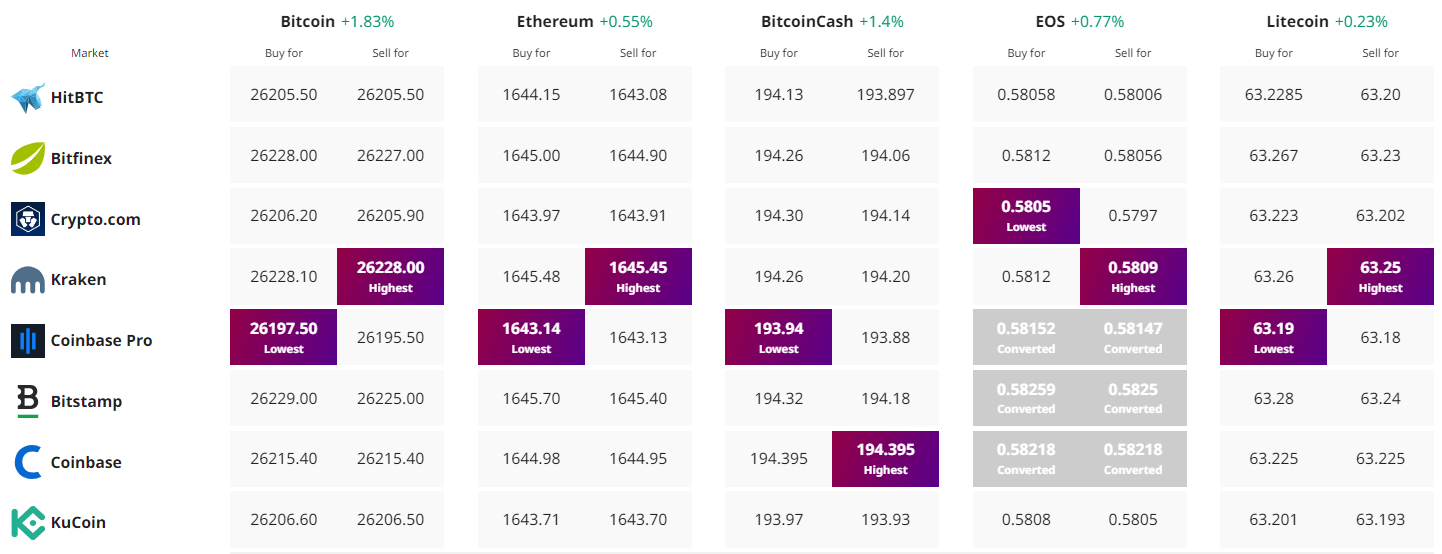

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Credit: Source link